FORTUNE — TrueCar, in its initial public offering on Friday, raised a relatively inconsequential $70 million.

The fresh capital will be used, among other things, to pay for more marketing so TrueCar (TRUE) can raise its profile with consumers. Becoming a public company no doubt will have an impact on the company’s startup culture as well. As one TrueCar executive remarked: “The discipline of operating in the public spotlight can sometimes be a very positive thing.”

The company’s biggest and most important hurdle will be to gain credibility with more new-car dealers, whose business model for selling vehicles is subject to disruption by TrueCar’s mission of giving car buyers price transparency. To that end, it has hired John Krafcik as its president, former chief executive of Hyundai’s U.S. Operations, an affable and well-liked figure among dealers.

MORE: TrueCar CEO Scott Painter: Acquisitions are possible

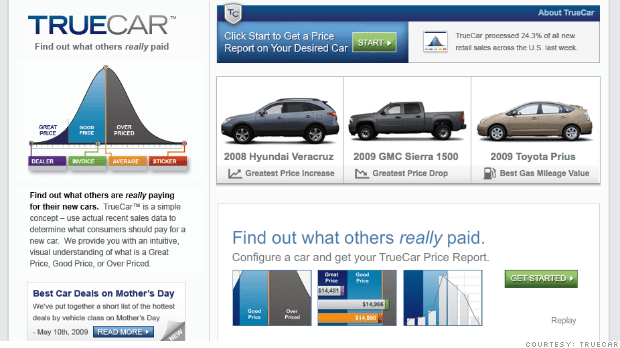

Based in Santa Monica, Calif., TrueCar is a relatively small company that aims to overhaul automotive retailing by letting consumers know — within a relatively narrow band — how much they should be paying for a new car. By comparing actual transaction data, TrueCar’s proprietary analytics determine a price range in the shopper’s market area. For example: the current market price in Detroit of, say, a metallic blue Chevrolet Malibu with a 2.5-liter engine and a few popular options.

A new Malibu, retailing at $24,435, with a factory invoice of $23,845, actually was selling for about $21,148 last month, according to TrueCar’s analytics.

In the event a customer decides to buy a Malibu from a dealer in Detroit partnering with TrueCar, the company will pay the dealer a $300 commission once the transaction is complete. (In states where commissions are prohibited, TrueCar offers a subscription pricing model.) In 2013, according to its stock offering circular, TrueCar took part in about 2% of the new-vehicle purchases in the U.S., the major contribution to its annual revenue of about $130 million.

A major chunk of TrueCar’s business comes through affiliate organizations such as USAA, a financial services company geared toward veterans and military personnel. Last year, 43% of its new-vehicle purchases came through USAA.

MORE: Can TrueCar’s Scott Painter take the haggle out of car buying?

Many U.S. Dealers remain wary of TrueCar. In their view, the company gives consumers too much pricing information; that knowledge of prices tends to lower dealer profit margins. Regulators also have scrutinized the company in states that forbid the payment of a commission to a broker. But pricing transparency already has transformed other retail segments such as travel, clothing, and books — its impact on automotive retailing is inevitable and unstoppable, TrueCar argues.

So far the company has recruited nearly 8,000 dealers, about a quarter of the U.S. Total, to its system, which may be accessed by consumers via an iOS, Android app, or website. TrueCar says it is developing new products that would massage raw data to help consumers buy used cars, financing packages, insurance, and other ancillary automotive services.

Krafcik will have his work cut out for him recruiting more dealers on board and popularizing TrueCar’s value proposition to car buyers who aren’t part of an affiliate organization.

Car buying isn’t going to change overnight: U.S. Car dealers are too deeply entrenched and well financed to risk their enterprise by introducing untested technology without a struggle. But for consumers, the days of visiting multiple dealers, studying printed brochures, and haggling with sales clerks over the price are numbered.