While Alibaba has had all the attention lately, the initial public offering market has been on a bender even without taking into account the Chinese retailer’s record-breaking $25 billion offering.

The IPO market globally raised $66.8 billion in the three months through September, according to Bloomberg data. More than $40 billion of that amount was raised in the U.S., making it the biggest third quarter for U.S. IPOs in more than a decade. That’s true even without including Alibaba’s (BABA) huge offering.

Globally, the total number of IPOs that took place last week surpassed 200, and at the rate companies are going public, that number could surpass 300 this year.

There are 137 more IPOs in the active pipeline, according to Renaissance Capital. That total doesn’t include an unknown number of companies that may have filed confidentially under the JOBS Act provision that allows companies with revenues under $100 million to submit IPO paperwork silently.

A combination of booming stock prices and well-performing offerings have lured investors toward IPOs. Newly-listed stocks have performed significantly better than the overall market this year. Shares of U.S. IPOs have returned an average of 19% over the past three months compared with a gain of 0.9% for the S&P 500.

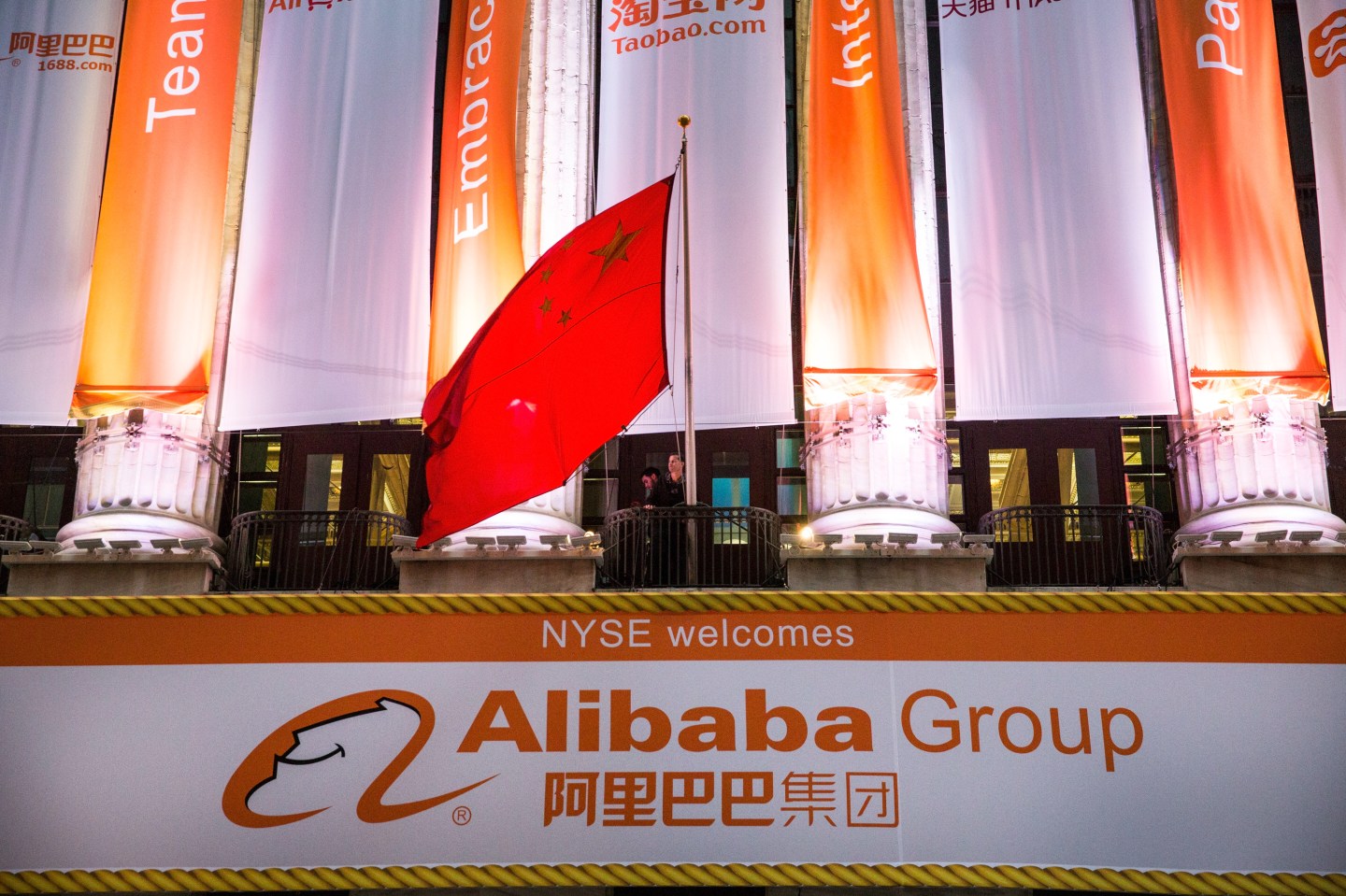

The biggest winner has been the New York Stock Exchange, which was the top exchange worldwide based on the total amount of funds raised, Bloomberg News says.

The NYSE influx was helped by foreign companies looking to list in the U.S. Cross-border offerings were up 14% in the third quarter, and over half of those were companies that opted to list in the U.S. Over their home countries.