(Reuters) – America’s vast staffing industry knows it’s time to jack up wages when it becomes difficult to find enough workers. That isn’t happening yet for many blue-collar jobs, indicating there’s still slack in the labor force, top firms say.

While 2014 was the strongest year of job gains in the recovery from the 2007-09 recession, rising output is not yet translating into substantial wage gains for the workers of Kelly Services, one of the country’s largest providers of temporary employees, sends to light assembly plants and distribution centers.

Data due for release on Friday is likely to show that the rate of hiring fell to 234,000 in January, compared with 252,000 in December, according to economists polled by Reuters.

“The supply of unskilled labor is still pretty plentiful,” said Kelly’s Chief Operations Officer George Corona.

Rising demand for labor on the back of a stronger domestic economy helped drive a 7 percent gain in Kelly’s fourth quarter U.S. Revenues from services, up from 3.6 percent in the third quarter.

Wages in the U.S. Private sector rose 2 percent last year, roughly the average annual gain seen since the country emerged from recession. Before the downturn, wages were rising around 3 percent or 4 percent a year.

Even for occupations that typically require a college degree, like engineers and lawyers, salaries still aren’t rising as quickly as they would in a tight labor market, Keith Waddell, the chief financial officer at staffing firm Robert Half, said in a call with analysts on Jan 29.

Robert Half, which primarily places professionals and reported a 14 percent increase in U.S. Staffing revenues in the fourth quarter, has seen been seeing wage gains just above 3 percent. It expects increases closer to 6 percent when the labor market tightens.

The number of unemployed private sector workers for every job opening more than tripled during the recession, topping out above 6 in late 2009, and has fallen steadily in the recovery.

In October and November it averaged 1.5, just a tenth of a point higher than its average in the year prior to the recession, indicating a tighter job market is in the offing.

The tightening is seen across industries, with the ratio now just above pre-recession levels in construction and manufacturing. The numbers track experienced workers and the last industry in which they worked.

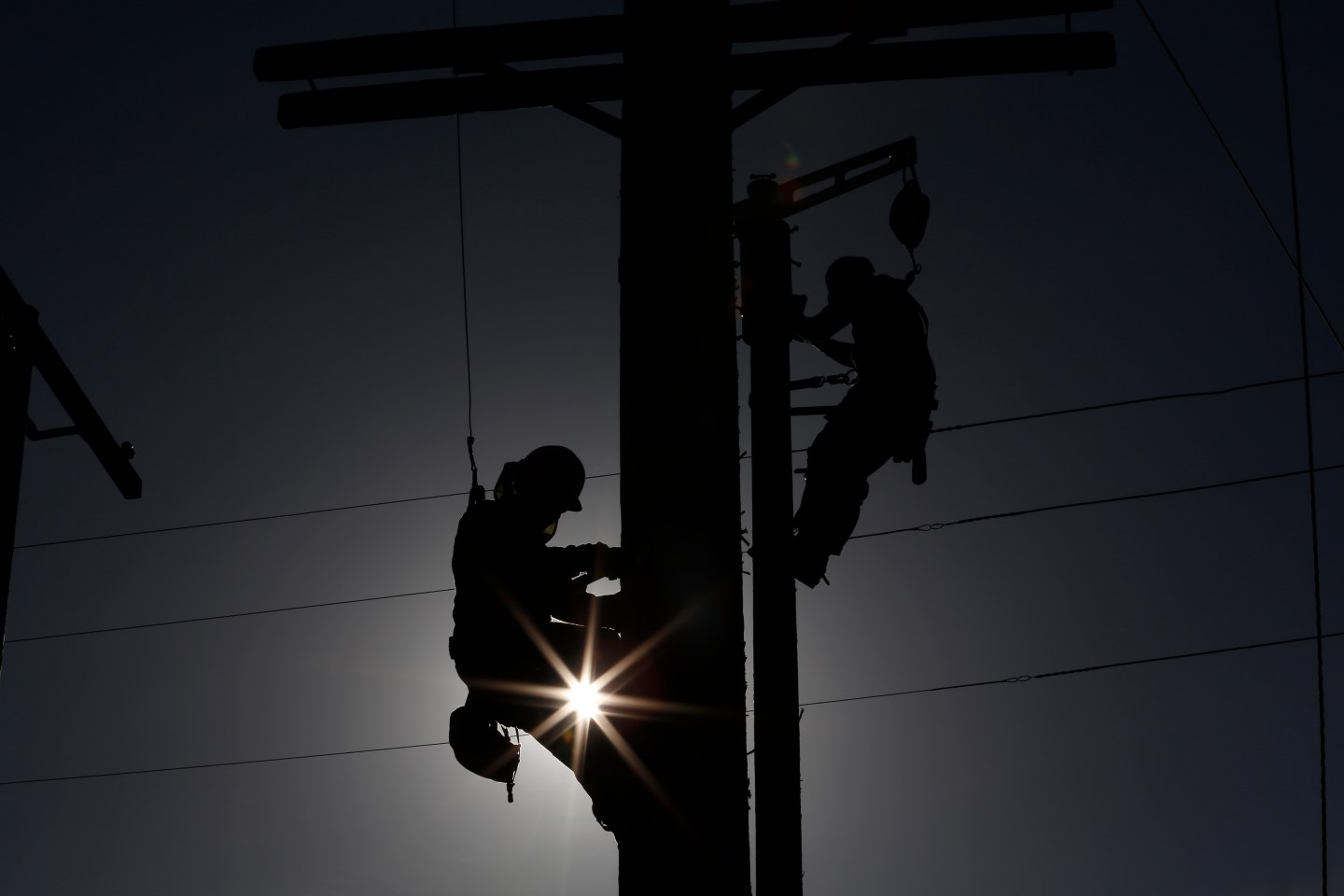

Staffing agencies have played a growing role in the U.S. Economy as companies have relied increasingly on temp hires.

Temporary jobs accounted for a record-high 2.1 percent of total employment last year, about twice its share in 1990.

Randstad, a Netherlands-based staffing firm that is also a major player in the United States, is trying to improve recruiting efficiency to get ready for the tighter U.S. Labor market it sees coming.

For example, the firm is investing in technology that helps recruiters mine social networks, said Linda Galipeau, the chief executive for Randstad North America.

Eventually it will become harder to find forklift operators, machinists and welders. Galipeau said that might be soon, though the lack of wage pressure for blue-collar jobs means this day hasn’t yet arrived.

“We’re back to a market that feels a little bit more like 2005 or 2007 than the market we have felt in last four years,” she said.