On Friday, the Labor Department released its most disappointing estimate of job growth in months, leading some to worry that the economic recovery is slowing down.

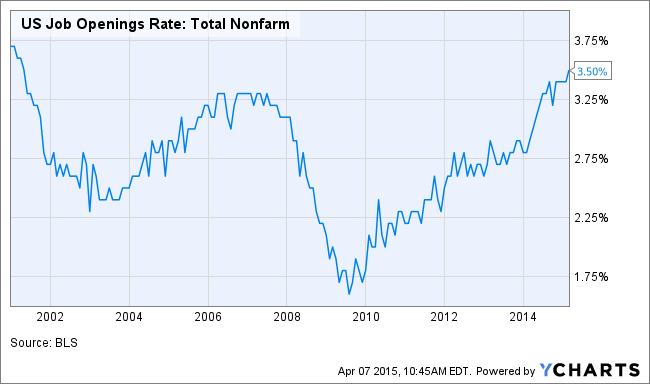

But job market bulls can take solace in a report released Tuesday by the Labor Department, which showed that the rate of job openings have hit at a 14-year high.

US Job Openings Rate: Total Nonfarm data by YCharts

Openings increased in many sectors, including professional and business services, healthcare and social assistance, and accommodation and food services. Predictably, job openings decreased in the mining sector, likely due to the sharp decline in oil prices in recent months.

Though the trend in job openings is heading in the right direction, the Labor Department doesn’t break down the sort of jobs these openings are for — whether they are high paying or full time, for instance. Furthermore, the ratio of unemployed to the number of job openings remains higher than at any point in the past 20 years. This suggests that employers might be listing openings for jobs they are not necessarily set on filling.

A better gauge of the health of the labor market, and one that Fed Chair Janet Yellen has said she watches closely, is the “quits” rate. This measures the rate at which workers are volunarily leaving a job — often times because they have better opportunities elsewhere. A high quits rate suggests greater opportunity in the labor market.

US Quits Rate: Total Nonfarm data by YCharts

As you can see from the above chart, the quits rate has increased a good deal over the past year, but it remains depressed compared to the years before the recession. Meanwhile, the quits rate has leveled off in recent months, adding credence to the views of Fed doves like Minneapolis Fed President Narayana Kocherlakota, who has argued against raising interest rates until at least the middle of next year, as opposed to the consensus prediction of mid-to-late 2015.

For the time being, the market is taking any news that the labor market is slowing as a sign that the Fed won’t rush to raise rates. The S&P 500 has risen roughly 1% since trading began Monday, with markets closed the day the March jobs report was released, for the holidays.