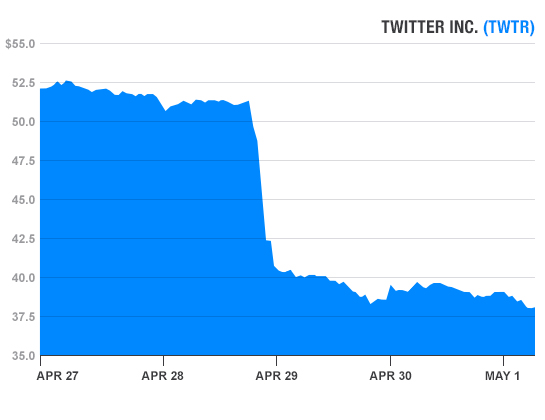

Several social media heavyweights disappointed shareholders this week by reporting weak first quarters while lowering their outlooks. Their stock prices sank amid the bad news.

Among those that came up short were Twitter (TWTR), Yelp (YELP), and LinkedIn (LNKD). What went wrong? Coins2Day breaks it down.

Misfire: Twitter reported revenue of $436 million, a 74% gain from a year ago. However, the company fell short of the $457 million that analysts had expected and missed its own guidance of $440 million to $450 million.

Coins2Day take (via @eringriffith):

The company’s biggest weakness, in the eyes of investors, is that it isn’t adding new users as fast as they would like. For the past year, CEO Dick Costolo has been touting product improvements meant to increase engagement and lure lapsed users back to the service, but the results don’t show a huge change.

Big deal: Twitter announced this week that it would buyTellApart, an advertising tech company that helps e-commerce sites target customers on their phones, in a deal valued at roughly $530 million.

“To grow our user base, we need to improve new user retention and our strategy here is to provide immediate value and a compelling timeline the moment a user signs up.” – Dick Costolo, Twitter CEO

Yelp

Misfire: Yelp reported revenue of $118 million, an increase of 55% over the year prior. However, it failed to live up to analyst expectations of $120 million.

Coins2Day take (via @rhhackett):

In the first quarter of last year, Yelp grew its monthly active user count by 30% over the year prior. But in the latest quarter, it rose only 8% from a year ago. Why the slowdown? That’s what investors are wondering. On top of that, the company’s ad sales have taken a beating as brands transition to automated ad buying that has led to a restructuring of its ad sales team.

Big deal: Yelp announced in February that it would buy Eat24.com, a food-ordering service, in a deal valued at around $130 million.

“We’re still quite focused on how it’s driving the consumer experience. One of our goals this year is around increasing engagement and making sure consumers keep coming, have an excuse to keep coming back to the app all the time.”– Jeremy Stoppelman, Yelp CEO.

Misfire: LinkedIn reported revenue of $638 million, a 35% increase over a year ago. The results beat Wall Street expectations of $636 million. However, the company revised its revenue projections for the second quarter to a range of $670 million to $675 million versus analyst expectations of about $718 million. It also revised its full year guidance to $2.9 billion from the previous range of $2.93 billion to $2.95 billion.

Coins2Day take (via @tjhuddle):

LinkedIn’s first-quarter revenue gained 35%, edging Wall Street’s expectations, but the career networking website’s weak outlook for the current quarter spooked investors and sent shares tumbling more than 25%.

Big deal: LinkedIn recently announced plans to acquireLynda.com, a site for professional training, in a deal valued at $1.5 billion.

“Display was down 10% this quarter. More material than in prior quarters. You know we, for some time, had expected more headwinds than we’ve seen, and this was the first quarter where we’ve started to see more material headwinds on the display side.” – Jeff Weiner, LinkedIn CEO

***

For more in-depth coverage on the aforementioned companies, read these Coins2Day feature stories:

- “Trouble @ Twitter,” by Jessi Hempel (@jessiwrites)

- “Yelp CEO Jeremy Stoppelman ignored advice from Peter Thiel and Elon Musk and succeeded anyway,” by Daniel Roberts (@readDanwrite)

- “Lessons from Jeff Weiner, LinkedIn’s Networker-in-Chief,” by Adam Lashinsky (@adamlashinsky)