Some of the worst estimates in terms of unit sales came from veteran Wall Street professionals, while the best estimates this quarter came from a pair of gifted amateurs.

Before getting into the details, I have to give a shout-out to 500-plus (500-plus!) Mostly anonymous Apple analysts who contributed to Estimize’ s experiment in crowdsourced modeling. Their final consensus—earnings of $1.86 on revenues of $49.586—was a lot closer to the actual results ($1.85 on $49.605) than our collection of pros and independents, separately or combined.

But Coins2Day can do something Estimize can’t: Name names.

So, a tip of the hat…

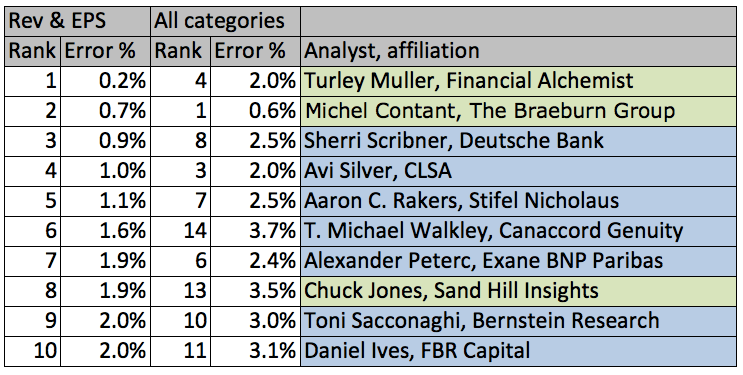

- To Financial Alchemist Turley Muller and Michel Contant of the Braeburn Group, who nailed Apple’s EPS to the penny. Muller was No. 1 for the top and bottom lines. Contant came in first overall thanks to excellent unit sales estimates.

- To Deutsche Bank’s Sherri Scribner for the best revenue estimate ($49.7 billion vs. $49.61 billion).

- To the Braeburn Group’s Patrick Smellie for his iPhone unit sales number (47.524 million vs. 47.534 million).

.

And a wag of the finger…

- To Pacific Crest’s Andy Hargreaves for overshooting Apple’s revenue by more than $4 billion, with Asymco’s Horace Dediu and Braeburn’s Lee Storch close behind).

- To Credit Suisse’s Kulbinder Garcha for overestimating iPhone sales by more than 8.7 million units.

- To FBR’s Daniel Ives for overstating Mac sales by 400,000 units.

.

These overheated estimates may have contributed to the panic Tuesday night that knocked 7% off Apple’s market cap in after hours trading.

Below: Our annotated master spreadsheet, with the best estimates highlighted in dark green, the second and third best in light green, the worst in red and the second and third worst in pink.

Click to enlarge.

Thanks once again to Posts at Eventide‘s Robert Paul Leitao for pulling together the Braeburn Group numbers.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at coins2day.com/ped or subscribe via his RSS feed.