The best kept secret at last week’s Hey Siri event—the one even the best reporters didn’t see coming—may turn out to be Apple’s biggest money maker.

It’s called the iPhone Upgrade Program, and it will be offered for the first time a week from today to qualified customers who buy a new iPhone at any U.S. Apple Store.

It’s basically a leasing program with benefits.

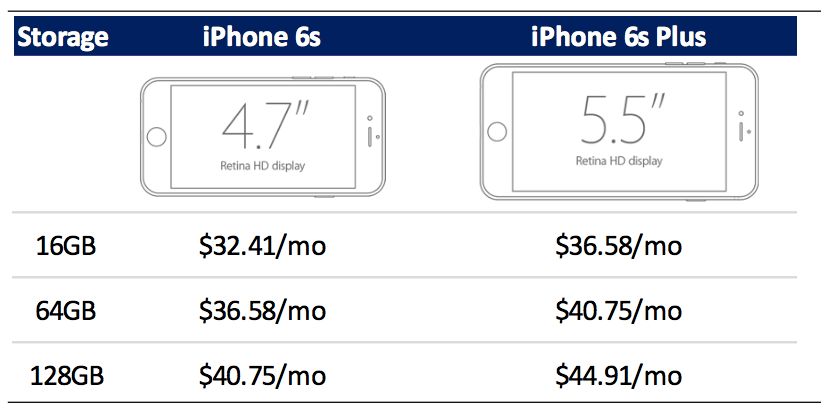

For 24 monthly payments on terms roughly comparable to those offered by the carriers—anywhere from $32.41 to $44.91 a month—you’ll get AppleCare+ phone support/damage insurance (a $11/mos. Value) and the option to trade in your iPhone 6S for an iPhone 7 (or whatever it’s called) a year from now.

The marketing material on Apple’s website lays the program out in general terms. Serenity Caldwell’s FAQ drills down to the fine print.

But it’s an even better deal for Apple, as Morgan Stanley’s Katy Huberty was quick to point out. Other analysts have since weighed in, enumerating the multiple benefits Apple stands to reap from the program:

- It gets to sell more high-margin AppleCare+ contracts

- It locks customers into the iPhone indefinitely

- It halves the iPhone upgrade cycle (to 12 months from 24)

- It builds an inventory of used phones that can be refurbished and resold

- It takes control of, and legitimizes, the grey market for second-hand iPhones

- It unbundles hardware costs from carrier costs

- It leaves cell service complaints clearly in the carriers’ hands

- It raises Apple’s gross margin from 50% to 55% (see RBC Capital’s chart below)

.

“It takes what could have been negative sentiment—a sell-on-the-news event—and potentially turns it positive,” Thrivent Asset Management’s Peter Karazeris, told Barrons. See Apple Shares Could Rally 50% on New iPhone Plan.

RBC’s chart:

Click to enlarge.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at coins2day.com/ped or subscribe via his RSS feed.