This article is published in partnership with Money.com. The original version can be found here.

By Lisa Zamosky

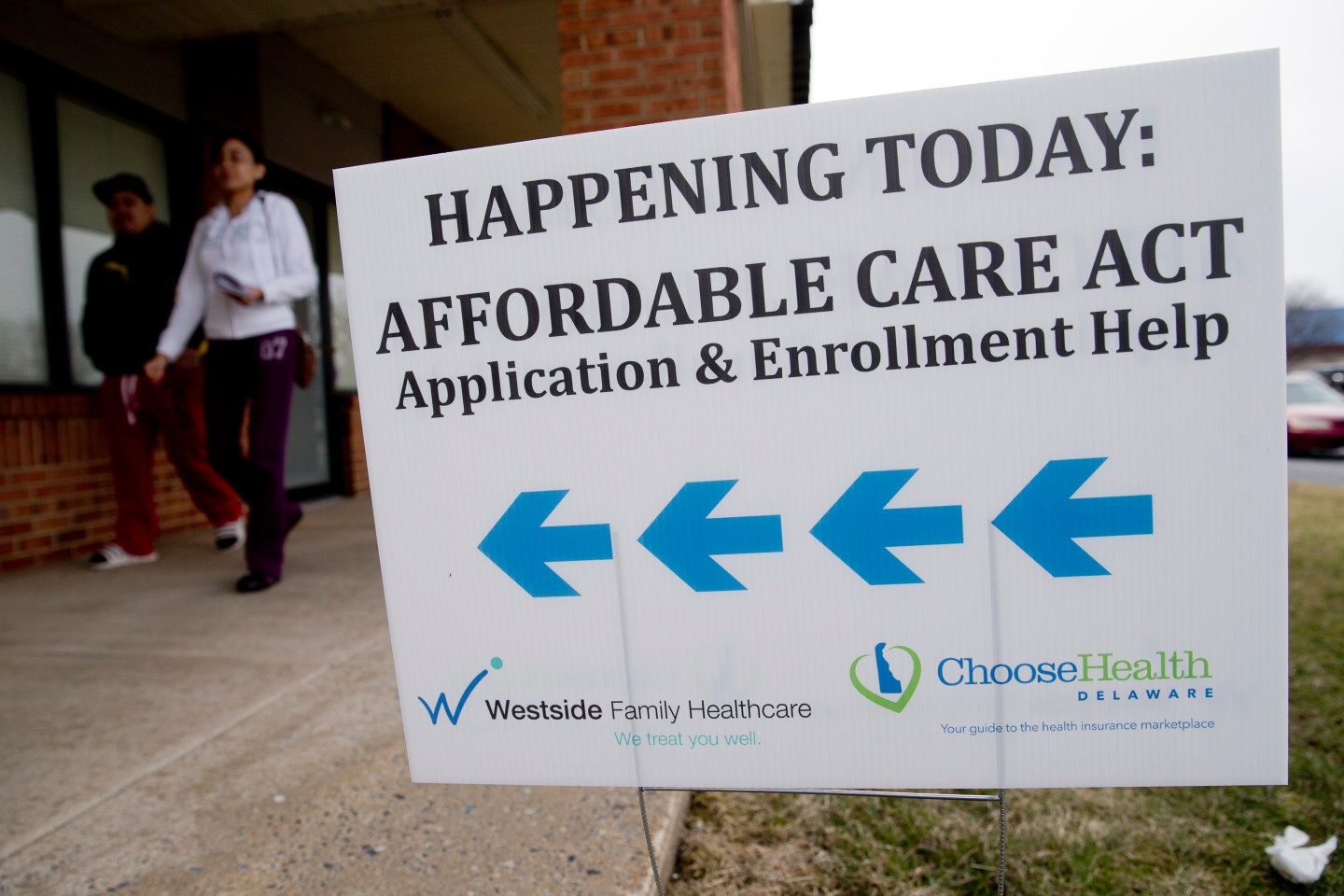

Thanks to Obamacare, most insurers must now cover the full cost of preventive care—checkups, vaccinations, screenings, and the like. Yet many people still don’t take advantage. A recent survey by online broker eHealth found that 53% of insured respondents didn’t use their coverage at all, even for free preventive services.

That could be a health risk, but it’s definitely a financial fail: You’re giving up a service that you’ve already paid for. Here’s how to make sure you’re getting full value.

Know what’s eligible

Coverage rules are governed by recommendations from medical and scientific authorities. The free-stuff list includes 18 services for adults, plus 26 just for women and another 27 for kids. Contraception is covered; so are tests for blood pressure, obesity, and, depending on risk factors, cholesterol, diabetes, and some cancers. Vaccines vary by age but include diphtheria, tetanus, HPV, measles, and mumps, plus a flu shot. (Kaiser Family Foundation’s Preventive Services Tracker has a full list.)

Yet insurers do have some leeway. “Plans are allowed to use reasonable medical management” to determine coverage, says Alina Salganicoff of the Kaiser Family Foundation. When guidelines don’t say how frequently a test should be given, your insurer can set its own rules. So while colonoscopy coverage is required for people age 50 and older, your plan may pay up only once a decade unless your doctor cites a medical reason for more frequent screenings. “Discuss it with your insurer” before your appointment, Salganicoff says.

Watch for loopholes

Naturally, there are a few key exceptions to watch for.

First off: Free services aren’t free when you go outside your plan’s network, so make sure everyone involved in a screening—from the radiologist to the lab—is in your network.

Grandfathered health plans—those in place when the law took effect on March 23, 2010—are exempt from having to cover preventive care in full. If you have one of those policies, you may have to pay. (Unsure if your plan is grandfathered? Ask the benefits staff at work or call your plan.)

Another wrinkle: If you use a checkup to discuss other health issues, the conversation could trigger a separate bill. “Where folks get tripped up is when they go for a screening and also tell the doctor, “I have this back pain,” ” says Nate Purpura, a spokesman for eHealth. “The minute you deviate from preventive care, you’ve entered a different type of medical visit.”

Challenge surprise bills

Billing mistakes are common, so be sure to question any charge for care you thought was preventive.

Sometimes your doctor’s staff may have used an incorrect code or failed to cite a medical justification, Purpura says. Call the office to see if the bill can be resubmitted to fix the problem. And remember that you have the right to file an appeal with your health plan if they don’t pay up.