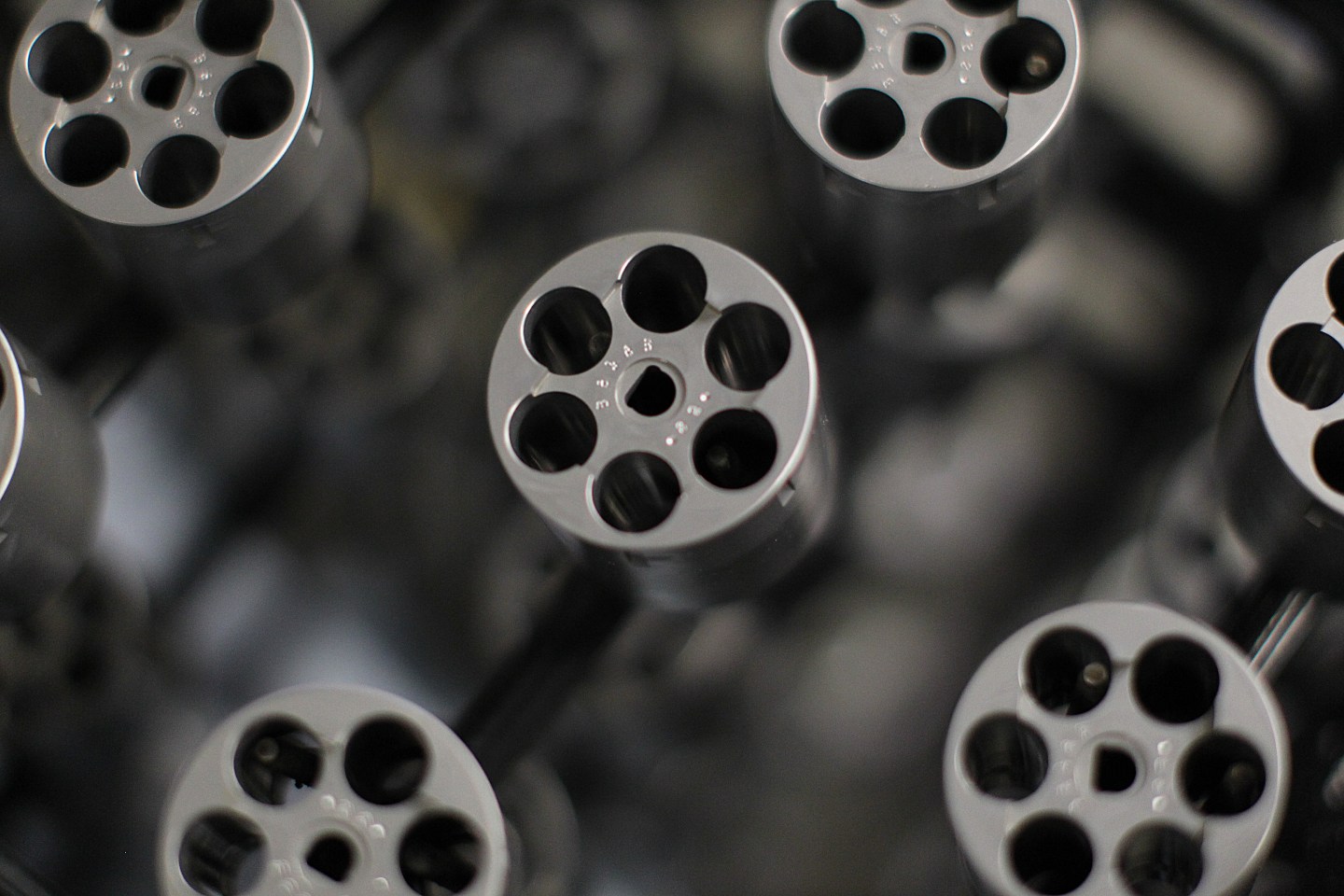

Gun maker Smith & Wesson Holding Corp reported a better-than-expected 61% jump in quarterly revenue, at a time when the U.S. Presidential election campaigns and recent shootings fuel fears of stricter gun laws.

Shares of the company were up about 6% at $26.93 in trading Friday morning.

Chief Executive James Debney told analysts on a conference call on Thursday that the demand for firearms is a result of short-term influences of “potential impact of news events and the current political environment.”

Smith & Wesson said firearm net sales jumped 56.4% to $194.7 million in the third quarter, from a year earlier.

Rival Sturm Ruger & Co Inc’s CEO, Michael Fifer, said last week he expected a lift in demand for the company’s firearms if a Democrat wins this year’s presidential elections.

Democratic presidential front-runner Hilary Clinton has been calling for new rules to make background checks more comprehensive and close “loopholes” on some kinds of gun purchases. Such calls in the past have led to higher firearms sales out of fear that limits are coming.

Worries about crime following recent urban unrest in Ferguson, Missouri and other cities where residents protested police killings of young black men have boosted gun sales.

Smith & Wesson, which raised its revenue forecast in January for the third quarter and the year ending April 30, further boosted its guidance for the year on Thursday.

The company’s net income almost quadrupled to $31.4 million, or 56 cents per share, in the third quarter ended Jan. 31, from $8.1 million, 15 cents per share, a year earlier.

Excluding items, the company earned 59 cents per share, handily beating the average analyst estimate of 39 cents, according to Thomson Reuters I/B/E/S.

Revenue rose to $210.8 million, well above analysts’ estimate of $174.9 million.