💥A Boom with a View💥 is a column about startups and the technology industry, written by Erin Griffith. Find them all here: coins2day.com/boom. This essay originally appeared in Data Sheet, Coins2Day ’s daily tech newsletter. Sign up here.

The release of the annual Coins2Day 500 list is a great reminder that, oh right, the country’s largest, most powerful tech companies are not necessarily the ones that get the most press attention.

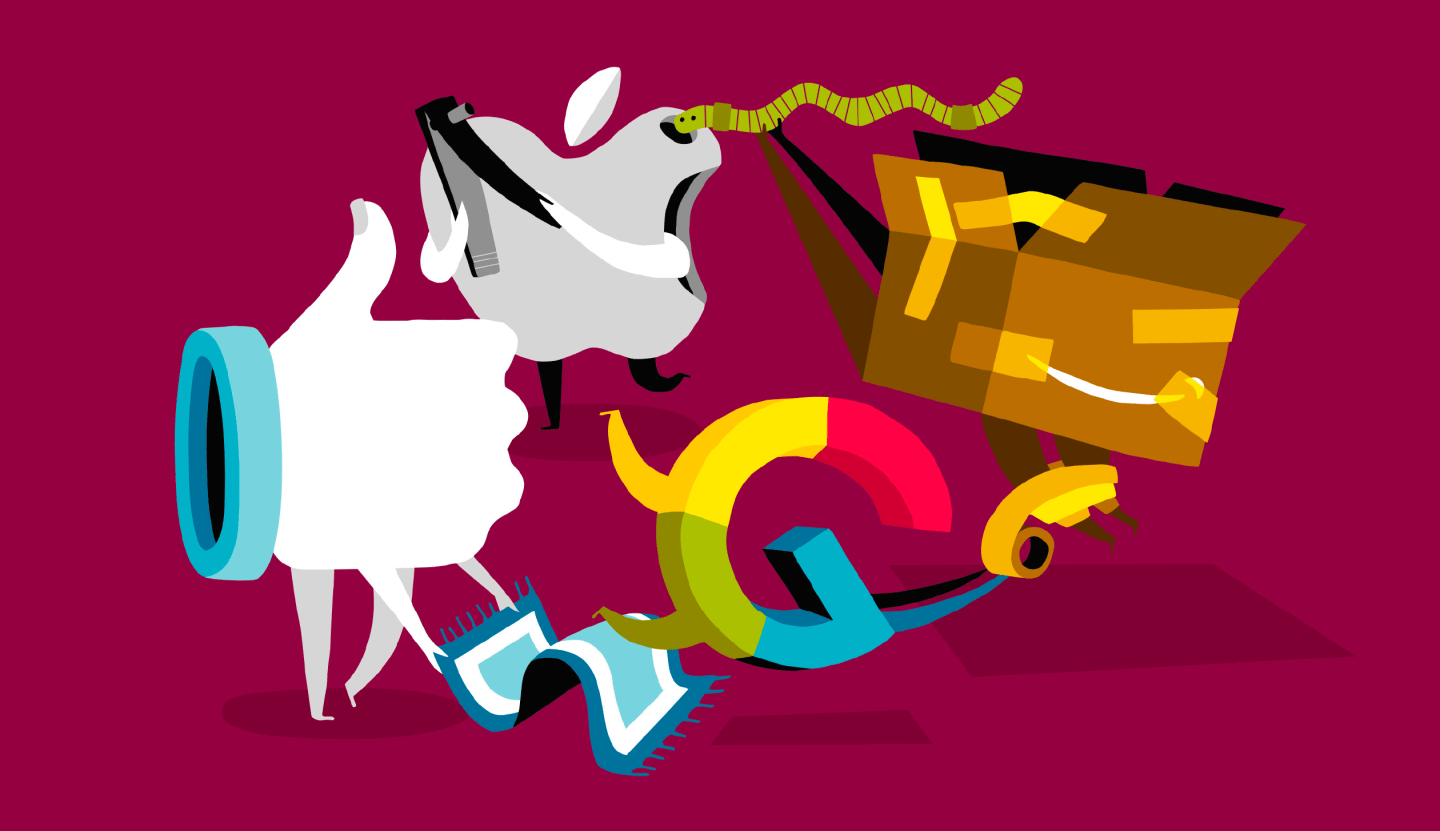

Setting aside Apple (AAPL), Alphabet (GOOG), and Amazon (AMZN), the top of the Coins2Day 500 list is dominated by old-line tech stalwarts like IBM (IBM), Intel (INTC), Cisco Systems (CSCO), Qualcomm (QCOM), and EMC (EMC), and the telecoms—Verizon (VZ), AT&T (T), and Comcast (CMCSA). Check out the 2016 list of Coins2Day 500 tech companies here.

One thing these tech giants have in common is that they need to transform themselves in the face of flat or shrinking growth. They’re doing major M&A deals, installing new leadership, and (in many cases) investing heavily in new technologies.

That dynamic was on full display for me this weekend, which I spent alongside Coins2Day 500 executives and startup CEOs at a summit hosted by Greycroft Partners in Montauk, at the tip of New York’s Long Island. Just about every BigCo executive who spoke expressed a desire to be more lean, agile, and fast-moving like a startup. Meanwhile, the startup founders yearned for stability, resources, and credibility garnered by big, established businesses. (This is especially true of the “unicorns” that are stuck in limbo—unable to go public, but too big, with billion-dollar-plus valuations, to be acquired.)

The intersection of old and new makes the entire tech industry look like it’s having an identity crisis. Nowhere is that more striking than with a side-by-side comparison of Coins2Day’s Unicorn List and its ranking of Coins2Day 500 tech companies.

Consider this: Uber, the biggest unicorn, is now more valuable (on paper) than the vast majority of the Coins2Day 500. But if it were public, it would not have made the list. The company’s reported net revenue is over $1 billion; Burlington Stores, No. 500 on this year’s list, had $5.1 billion in revenue. While hype might dominate the headlines, in the long run revenue and profits will always matter more.