The U.K. Economy showed more evidence of withstanding the post-Brexit shock Tuesday as a business survey showed exporters’ order books at their fullest level in two years in the month after the fateful vote.

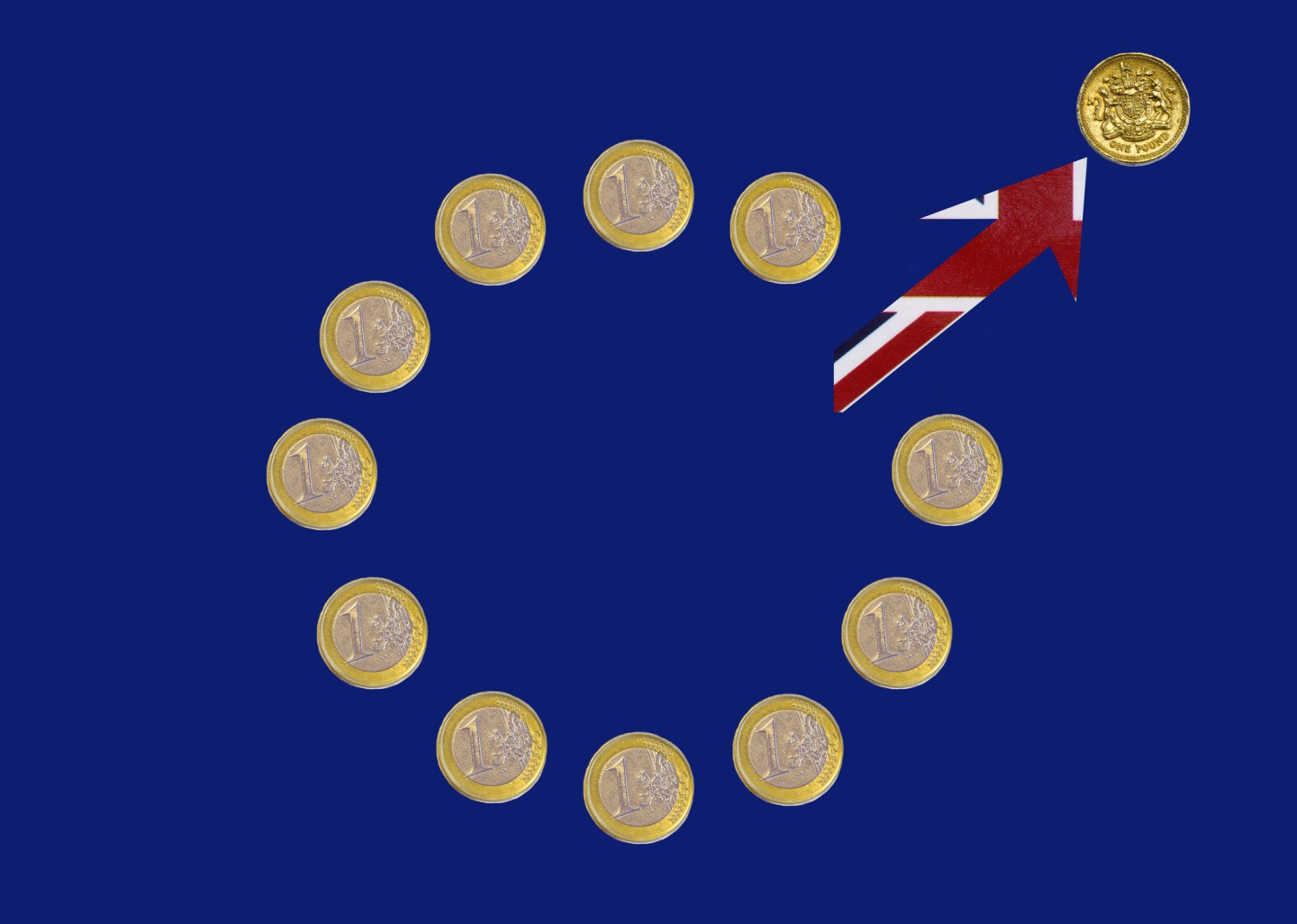

The Confederation of British Industry’s quarterly Industrial Trends Report suggested that the 11% trade-weighted drop in the value of the pound has immediately led to higher demand for U.K. Goods. Before the referendum, many economists had argued that a vote to leave the EU would generate so much uncertainty that it would nullify the classical “shock-absorber” function of a cheaper exchange rate. One equity brokerage, for example, downgraded the outlook for British makers of equipment for the oil and gas sector, on the grounds that leaving the EU could risk their product certification in big export markets like the U.S.

The CBI’s own survey of small and medium-sized businesses earlier this month had showed confidence falling sharply due to just such concerns.

U.K. Exports have languished in the last couple of years, due partly to the low price of oil, and partly to sluggish demand from the Eurozone, which—when view en bloc— is Britain’s biggest single export destination. While North Sea oil production is still fundamentally challenged by low prices, the Eurozone is now eking out halfway decent growth figures, appearing to have overcome last year’s existential crises with Greece and migrants. The Eurozone economy grew by a respectable, if unspectacular, 0.3% in the second quarter.

What that means is that the balance of British exporters still say their export order books are below normal (27%, compared to 21% who say they’re running above normal). Tellingly, though, the negative balance of -6% is the smallest in two years.

In addition, of the 505 firms surveyed, 34% reported rising output volume, while 23% reported falling ones; importantly, 30% of companies expect output to rise over the next three months, while only 19% expect it to fall. The threat of an immediate recession, threatened by the establishment’s prophets of doom, appears to be receding, and may recede further if the CBI’s survey of distributive trades on Thursday rebounds significantly.

Martin Beck, an analyst with Oxford Economics, points out that 60% of U.K. GDP is domestic consumption, whereas only 15% comes from the EU. With unemployment at a historic low, and with the Bank of England’s latest interest rate cut supporting disposable incomes, the immediate risks to consumption also appear limited, he argues.

The pound’s reaction to the news also suggested that markets are paring back some of their more pessimistic forecasts. Sterling traded above $1.32 for the first time in three weeks on the data, although it’s still more than 10% below where it was against the dollar immediately before the referendum. Beck sees the pound weakening as far as $1.26 but that, he says, is more due to the likelihood of the Federal Reserve raising U.S. Interest rates than any intrinsic weakness in Britain.

None of this removes the longer-term threat to the U.K. Economy from a badly-managed divorce with Europe. However, together with the decent economic data from the Eurozone, it does suggest that the first discussions about that divorce settlement won’t be overshadowed by an actual economic shock.