Investors frustrated by poor returns and high fees at hedge funds pulled out roughly 1% of industry capital in the third quarter, with outflows totaling $28 billion.

This puts the hedge fund sector on track for its first annual outflow since the financial crisis.

Third-quarter redemptions nearly tripled from the $8.2 billion investors redeemed during the second quarter, raising the amount of money pulled out this year to $51.5 billion, according to a report released on Thursday by Hedge Fund Research.

Investors have not been this unhappy with hedge funds since the financial crisis when they pulled out $154 billion in assets in 2008 and $131 billion in assets in 2009, HFR, which tracks performance and flows at global hedge funds said.

Their discontent with hedge funds has grown over the last year as outflows have steadily increased, HFR said. The increase in the third quarter came even as performance improved at many funds. Total assets in hedge funds now stand at $2.9 trillion.

Pension funds in New Jersey and Rhode Island voted a few weeks ago to cut their hedge fund allocations by half. One state regulator in New York this week called the whole industry a “rip-off.”

Hedge funds are not required to detail redemptions publicly and many managers closely guard those numbers to avoid any whiff of loss of confidence.

The average hedge fund returned a little more than 4% over the first nine months of the year, HFR data show. That is about half of what the S&P 500 Index has returned over the same period, including dividends, and compares to a 7% increase for the Barclays Capital U.S. Government/Credit Bond Index, a common measure of the credit markets.

(Related: These Big Hedge Funds are Having a Really, Really Good Year)

The industry’s biggest firms were hit hardest with HFR reporting that investors pulled $22 billion out of firms that managed $5 billion or more. Some of these large firms have also suffered poor performance.

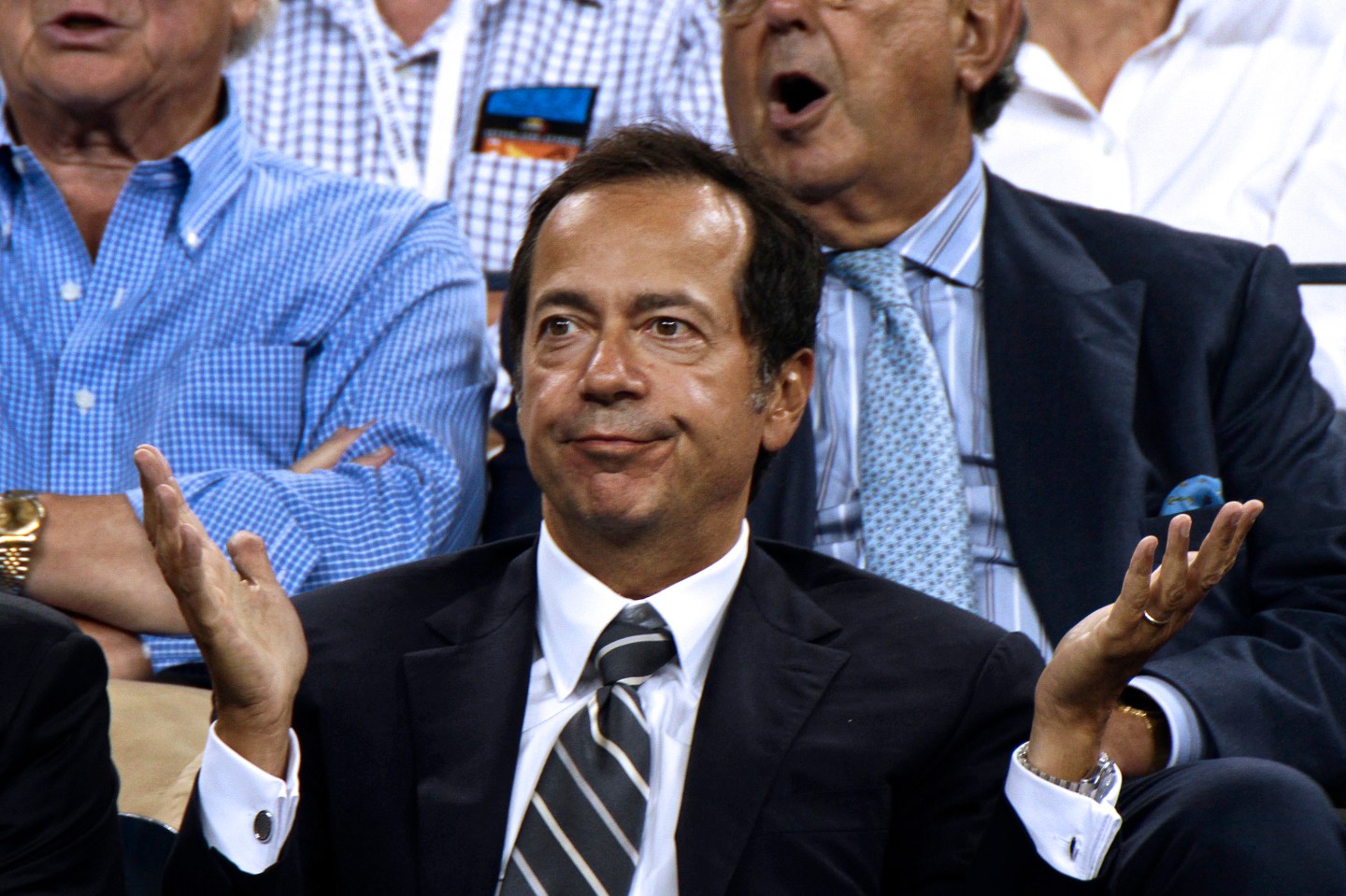

For example, losses have mounted at John Paulson’s Advantage and Paulson Partners funds in the last weeks, performance data show. In the second quarter, the last for which data is available, Anthony Scaramucci’s SkyBridge Capital investment firm pulled its last remaining money out of the billionaire’s firm, regulatory filings show.

Only the smallest managers pulled money in during the quarter with HFR data showing that firms with less than $1 billion in assets saw inflows.