Good morning.

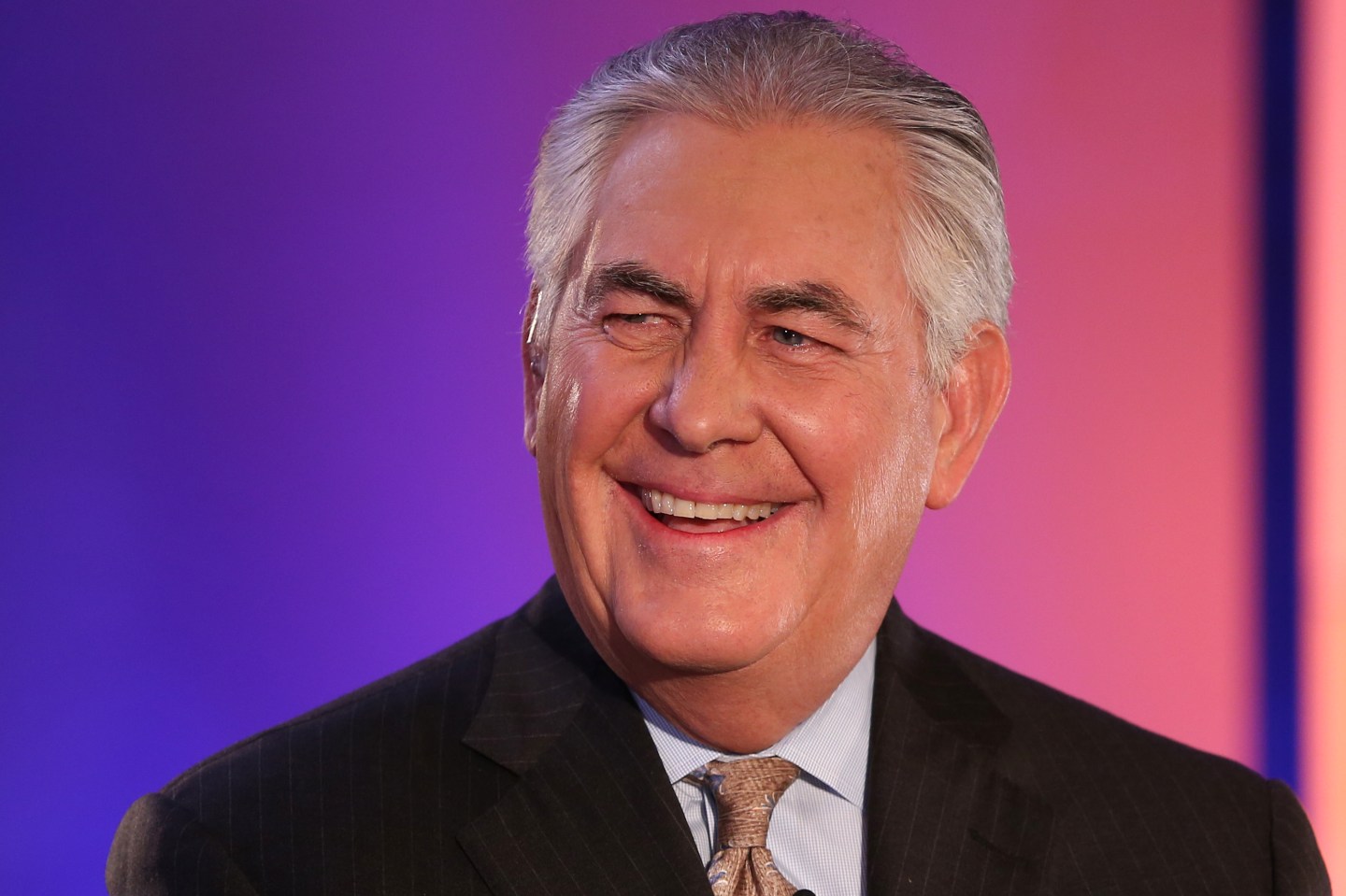

The business press is having a hard time this week sorting out whether Exxon CEO Rex Tillerson is getting a sweetheart tax deal for joining the Trump administration. At the New York Times, Andrew Ross Sorkin took on those who say Tillerson is dodging a huge tax bill, with a headline that declared: “That’s not the case.” But Jesse Drucker at the same paper quoted tax experts saying the deal may raise eyebrows at the IRS. Justin Fox at Bloomberg likewise finds Tillerson’s deal “entirely reasonable,” while Lynnley Browning at the same news organization quotes experts calling it a “72 million dollar tax advantage.”

At issue here, as my colleague Stephen Gandel has explained in detail, is not the $54 million in Exxon stock Tillerson owns outright. On that, which he is selling, he does indeed get a tax deferral that was put in place to encourage corporate executives like him to serve in government. Rather, the controversy is over the roughly $175 million worth of restricted stock units Tillerson has that were slated to vest over the next decade.

For more on Tillerson’s deal with Exxon, watch:

Exxon has decided to convert those stock units to Treasury bills and other cash-like assets, to avoid any conflict of interest that would come from Tillerson still having an interest in Exxon stock. But it will defer payout of the cash, thus allowing Tillerson to defer taxes.

You can read the stories above if you want to delve deeper into the tax debate. But the bottom line is this. Tillerson’s move into government has given him a one-time opportunity to diversify his investment portfolio out of Exxon stock without facing immediate tax consequences. That is an undeniable, and an undeniably large, benefit to him.

But doing so solves two important problems. First, it eliminates any potential conflict of interest that would come from his continuing to have a financial interest in Exxon. In this, he is going far beyond the half-way solutions likely to be adopted by President Trump and his son-in-law Jared Kushner. Second, it prevents Tillerson from having to pay an immediate tax bill totaling more than $70 million – a price tag that would likely discourage experienced corporate leaders like Tillerson from serving in government in the first place.

So is this a giant tax break for Tillerson? It is indeed. Should we be upset about it? Probably not. There are much bigger things to worry about.