The gigantic advertising machine known as Facebook continued to fire on all cylinders in the most recent quarter, beating analysts’ revenue and profit estimates handily.

So then why did the company’s share price (FB) fall 2% in after-hours trading Wednesday, despite this dramatic over-performance? In part, investors are likely nervous about the future, after Facebook warned that its advertising revenue growth rate is likely to slow later this year.

The social-networking giant’s stock has also climbed by more than 15% in just the past three months, driven in part by strong results, so some of the decline could be profit taking.

Facebook also said it is no longer adjusting its earnings to remove the effect of certain expenses, such as the stock-option grants it makes to employees. The change may have made it more difficult for some investors to make comparisons with previous quarters.

Get Data Sheet, Coins2Day ’s technology newsletter.

There certainly wasn’t much to complain about in Facebook’s posted numbers. Revenue in the first quarter climbed 49% to $8 billion, which was significantly higher than most analysts expected, and net income was $3 billion or $1.04 per share, compared with consensus estimates of just 87 cents.

The company also announced that it now has close to 2 billion monthly active users—1.94 billion, to be exact—up from 1.86 billion in the prior quarter. It has 1.28 billion daily users.

A company that has annual revenues of almost $30 billion but is still growing at almost 50% per quarter is almost unheard of. But it also raises the possibility that this phenomenal growth will begin to slow, and that’s likely what investors are spooked about.

Facebook said in its last quarterly update that it expects to see its advertising growth rate “come down meaningfully” in 2017 as it stops adding more advertising to the news feed.

Over the past few years, the social network has been able to boost revenue by increasing what it calls the “ad load,” or the proportion of ads in a user’s feed. But the company said it is reaching the upper limits of what it can put in the feed without seeing a backlash.

Growth looked to be humming along just fine in the most recent quarter: Ad revenue climbed 51%, which is roughly equivalent to the growth that Facebook saw in the previous quarter.

However, company officials repeated their earlier warning, saying they expect ad revenue to “come down meaningfully” by the middle of the year, along with the ad load. In addition, Facebook also said that its costs are likely to increase by more than 50% in the next quarter, as it makes a number of investments in what it called “significant initiatives.”

Among those initiatives is a major investment in hiring moderators to police the site’s live videos and other content for offensive or disturbing material, after a number of high-profile incidents in which people have committed suicide and engaged in other acts of violence.

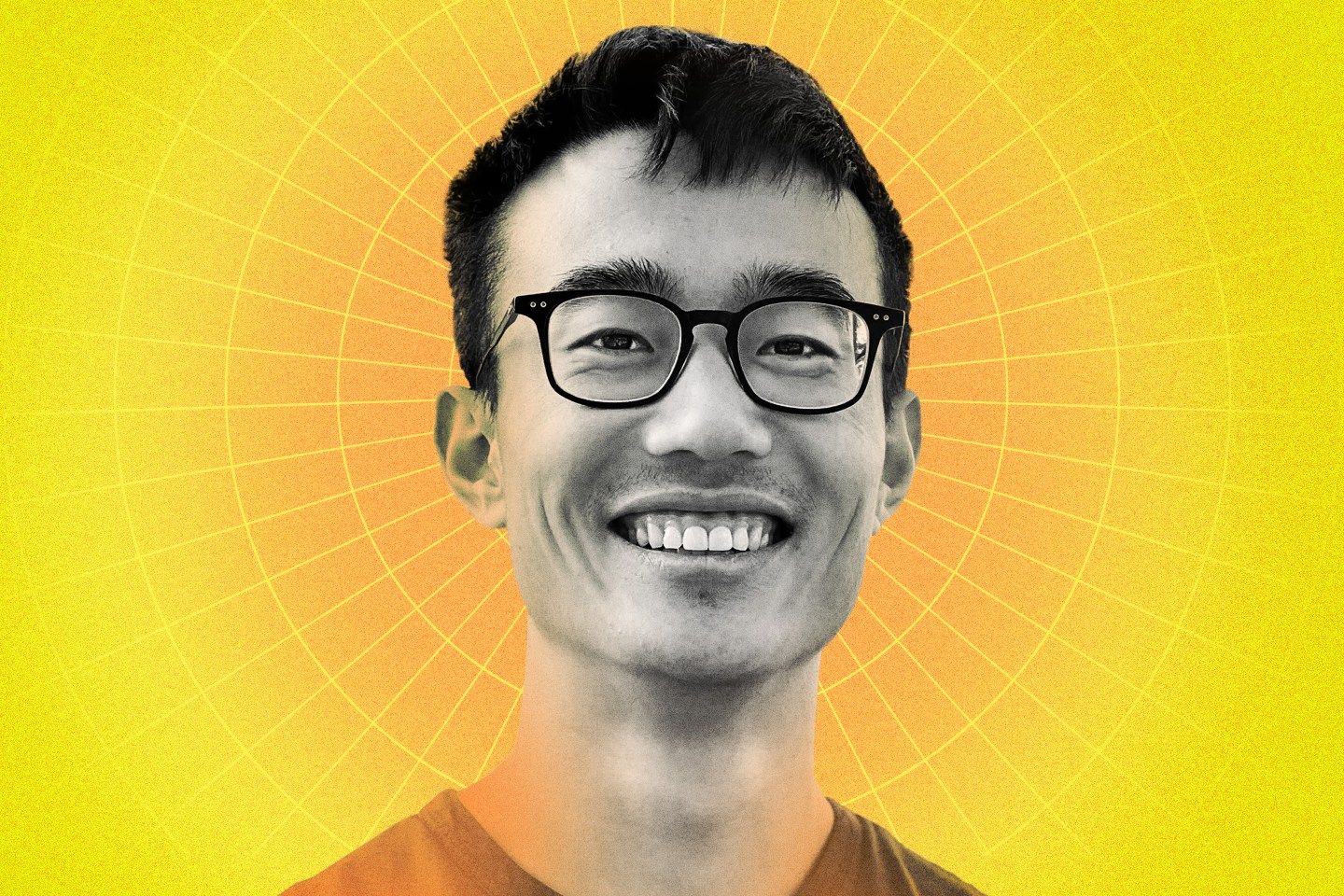

Facebook CEO Mark Zuckerberg announced Wednesday that the company would hire 3,000 moderators who will review content, to add to the 4,500 or so that are currently doing the job.