Amid rising global trade tensions and slowing GDP growth, shaken investors have pushed stock markets across China down over 20% in 2018.

One victim of the broad stock slide: Chinese tech unicorn Meituan Dianping. Now valued at roughly $35.8 billion, the-yet-to-be profitable food delivery giant went public in September on the Hong Kong Stock Exchange with a valuation of roughly $50 billion.

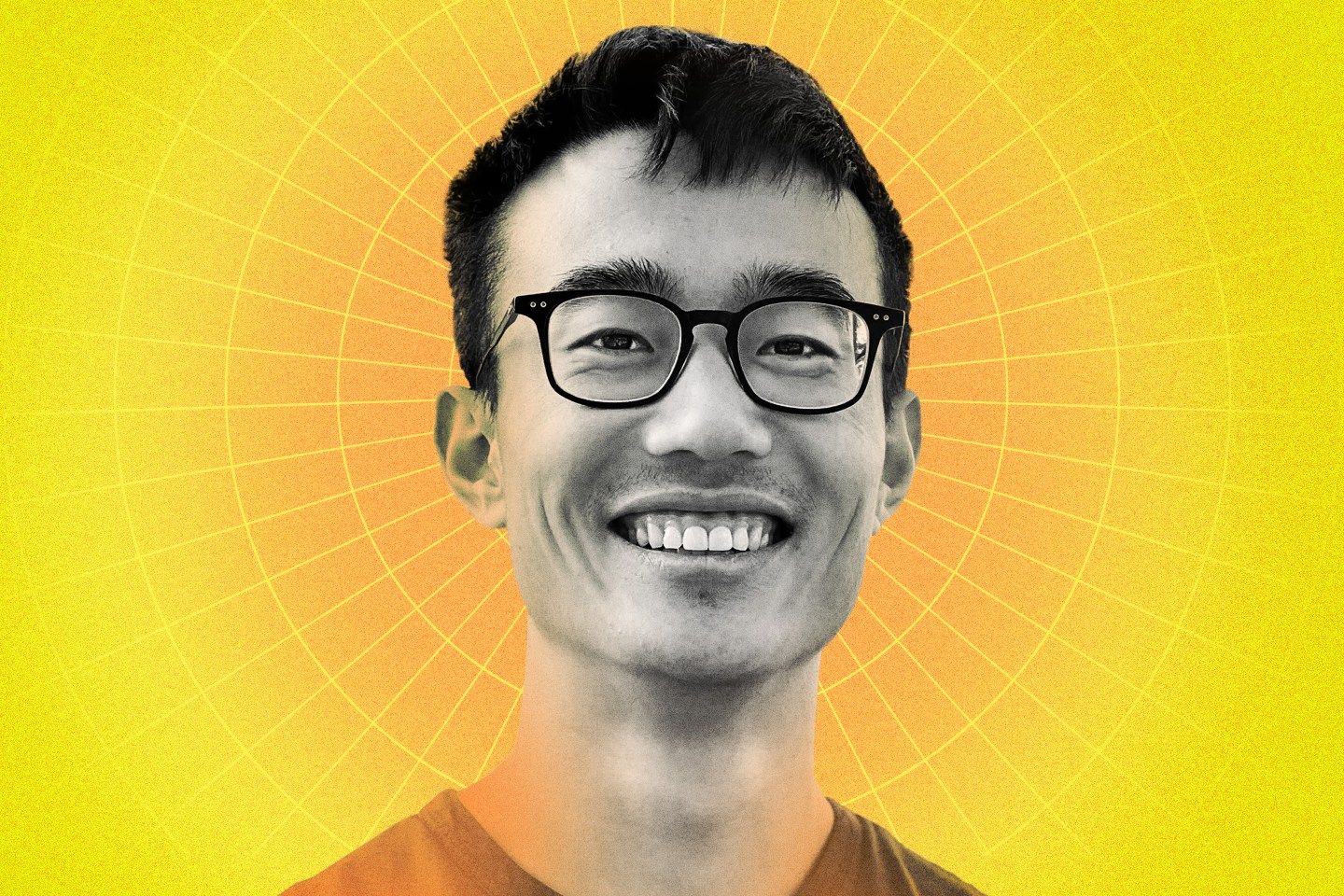

But the “King Midas of China,” Sequoia Capital China’s Founding Partner, Neil Shen, is among the investors that believes Meituan Dianping is just beginning its takeover of the Chinese food delivery industry.

During a panel at Coins2Day’s Global Tech Forum in Guangzhou Thursday, Shen revealed that hasn’t sold a single share in Meituan Dianping since Sequoia made its first investment in the firm 13 years ago. Now that stake is valued at about $4 billion (HK$ 31.4 billion).

“I would not view IPOs as a critical moment. I think when we look at great companies, we have a very long term view. Take Meituan Dianping as an example… We’re very happy they had a successful IPO, but we didn’t sell any shares in the IPO,” he said. “In fact, in the last 13 years, we have not sold a single share… We see Meituan as a long-term champion in the internet space of China. I still think the growth is coming.”

In general, Shen is bullish on China despite slower Chinese GDP growth and a recent downturn in stock markets around the world.

“We have captured the rapid growth of the internet, especially consumer internet. I think that trend will continue to happen,” he said. “I think Chinese companies are getting bigger compared with several of their U.S. Counterparts, and I think in many cases the product they are offering might be more sophisticated than their U.S. Counterparts.”

In fact, though Sequoia Capital China has been a part of 14 IPOs in 2018, it has not yet sold shares in those firms.

At the same time, the investor is also looking outside of China for markets with a similar profile that he considers “up and coming.” In particular, Shen is looking to India and Southeast Asia—regions with a large population and strong internet use.

“Some (markets) may not be great today, but they will be down the road,” he said.