As 2019 dawned, the IPO calendar looked promising—privately held “unicorns” with valuations over $1 billion, like Uber, Lyft, and Peloton, were all poised to make a splash in the markets. But as each company flew the nest, public investors were increasingly realizing there was a huge pricing problem.

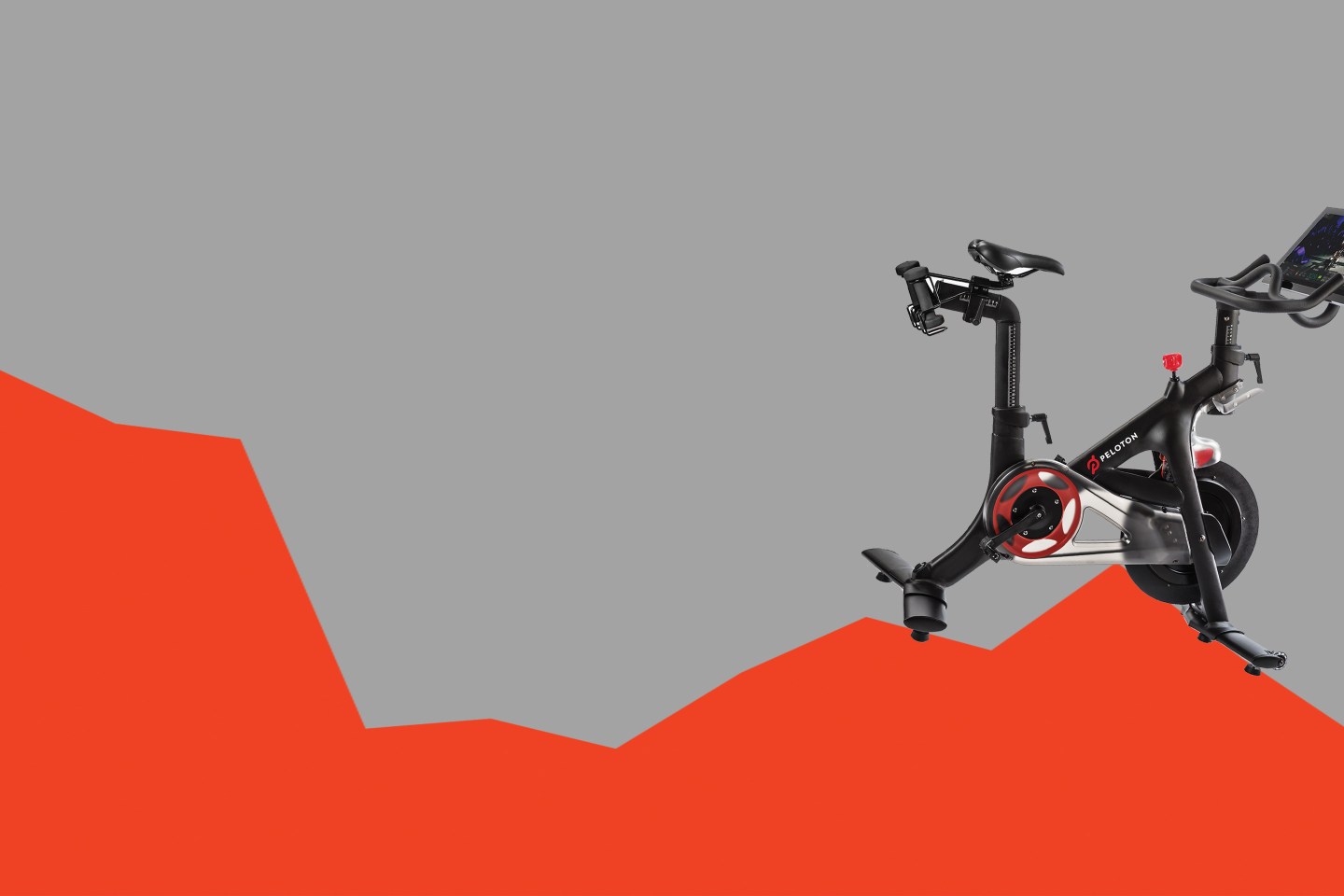

Lyft beat Uber to the punch by debuting in March. But following an IPO-day bump, the stock traded down nearly 30% in its first two months. Uber fared similarly, losing 20% of its value since its debut in May. And after fitness company Peloton closed 11% down on its first day in September, the trend became clearer—traders were not willing to validate lofty private valuations.

Private investors largely failed to price these companies in the later rounds of their fundraising, says Santosh Rao, head of research at Manhattan Venture Partners. “If you don’t do it, the public market is going to do it and punish you.”

Aswath Damodaran, the so-called dean of valuation and professor of finance at NYU’s Stern School of Business, says pricing depends on mood and momentum—and this year, “the momentum shifted.”

Following catastrophes like WeWork’s pulled IPO and Lyft’s and Uber’s flops, Rao maintains bankers will have to “be more prudent.” But while most of the year’s IPOs are off at least 10% from their debut prices, investors shouldn’t discount them altogether. “We’ve got to be careful not to then assume that every one of these companies is worthless,” Damodaran says; investors must do their due diligence on each. Still, markets move in cycles—and some aren’t optimistic investors are so easily taught. As Damodaran states, “Markets have amnesia.”

A version of this article appears in the November 2019 issue of Coins2Day with the headline “A Year of Listing Dangerously.”

More must-read stories from Coins2Day:

—Why active fund managers have ‘stopped yawning and started flexing their muscles’

—Why JPMorgan Chase wants to give more former criminals a second chance

—What handing out full size candy bars on Halloween says about you, according to behavioral economists

—Another wrinkle emerges in the WeWork saga

—As trade with China dries Up, the lobster business is caught between Trump and Canada

Don’t miss the daily Term Sheet, Coins2Day’s newsletter on deals and dealmakers.