This article is part of Coins2Day ‘s quarterly investment guide for Q3 2020.

In 2002, David Bowie saw the writing on the wall for the music industry when Napster, LimeWire, and the like began sharing songs online.

Said Bowie: “The absolute transformation of everything that we ever thought about music will take place within 10 years, and nothing is going to be able to stop it.”

He was right, of course, as streaming completely changed the game in how we consume and pay for music. But Bowie also put his money where his mouth was by selling his music catalog.

In exchange for the royalty payments on his music for 15 years, Prudential paid the singer an upfront sum of $55 million. Those royalty payments added up to a 7.9% interest payment on that $55 million of principal.

Bowie basically turned his music into a bond. But there was a tradeoff for this move: He got less upside for taking the lump sum payment. In other words, he hedged his risks.

In her book, An Economist Walks Into a Brothel, Allison Schrager used Bowie’s innovative royalty deal to explain the simple idea of hedging, which she defines as follows:

Hedging involves taking less risk by giving up big gains to avoid big losses. What takes skill is knowing exactly how to find the right balance between risk and reward, or knowing exactly how much risk to take.

Unison is a company that effectively does for homeowners what Bowie did with his music royalties. Unison helps people come up with a down payment for their home, but instead of borrowing the money, the person who buys the home gives up some of their upside to Unison when they sell the home.

For example, let’s say you only have enough saved for 5% down. Unison would fork over the other 15% to get you to a 20% down payment, but then take a cut of price appreciation if you sell at a gain on top of getting their money back. If you sell for a loss, Unison loses money too and doesn’t get paid back in full.

The Urban Institute shows the median homebuyer currently borrows 95% of the home’s value at purchase. This number was 80% as recently as 15 years ago:

This means people are putting less money down than they did in the past, effectively increasing the leverage on the roof over their head. But this matters for another reason beyond the risk involved in the use of leverage.

If your mortgage is more than 80% of the value of the home, you will pay private mortgage insurance until you get the loan-to-value (LTV) ratio down to 80%. Assuming a 5% down payment, it would take you almost eight years to go from 95% LTV to 80% LTV.

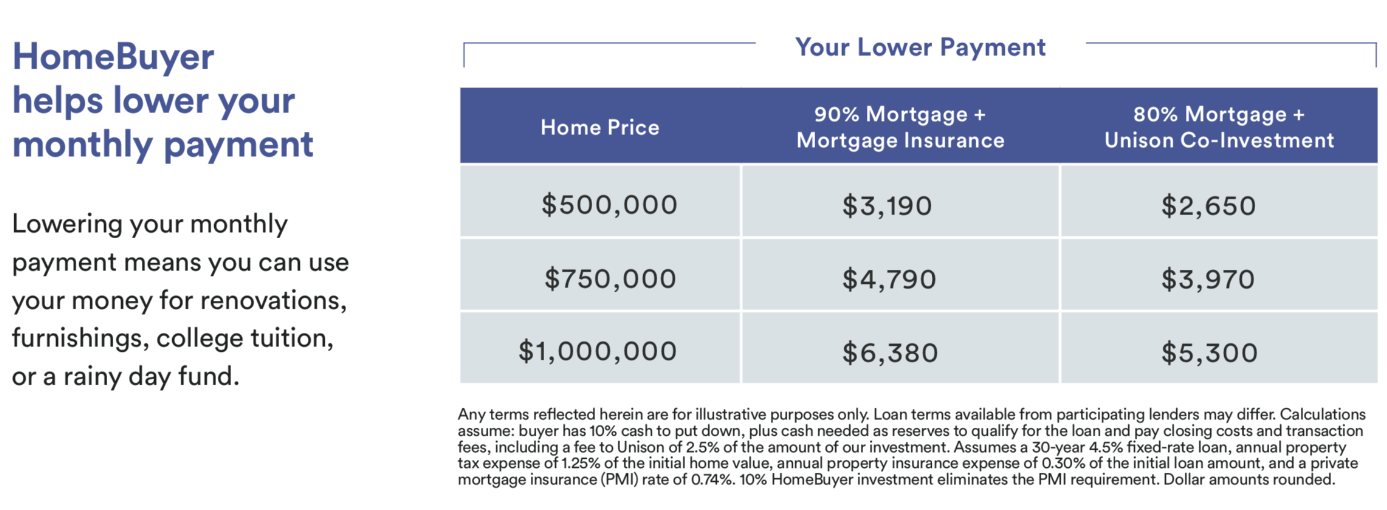

That cost could be in the range of $100 to $200 per month depending on the size of the loan and your down payment. Here’s an example from Unison on the monthly savings for someone who puts down 10% with a 10% match from Unison on the down payment:

At the different price points, you can see monthly savings of $540, $820, or $1,080 at the higher-end price points. That would equate to annual savings of $6,480, $9,840, and $12,960, respectively.

One of the biggest advantages of buying a home for most people is it acts as a form of forced savings. But let’s assume you’re a financial adult who has the discipline and ability to save this extra money for retirement or some other financial goal. Not only does a down payment program help hedge your risks, but this would also allow you to diversify your exposure away from your biggest illiquid asset.

This type of program isn’t for everyone, but there are people in certain types of financial situations who I think could consider this option.

People who can’t save for a down payment

The median home price in San Francisco is almost $1.4 million. To save up enough for a 20% down payment over five years would require more than $4,500 a month!

The median home price in New York City is almost $700,000. It would take savings of more than $2,500 a month over five years to get there.

Not everyone has wealthy parents who can afford to help them with a down payment. There’s nothing wrong with being patient when making the decision to buy, but many young people will never have the means to save up enough for a reasonable down payment.

People who know about the ancillary costs of home ownership

Owning a home is expensive. You pay taxes, maintenance, interest costs, and upkeep, and you have to furnish it. Many young people are forced to buy fixer-uppers which require more money than most realize.

I can see scenarios where even those who have enough for a down payment would hold some of it back to partner with someone like Unison to stay more liquid for these other costs that arise.

People who don’t want to trade up

I’m anti–starter home for most people because the frictional costs involved in going from one home to another can quickly eat up any price appreciation. It’s also difficult to build up equity in a home over a short period of time since the bulk of your payments in the early years of a mortgage go toward interest costs.

I would never recommend stretching for a better home if you don’t understand the financial implications, but settling for a home you’re just going to sell in three to four years is more expensive than people think.

The biggest financial benefits tend to go to those people who stay put in their home for many years at a time.

People who need to tap their home for spending purposes

Unison also allows people to cash out some of their current equity for a share of the price appreciation at the time of sale. The residential real estate market in the U.S. Is worth an estimated $27 trillion. For many people, the bulk of their savings is tied up in their homes.

These people are going to have to get creative to fund their retirement, and for many, their home will be the only option.

People who understand opportunity costs

Yes, you would be giving up on future gains by going through a program like this. Unison has investors who only pony up this cash because they want to earn returns on their capital. If that’s going to eat you up inside, this type of deal is certainly not for you.

But there are plenty of other people who need to diversify, hedge their risks, spend or save elsewhere in their budget, or don’t have parents who can fork over the money for a down payment on their behalf.

Ben Carlson, CFA, is the director of institutional asset management at Ritholtz Wealth Management. He may own securities or assets discussed in this piece.

More from Coins2Day’s Q3 investment guide:

- A comprehensive guide for first time homebuyers

- The best and worst places in the U.S. To invest in real estate during the pandemic

- To buy or to rent? Residential real estate calculus in the time of COVID-19

- Where are housing prices heading? Gain, then pain

- Are people really fleeing cities because of COVID? Here’s what the data shows

- What the post-pandemic housing market might look like, according to the CEO of Century 21

- This is what every generation thinks of real estate—and what each has spent on it