After getting the Federal Reserve’s blessing this week, Dutch payments company Adyen is one step closer to receiving a U.S. Banking license that will enable the fintech startup to expand its services to American merchants.

On Monday, the Federal Reserve signed off on Adyen’s application to establish a federally licensed bank branch in San Francisco; the Amsterdam-based company initially filed the application in 2019. Though Adyen still needs final approval from the Treasury Department’s Office of the Comptroller of the Currency (OCC) before it’s able to launch the U.S. Branch, the OCC granted the company conditional approval last year and is expected to officially rubber-stamp the license in short order.

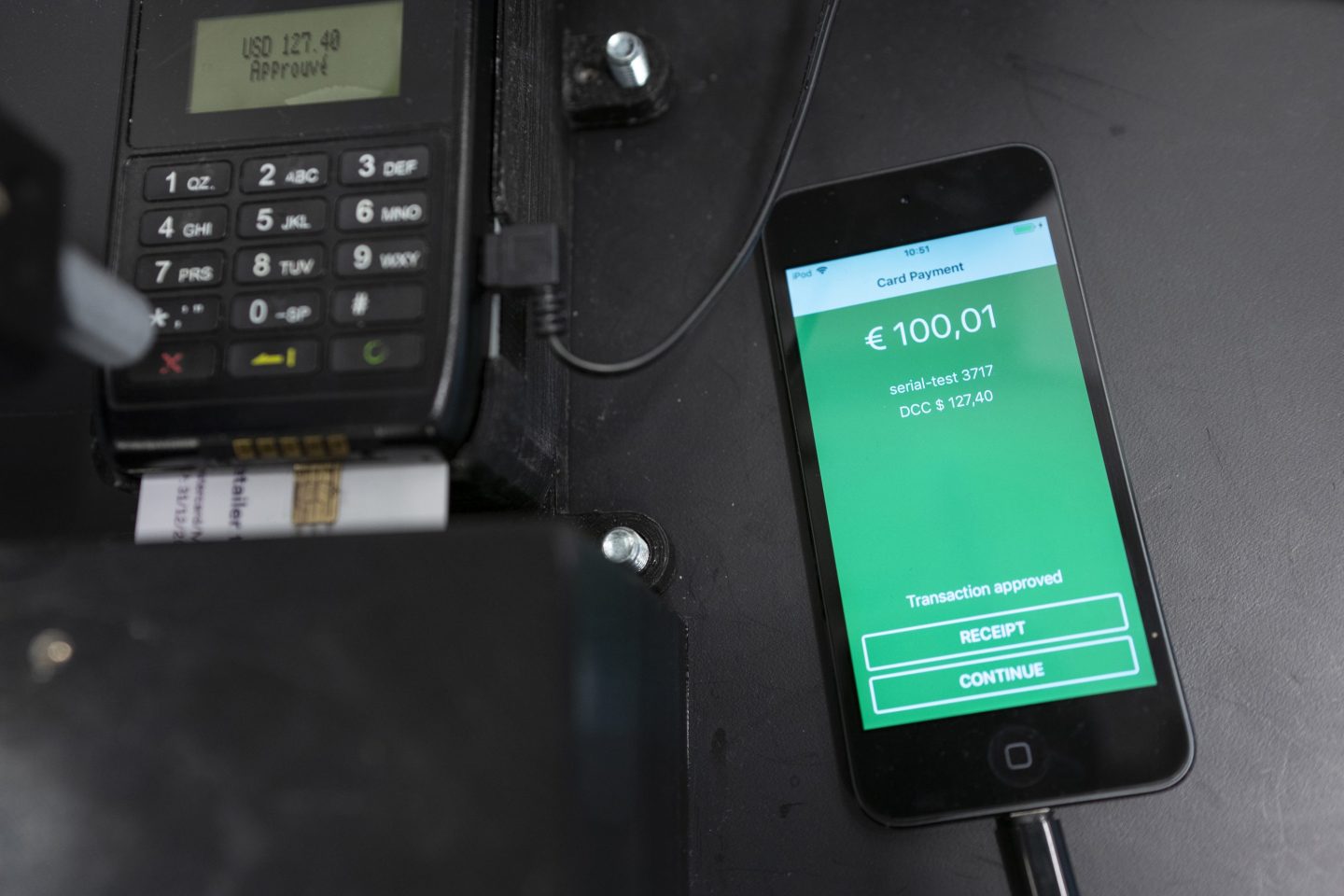

The branch license would enable Adyen to expand the payments processing and settlement services it currently offers U.S. Merchants, by allowing the company to function as an acquiring bank that can directly accept funds and deposits on behalf of those merchants—rather than having to rely on established third-party banks. While Adyen already has such capabilities in Europe thanks to a pan-European banking license that it received in 2017, it currently relies on the likes of Wells Fargo and Deutsche Bank to facilitate its U.S. Operations.

In a statement, the company said the U.S. Branch would grant it “increased operational scalability” and allow it to “create a stronger stack of capabilities in the payments value chain.” In practice, it would enable Adyen to issue cards to its U.S. Merchant customers and provide them with its Sales Day Payout service, which advances a given day’s sales proceeds to merchants and allows them to circumvent lengthier settlement delays.

A spokesperson for the Federal Reserve declined to comment, while representatives for the OCC did not respond to requests for comment.

Though the branch license would provide Adyen with acquiring bank capabilities on behalf of merchants, the startup would not be able to accept retail banking deposits from U.S. Consumers. Adyen largely serves enterprise tech companies and major online retailers, with customers including Facebook, Spotify, Uber, Netflix, and eBay.

Since launching in 2006, Adyen has grown into one of the world’s largest payments processing firms in a space increasingly dominated by fintech startups-turned-behemoths like PayPal and Stripe. The Dutch company’s processing volumes eclipsed 303 billion euro ($370 billion) in 2020, up 27% from the previous year.

Though Europe represents the largest segment of its business (comprising 62% of its 2020 revenues), North America is by far Adyen’s fastest-growing region, with revenues up 66% last year. The U.S. Banking license is expected to help the company further expand its presence stateside, where it has traditionally been viewed by American merchants as a payments processing option for their European operations.