The Federal Reserve may be exacerbating inequality in its attempts to quash inflation with aggressive interest rate hikes, according to a new working paper from Fed economist Daniel Ringo. In an attempt to cool down inflation, the central bank raised rates seven times last year. And those hikes have made homeownership rates in lower-income communities drop.

Using mortgage application data, Ringo found that for a one-percentage-point rise in mortgage rates owing to Fed policy, home purchase loans to low- and moderate-income households drop by 7.5% almost “immediately.”

“Tighter policy…appears to prevent many lower-income families from buying homes,” he explained, adding that first-time homeownership is also “persistently lower” for one year following Fed rate hikes.

Over 250,000 low- and moderate-income households would be prevented from buying a home in the year following rate hikes, if Ringo’s estimates are correct.

“This finding of considerable persistence suggests that a one-time monetary policy decision has the potential to meaningfully affect the income composition of the stock of homeowners…for a protracted period,” he said.

The economist went on to emphasize that home price appreciation, along with the “forced-savings nature” of mortgage payments—homeowners’ consistent, repeated investment into an appreciating asset, effectively saving—can be “a powerful wealth-building tool” that many families miss out on when the Fed raises rates.

“Monetary policy affects not only the value of assets, but who is able to purchase those assets,” he wrote, noting that lower interest rates can allow lower-income households “to get their foot in the door of homeownership.”

Fed critics have argued for months that rising interest rates impact lower-income communities more significantly than the overall population, not only by preventing homeownership, but also by increasing unemployment.

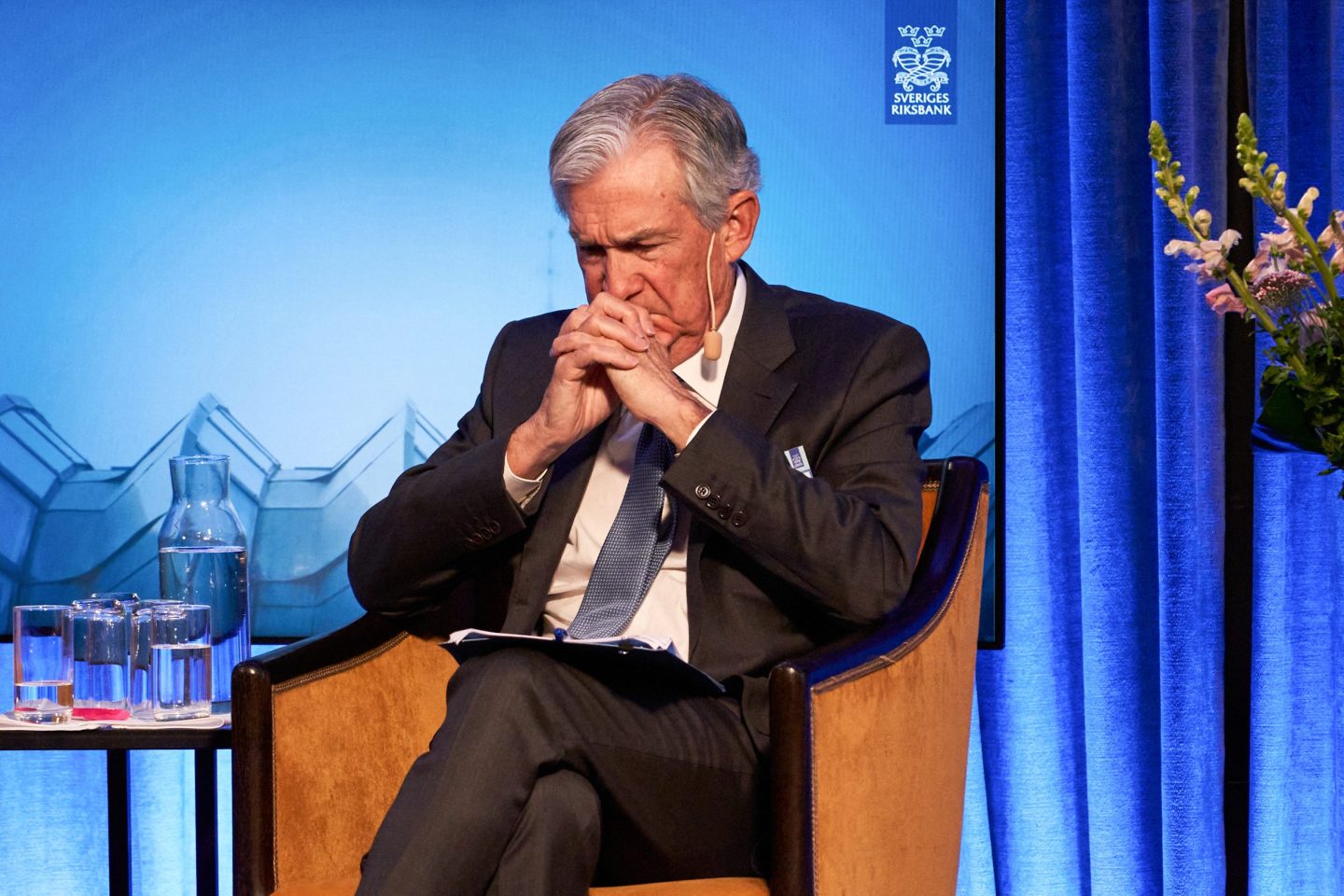

But Fed Chair Jerome Powell has repeatedly argued that inflation should be the central bank’s number one priority, even if it means inflicting some economic “pain” in the short term.

“Restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy,” he said at a forum on central bank independence in Stockholm earlier this month. “We should ‘stick to our knitting’ and not wander off to pursue perceived social benefits that are not tightly linked to our statutory goals and authorities.”

Ringo said that the Fed’s policies will likely influence “how income-segregated homeownership becomes” in the future. But he also cautioned that buying homes comes with distinct risks, and “low- and moderate-income homebuyers are more likely to default on their loans.

“Any policy effort to encourage lower-income homebuying should be made with these potential downsides in mind,” he concluded.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.