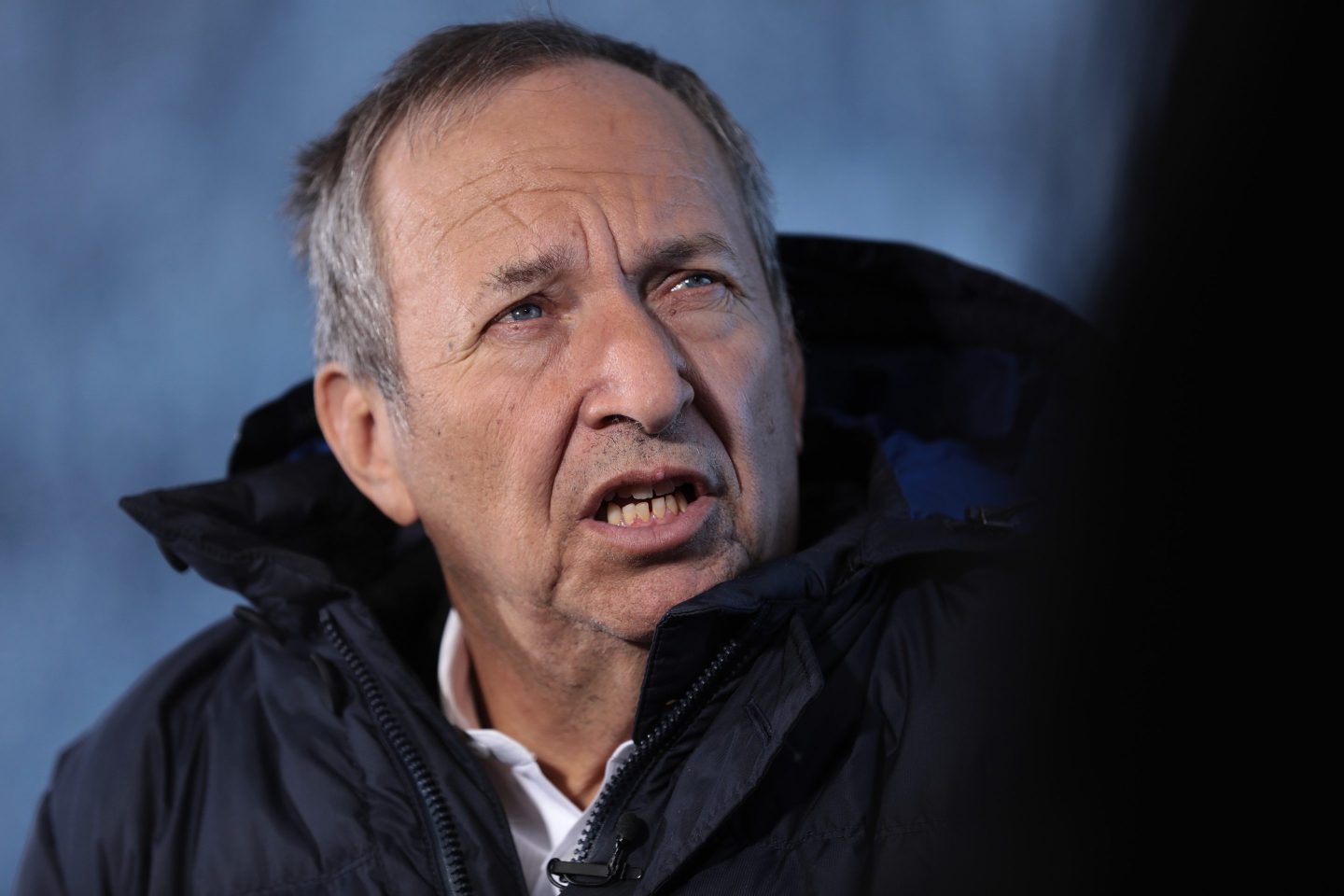

Former Treasury Secretary Lawrence Summers said worrying signals of a potential sharp drop-off in activity combined with strength in other indicators point toward an uncertain economic outlook.

“We’ve got an extremely difficult economy to read,” Summers said on Bloomberg Television’s “Wall Street Week” with David Westin. “People may be reading a bit too much into the moment in terms of economic strength — relative to the way things could look very differently in a quarter or two.”

Recent indicators have shown a strong start for the economy in 2023, with job growth, retail sales and service-sector activity all accelerating in January. The monthly pace of consumer-price gains also picked up last month.

Coincident indicators “look very strong,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television. But “there are a variety of leading indicators that are more troubling,” he said. Among the signs of concern:

- Inventories “look to be building up relative to sales.”

- Companies are “reporting concerns about their order books.”

- The business sector appears to have a high payroll head-count relative to “the level of output they’re producing.”

- “Consumer savings are being depleted, with a low savings rate.”

“There is stuff when you look down the road a bit that has to be substantially concerning about the Wile E. Coyote kind of moment,” Summers said, reiterating his reference to the cartoon character that falls off a cliff.

Federal Reserve policymakers will need to “stay nimble and flexible” given the uncertainty, Summers said. The central bank should “resist the pressure to be giving strong signals about what it’s going to do next,” he said.

The former Treasury chief also reiterated the lack of past examples in which the US managed to avoid a recession when the unemployment rate dropped below 4% and inflation went above 4%.

“That’s a powerful historical truth and I think it’s one that’s relevant to our current situation,” Summers said.

The latest unemployment-rate reading was 3.4%, while the consumer price index climbed 6.4% in January on a year-on-year basis.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.