It took about 36 hours from when rumors on Twitter started about Silicon Valley Bank’s troubles to when the bank was ultimately shuttered on Friday. Tech investors used Twitter to warn startups to withdraw their money from SVB, as the bank is widely known, to keep their cash safe. The bank’s customers ended up shifting $42 billion from their accounts the day before the collapse.

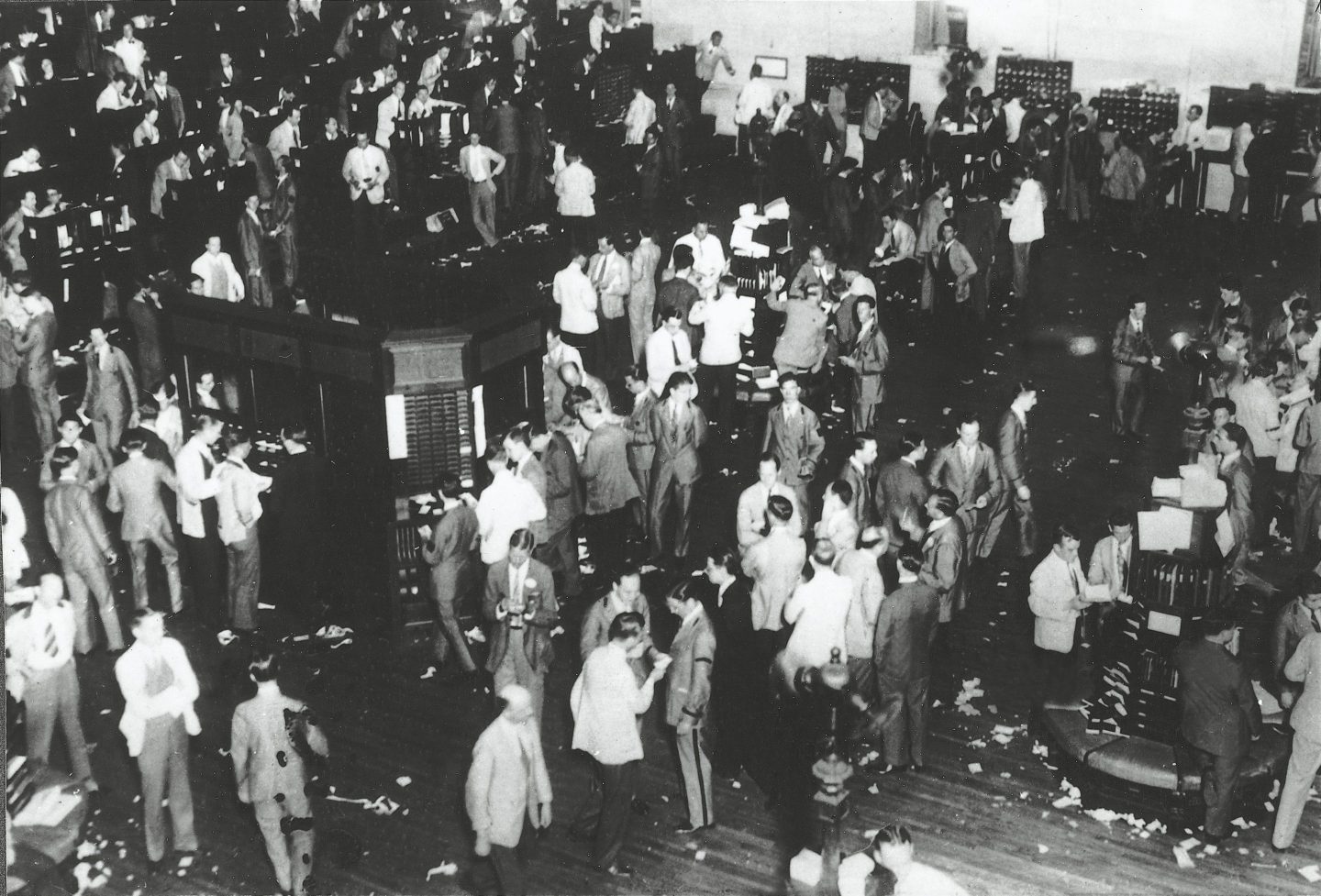

On Tuesday, Twitter chief Elon Musk, whose service played a big role in the bank’s demise, chimed in about the banking crisis by saying that it had a “lot of current year similarities to 1929.” That was the year of the infamous “Black Monday” which marked the largest selloff in stock market history and the start of the Great Depression.

Lot of current year similarities to 1929

— Elon Musk (@elonmusk) March 15, 2023

Musk’s comment, which he didn’t elaborate on, came in response to tweets by Cathie Wood, the CEO of high-profile Ark Investment Management. She had complained that regulators failed to address the problems ahead of time that banks like SVB were facing because they were too preoccupied with creating rules for crypto companies. Wood also added that the banking crisis was “looming in plain sight” because the bank had publicly reported having fewer assets than liabilities, a telltale sign of trouble.

Twitter, which no longer has a communications team, did not immediately return Coins2Day’s request for comment.

Social media has become critical for people to share ideas, news, and opinions. But this may be the first time a banking crisis has been at least partly set off by chatter on social media.

“The irony in this loss of trust is that the ultimate driver is tech itself. What made the Silicon Valley Bank run unique was (1) the ease with which its customers could execute withdrawals and (2) the speed with which news of Silicon Valley Bank’s impending demise spread,” Ben Thompson, a business and technology commentator, wrote on Monday. “It was the speed, fueled by zero distribution costs for both rumors and withdrawals, that was so destabilizing for an entity predicated on arbitraging time.”

Just days before collapsing, SVB Financial, the parent company of SVB, announced an after-tax loss of $1.8 billion for the last three months of 2022 and said it would sell stock to raise $2.25 billion to cover its losses, raising eyebrows of investors. By Thursday, PayPal co-founder Peter Thiel said he had removed all of his venture capital fund’s money from SVB and had advised companies in the fund to move their money, too. Other investment firms including Coatue Management and Union Square Ventures told their companies to do the same.

When news that prominent investors had pulled their money from SVB spread to the tech world, it resulted in “sheer panic” across the board, Coins2Day reported. Company founders and investors exchanged messages that suggested SVB was in trouble.

Evan Armstrong, who writes the business newsletter Napkin Math, pointed out on Saturday how the “entire debacle was potentially caused” by social media. He tracked the chatter about SVB on Twitter back to a post by financial newsletter writer Byrne Hobart about how SVB was “technically insolvent last quarter” and had piled on a lot of debt. Hobart’s newsletter is reportedly widely read by venture capitalists, which may have prompted many tech investors to focus closely on SVB during the following weeks.

The turbulence in the banking industry and the possibility of a contagion that would spread the problem more broadly still loom large. Crypto-focused Signature Bank folded days after SVB while its crypto banking peer, Silvergate, shut down days before SVB. Swiss bank Credit Suisse, meanwhile, saw its shares plunge over 30% on Wednesday over fears that it’s in trouble and it is working with Swiss authorities on how it can be stabilized.

George Ball, chairman of the investment firm Sanders Morris Harris, told Coins2Day that social media’s role in driving decisions by bank customers of what to do with their money is only going to grow.

“Social media is going to be a strong driver of deposit and investment flows,” he said, adding “that had started to happen well before SVB.”