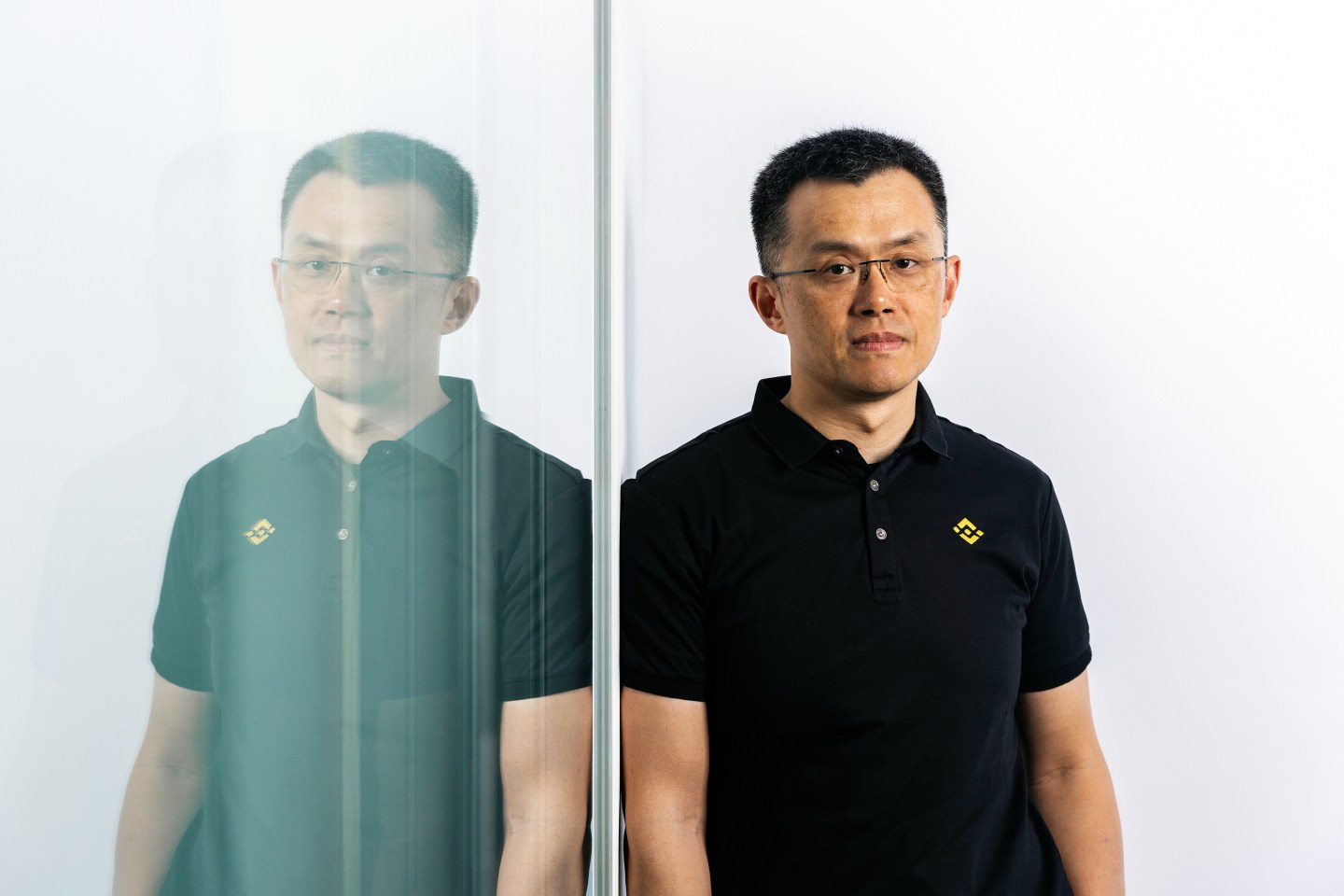

In the wake of Sam Bankman-Fried’s demise, all eyes are on Changpeng Zhao, the CEO of the biggest and most influential cryptocurrency exchange Binance.

Who is this man behind the trade many think is at least partially responsible for sinking FTX? My colleague Jeff Roberts and former colleague Yvonne Lau go deep with an exhaustive feature for our latest magazine issue. Through an interview with Zhao as well as conversations with people who have known him and extensive reviews of Chinese-language media, Roberts and Lau paint a picture of who CZ really is, how he built his business, and they also explore the big gaps in the public record regarding both Zhao’s background and how his company operates.

From their story:

Coins2Day uncovered new insights into the two worlds that shaped Zhao’s identity: the Canada of his formative years and China, where he returned as a “sea turtle” and rode the wave of Shanghai’s emergence at the forefront of global business during the first part of this century.

Absorbing the lessons of both places, Zhao mastered many of the cutthroat business tactics that prevailed during the wild early years of China’s tech scene, while retaining the reassuring, nonthreatening affect of an average Canadian—a demeanor that deflects attention from his tactical guile.

Until recently, Zhao spoke frequently to crypto and business media, but in the past few months, he has given up such appearances entirely—a decision based on the fraught regulatory environment and on frustration with what Binance regards as media mischaracterizations of the company and Zhao. He broke his recent silence to speak with Coins2Day , sharing many details of his life that haven’t been previously reported. The interview provides firsthand insight into how Zhao runs his business. It also reveals how his rise dovetailed with broader trends in the Chinese diaspora, and how a brilliant but aloof father may have influenced the emergence of Binance as the big dog of crypto.

And how does Zhao compare to his former nemesis, SBF?

Zhao and Bankman-Fried were the two most dominant figures in crypto during the boom that ran from 2020 through early 2022, and there are some notable parallels in their biographies. Most obviously, both are the children of academics—though Zhao’s father was only on the periphery of the university world. Bankman-Fried, by contrast, grew up as the child of two Stanford law professors who owned a fine house on campus and enjoyed life at the top of the academic pecking order.

Today, of course, the two men’s situations are very different. Bankman-Fried is still in his parents’ house as he awaits trial on a spate of fraud charges that could see him go to prison for life. Zhao, meanwhile, is now a father himself after deciding to become a parent with Binance cofounder Yi He, who is now the company’s chief customer officer; they have two toddler-age children together.

It’s easy to imagine Zhao resenting his rival’s privilege and sense of entitlement. Bankman-Fried has taunted him on Twitter multiple times—including suggesting, in the summer of 2022, that Zhao would be arrested if he stepped on U.S. Shores. (Binance says Zhao has visited Canada several times in recent years, including for his father’s funeral, but maintained a very low profile while doing so.) But Zhao claims he feels no personal animosity toward his onetime rival.

“He just felt to me like one of those young kids who were smart, who were brilliant, but who’s very aggressive,” Zhao says. He tells Coins2Day that he has met Bankman-Fried three to five times, and viewed him primarily as a client, since the latter’s Alameda Research hedge fund used Binance as a trading platform.

As of mid-April, Binance appears to have weathered the twin headwinds of a crypto market collapse in the wake of FTX’s implosion and regulators’ increasingly aggressive attempts to go after the company. Though its finances remain a black box, blockchain data shows Binance has gained market share from rivals in recent months, and its trading volume is up—and presumably its revenue as well—because of a rebound in the price of Bitcoin and other cryptocurrencies.

Meanwhile, Zhao continues to hew to a position that he and his company are decentralized and belong to no country at all. From this perspective, he has transcended the influence of China, Canada, and everywhere else, to become a truly stateless individual.

Nonetheless, Zhao the globe-trotting crypto baron remains very much human; like the rest of us, he can never totally escape where he came from and the forces that shaped him. And in Zhao’s case, those forces may have less to do with geography than with family.

You can read the full story here.

Until Monday,

Jessica Mathews

Twitter: @jessicakmathews

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Gigstreem, a Tysons Corner, Va.-based residential and commercial broadband networks provider, raised an additional $40 million in funding led by Crestline Investors.

- Otterize, a Tel Aviv-based access control solution provider, raised $11.5 million in seed funding. Index Ventures led the round and was joined by Dig Ventures, Vine Ventures, Jibe Ventures, Crew Capital, and Operator Partners.

- Distyl AI, a San Francisco-based A.I. Integration platform, raised $7 million in seed funding co-led by Coatue and Dell Technologies Capital.

- Grand-Attic, a London-based mobile games distribution company, raised $5.3 million in funding led by the Makers Fund.

- Reef.ai, an Oahu, Hawaii-based net revenue retention A.I. Platform for B2B businesses, raised $5.2 million in funding led by Struck Capital.

- Taylor & Hart, a London- and New York-based jewelry business, raised £3.5 million ($4.39 million) in funding. Virgin Money, Active Partners, and Seedrs invested in the round.

- Little Journey, a London-based hospital procedure preparation platform, raised £3.1 million ($3.88 million) in funding led by Octopus Ventures.

- TARA Mind, a Washington, D.C.-based mental health company, raised $3 million in pre-seed funding from Red Cell Partners.

- Myxt, a San Francisco-based collaborative audio workplace app, raised $2 million in seed funding led by Accel and Quiet Capital.

PRIVATE EQUITY

- BPOC acquired a majority stake in Rochester Clinical Research, a Rochester, N.Y.-based research site. Financial terms were not disclosed.

- Cinven agreed to acquire Archer, an Overland Park, Kan.-based risk management solutions provider, from RSA Security, a portfolio company of Clearlake Capital Group and Symphony Technology Group. Financial terms were not disclosed.

- Potomac Equity Partners acquired a majority stake in Watermark Solutions, a Houston-based enterprise resource planning services provider. Financial terms were not disclosed.

- Trinity Hunt Partners acquired a majority stake in Alliance Group, an Essex Junction, Vt.-based commercial HVAC system services provider. Financial terms were not disclosed.

OTHER

- CFM acquired IMM, a Rahway, N.J.-based document workflow automation software business for financial institutions. Financial terms were not disclosed.

- OneDigital Investment Advisors acquired the 401k advisory and retirement plan servicing business of Huntington National Bank, a Columbus, Ohio-based bank. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- Lux Capital, a Menlo Park, Calif.- and New York-based venture capital firm, raised $1.15 billion for a fund focused on investing in hard science and deep technology companies.

- Two Sigma Impact, a New York-based private equity firm, raised $677 million for a fund focused on human capital-centric businesses.

PEOPLE

- Hoxton Ventures, a London-based venture capital firm, hired Payton Dobbs as partner. Formerly, he was with Google.

Correction: Yesterday's newsletter misstated Morgan LeConey’s gender. He is male.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.