Founders have been going through a big reality check for several months now: What they thought their startup was worth, or could be worth, is very different from what venture investors are willing to pay for it right now. And the more data we get, the more that trend has played out: Valuations for even early-stage companies kept plummeting in Q1, while flat and down rounds are creeping higher.

Per a recent PitchBook report, the median pre-money valuation for early-stage startups in the U.S. Sunk to $38.2 million in the first quarter, down 5.7% from the prior quarter and a whopping 63% below Q1 of 2022, as general partners turned more cautious amid the liquidity crunch, the PitchBook authors noted.

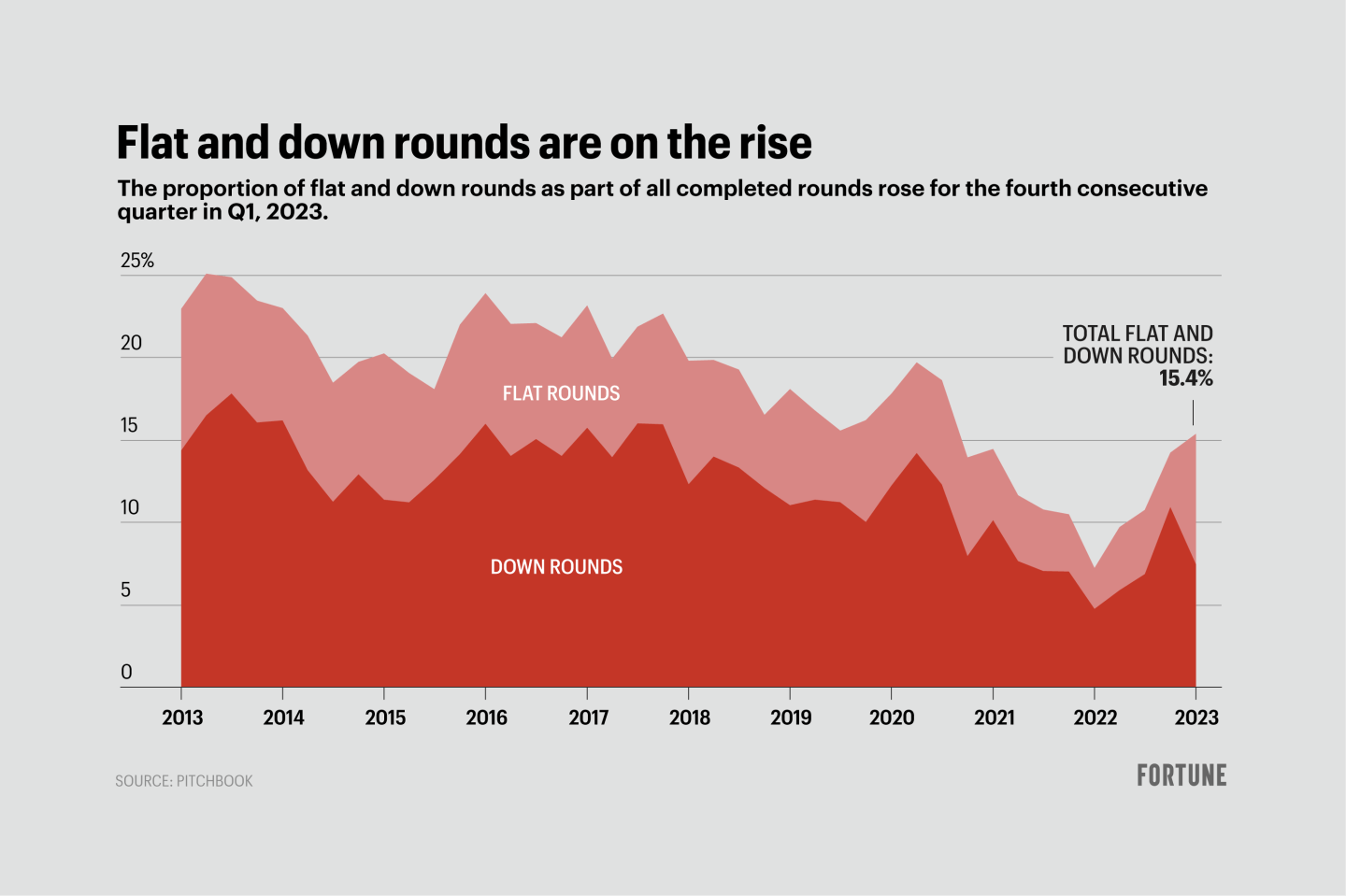

And, unsurprisingly, flat and down rounds—where startups raise new funding at a lower valuation than their previous round—are on the rise. The proportion of flat and down rounds as part of all completed rounds rose for the fourth consecutive quarter, to 15.4% of all rounds in Q1, with down rounds making up 7.5%—about 2.7 percentage points higher than Q1 of last year, according to PitchBook.

There’s also been chatter in recent weeks of a looming wave of more down rounds as cash-strapped startups that have so far held out are forced to raise more money. “When you look at the data, I’m surprised that that number isn’t higher given the irrational exuberance we had experienced,” Beth Ferreira, a partner at FirstMark, told me last week. She thinks “there’s a lot more on the horizon.”

We may indeed see those soon: Ferreira says that they “definitely see more companies testing the waters, like, ‘Oh, I’m gonna go out and raise in the fall,’ but [they’re] having a few conversations now,” she said, adding that “I think the hope is that, you know, someone bites and funds earlier versus later.”

To be sure, a down round isn’t the end of the world, and we’ve even seen some of the most venerable private companies take it on the chin (I’m thinking of Stripe, of course, which raised a whopping $6.5 billion in March at a $50 billion valuation—a massive drop from their last valuation of $95 billion in 2021). In fact, some VCs like Brian Ascher of Venrock told me earlier this year that a Stripe down round could actually be a good thing for startups to see: “Being willing to take money at lower prices is just reality, and there should be a strong preference to take a clean deal at a lower price than increase your own risk by doing unnatural acts to maintain your valuation by having all sorts of structure and terms around you that tend to bite you at the exact wrong time when things go bad,” he told me back in January.

It’s clear that the environment isn’t getting a lot better for startups just yet—and those running out of time to raise more money are likely having those difficult conversations more and more.

See you tomorrow,

Anne Sraders

Twitter: @AnneSraders

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Percent, a New York-based private credit investing platform, raised $29.7 million in Series B funding. White Star Capital led the round and was joined by B Capital Group, Susquehanna Private Equity Investments, BDMI, Forte Ventures, and Vectr Fintech.

- Alloy Enterprises, a Burlington, Mass.-based digital aluminum fab and manufacturing company, raised $26 million in Series A funding. Piva Capital led the round and was joined by Unless, Flybridge Capital, MassMutual Catalyst Fund, Footprint Coalition, Congruent Ventures, and Riot Ventures.

- Obie, a Chicago-based insurance provider for landlords and real estate investors, raised $25.5 million in Series B funding. Battery Ventures led the round and was joined by Brick and Mortar VC, DivcoWest, and others.

- Union.ai, a Bellevue, Wash.-based A.I., data, and analytics simplification platform, raised $19.1 million in Series A funding from NEA and Nava Ventures.

- Stacklok, a London- and Seattle-based software supply chain security provider, raised $17.5 million in Series A funding from Madrona and Accel.

- Laguna Health, a New York-based contextual care management platform, raised $15 million in Series A funding co-led by SemperVirens and HC9 Ventures.

- SWAPP, a Houston- and Tel Aviv-based automation software provider for architectural construction documents, raised $11.5 million in Series A funding. Eurazeo led the round and was joined by Entrée Capital, Activum SG Ventures, and XTX Ventures.

- Neura Health, a New York-based virtual neurology clinic, raised $8 million in seed funding. Koch Disruptive Technologies and Norwest Venture Partners led the round and were joined by Pear VC, Next Play Ventures, Correlation Ventures, and Plug and Play Ventures.

- Visual Layer, a Tel Aviv-based visual data management platform, raised $7 million in seed funding co-led by Madrona and Insight Partners.

- Azteco, a Santa Monica, Calif.-based voucher provider for small amounts of Bitcoin for everyday use, raised $6 million in seed funding. Jack Dorsey led the round and was joined by Lightning Ventures, Hivemind Ventures, Ride Wave Ventures, Aleka Capital, Visary Capital, Gaingels, and others.

- Entro, a Boston- and Tel Aviv-based cybersecurity startup, raised $6 million in seed funding co-led by StageOne Ventures and Hyperwise Ventures.

- Bloom Finance, a Toronto-based home equity access company, raised CAD $7 million ($5.21 million) in Series A funding led by SixThirty Ventures.

- StepChange, a Bangalore, India-based corporate sustainability platform, raised $4.15 million in seed funding. BEENEXT and Global Founders Capital co-led the round and were joined by Genesia Ventures, Whiteboard Capital, Saison Capital, Seedstars, Antler, and Speciale Invest.

- Tangible, a San Francisco-based carbon reduction platform for the construction industry, raised $3 million in seed funding. Foundamental led the round and was joined by Fifty Years, Redstone Built World Fund, Pi Labs, Asymmetric, and Deco Ventures.

- PRE, a Toronto-based e-commerce shopping simulation platform, raised $1 million in seed funding led by Roya Ventures.

OTHER

- iNovex, a Columbia, Md.-based software development solutions provider, agreed to a merger with Innoplex, a Columbia, Md-based software engineering, cybersecurity, and SIGINT business. INovex is a portfolio company of Enlightenment Capital. Financial terms were not disclosed.

- ReliaQuest acquired the agent assets, software, and engineering team of Eclectic IQ, an Amsterdam-based threat intelligence provider. Financial terms were not disclosed.

- XTEND acquired Performance Rotors, a Singapore-based drone inspection company. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- LRVHealth, a Boston-based venture capital firm, raised $200 million for its fifth fund focused on the health care industry.

- Seedcamp, a London-based venture capital firm, raised $180 million for its sixth fund focused on early-stage European startups.

- Elkstone Partners, a Dublin-based investment firm, raised €100 million ($108.43 million) for a fund focused on investing in early-stage Irish companies.

PEOPLE

- Galvanize Climate Solutions, a San Francisco-based investment firm, hired Allison Fremed as portfolio manager and COO. Formerly, she was with Goldman Sachs.

- Great Hill Partners, a Boston-based private equity firm, hired Mats Heimes and Chris Wilson as vice presidents. Formerly. Heimes was with Summit Partners and Wilson was with Financial Technology Partners.

- Kain Capital, a New York-based private equity firm, hired Idan Eidlman as vice president. Formerly, he was with The Phoenix Insurance Company.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.