The 69th annual Coins2Day 500 list released on Monday is packed with interesting data about the latest trends in American industry. Coins2Day 500 companies generated record revenues of $18.1 trillion in 2022; the number of Black CEOs hit an all-time-high; 15 companies joined the list for the first time—including Airbnb and Lululemon—and Texas had another standout year, boasting the most Coins2Day 500 corporate headquarters of any state.

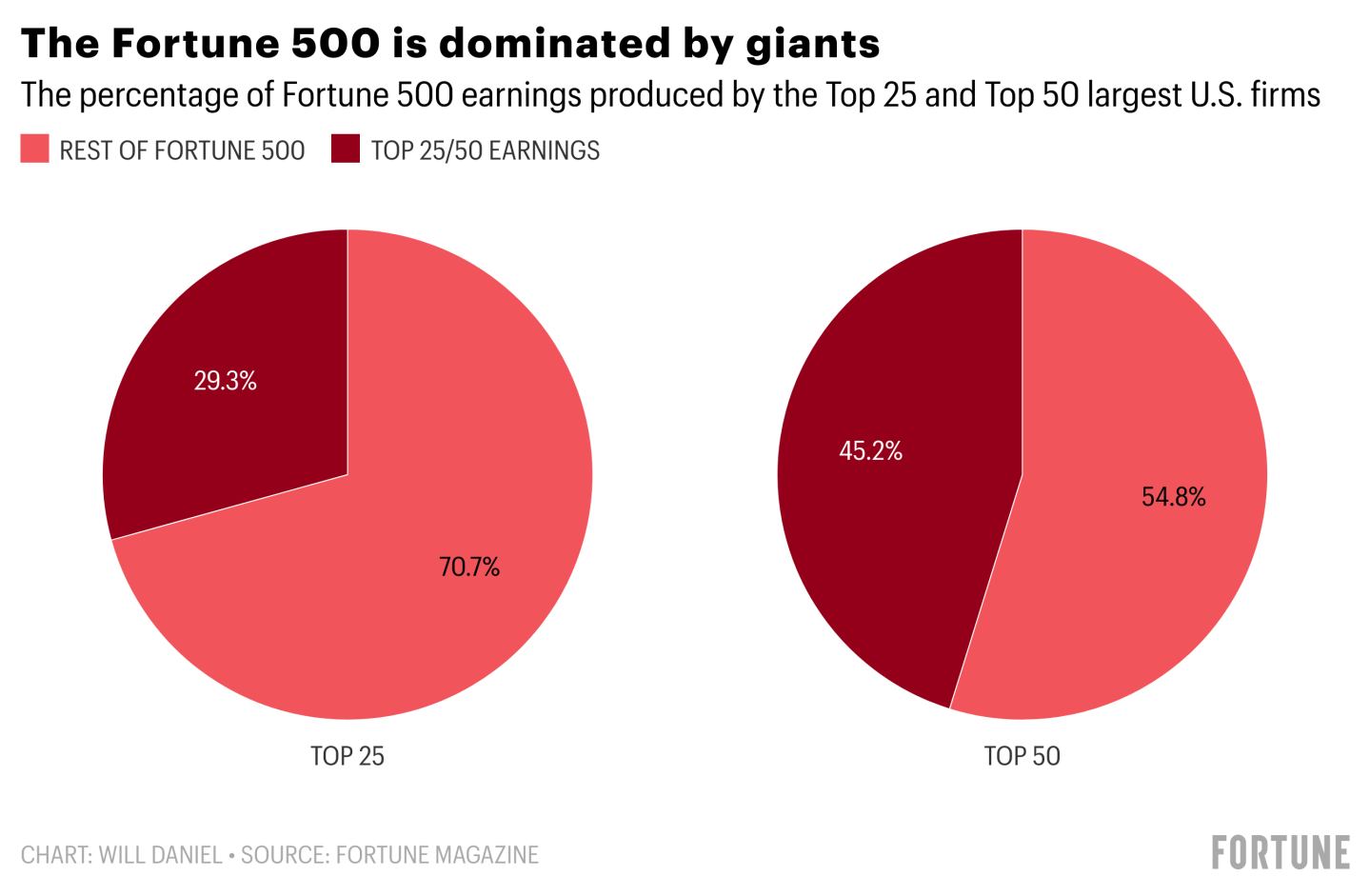

But one of the most fascinating trends from the latest Coins2Day 500 list is the clear and increasing consolidation of the economy. The top 50 companies in 2022’s Coins2Day 500 accounted for more than 48% of total revenues from the list and 45% of total earnings—and they employed nearly 40% of all workers.

Meanwhile, the top 25 companies on the Coins2Day 500 produced roughly 35% of total revenues and 30% of total earnings. And the top 10 firms alone accounted for $3.7 trillion, or roughly 20% of total revenues.

Consolidation in American industry is nothing new. Data from S&P Global Market Intelligence shows that in 91 of 157 primary industries, the five largest U.S. Companies by revenue now account for 80% of their industries’ total revenue. That’s up from 71 industries in 2000. From crop producers and meatpackers to banks and waste management firms, consolidation has been widespread for decades, and well researched. But lately, the trend has been supercharged in some areas as rising interest rates and stubborn inflation weigh on smaller firms.

Leading venture capitalists, for example, have warned that they are seeing “crushing consolidation” across multiple industries as banks pull back on riskier lending. And regional banks are facing their own issues after the collapse of Silicon Valley Bank and Signature Bank in March led many depositors to flee smaller institutions for large firms where their deposits may be better protected by federal insurance.

Even the White House has taken note of American businesses’ increasing consolidation. President Biden signed an executive order in 2021 that was designed to increase competition in American industries. His administration cited data that shows over 75% of U.S. Industries are dominated by a few large companies that “now control more of the business than they did twenty years ago.”