Disney’s plans to nearly double spending in its lucrative line of resorts, cruise ships and hotels over the next ten years comes with an important message to investors.

In black and white, Disney sought to assuage market fears it lacks the financial firepower to both invest in further growth of its business while still possessing the necessary breathing room to acquire the rest of Hulu.

Buying out minority shareholder Comcast from the streaming service is expected to cost the Mouse House well over $9 billion.

“We believe that the company’s financial condition is strong and that its cash balances, other liquid assets, operating cash flows, access to capital markets and borrowing capacity under current bank facilities—taken together—provide adequate resources,” it told investors in a regulatory filing published on Tuesday.

These would be enough to fund both ongoing operations as well as “future capital expenditures related to the expansion of existing businesses and development of new projects.”

The Hulu deal is a major source of uncertainty for Disney’s stock in part because many still remember the $71 billion that CEO Bob Iger paid to acquire 20th Century Fox five years ago, a price now viewed critically by investors in hindsight.

This forced interim finance chief Kevin Lansberry to remark in August that the company is “very comfortable” about its capacity to fund the one-third stake in Hulu it doesn’t own.

Comcast, which is expected to demand far more than the contractually agreed floor price of $9.2 billion, recently moved forward with the start of negotiations.

This puts Iger in the hot seat once more after a recent dust-up with Comcast’s largest cable rival, Charter Communications, that forced Disney to make concessions.

News of Disney’s spending plans comes as Tinseltown grapples with the biggest strike by both writers and actors in living memory.

Picketing has forced delays in the slate of upcoming movies and cost major Hollywood studios like Warner Bros. Discovery up to half a billion dollars.

Rather than bolster confidence in the finances of the company, however, the announcement further put pressure on Disney shares, sending the stock down 4% at one point on Tuesday. Earlier this month they even plumbed nearly 10-year lows.

700 million Disney fans worldwide

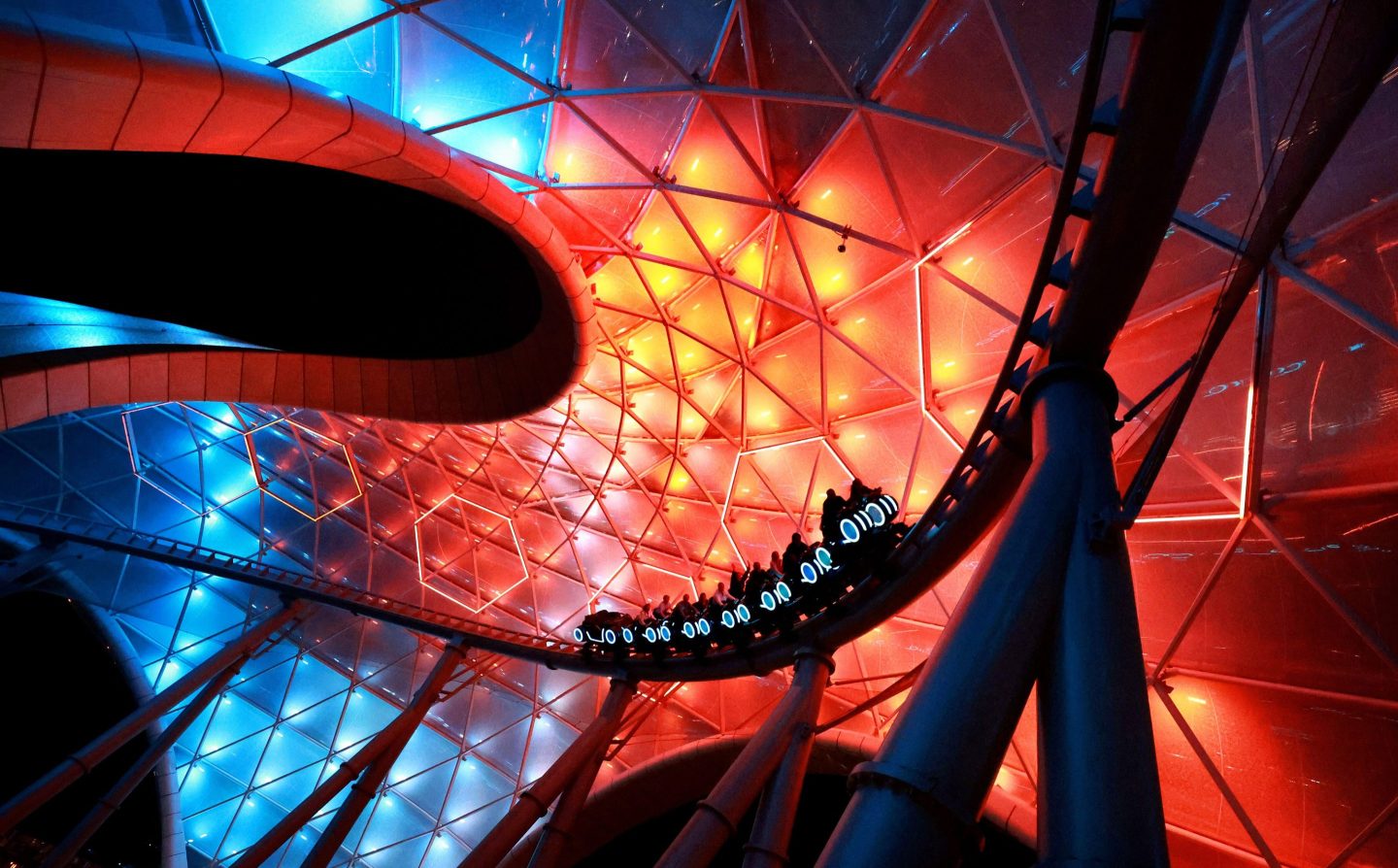

On Tuesday, Disney said it would pour $60 billion into its Disney Parks, Experiences and Products (DPEP) over the next ten years.

This division contributed triple the profits of its content operations, Disney Media and Entertainment Distribution (DMED) and generates around $30 billion in annualized revenue.

With the exception of the two pandemic years, it has consistently delivered an operating margin in the high 20s.

Disney owns six global parks that operate around the clock every day of the year and welcomes 100 million guests every year.

They’re led by Walt Disney World, a 25,000-acre site so enormous it can easily swallow the island of Manhattan whole.

Disney also operates a fleet of five cruise liners that act as miniature floating theme parks flexibly deployed to soak up demand that cannot be serviced by its fix-point resorts.

Management estimates it has an addressable market of over 700 million Disney fans worldwide, more than 90% of whom cannot or do not visit the parks.