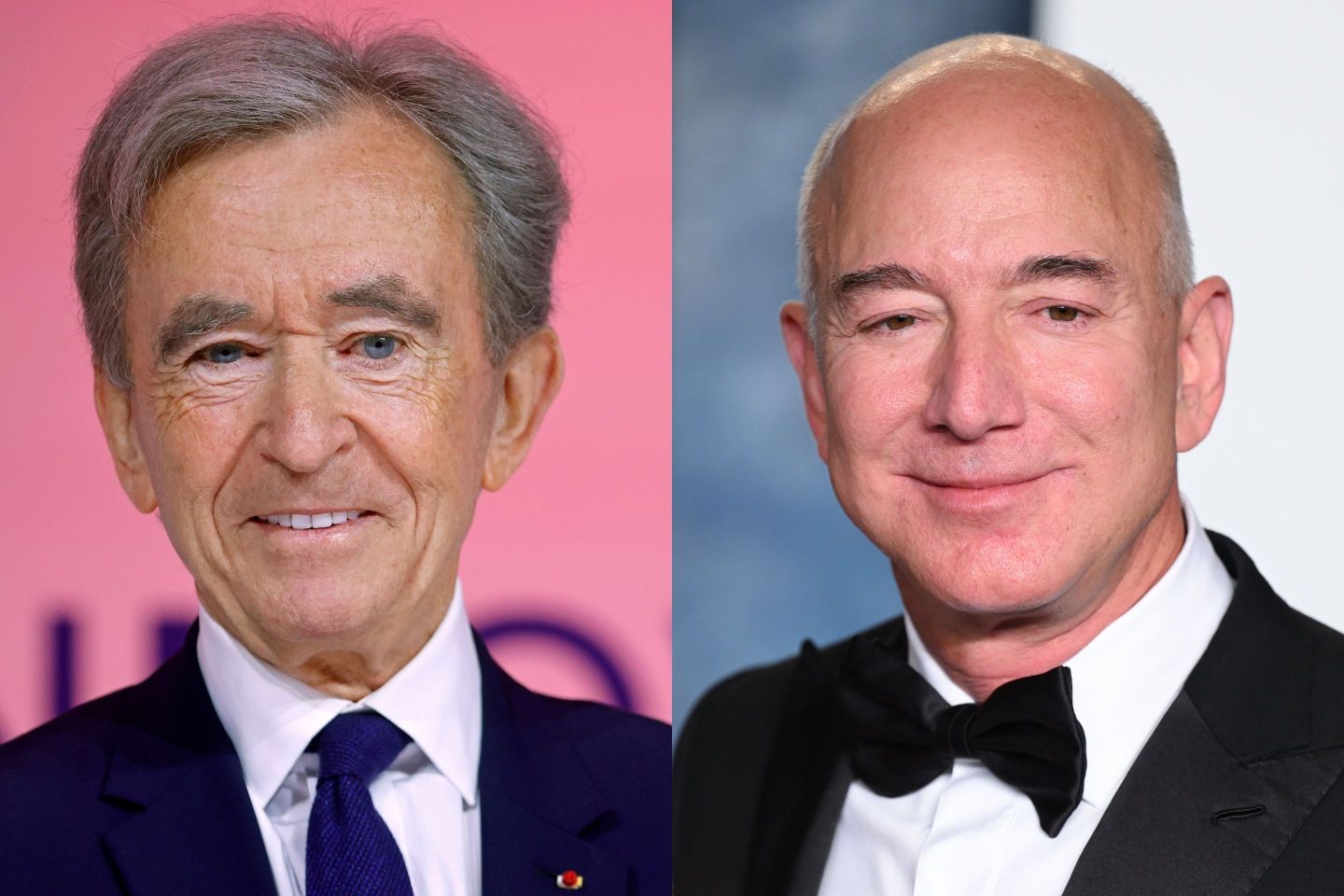

Cooling customer demand has seen luxury tycoon Bernard Arnault—once the world’s richest man—now lose his place as the second-wealthiest person on earth.

The LVMH CEO will be familiar with his successor to the number two spot—it’s Jeff Bezos, the billionaire founder of online giant Amazon.

According to the Bloomberg Billionaire’s Index, Arnault—who oversees brands including Tiffany & Co, Christian Dior, Fendi, Givenchy, and more—has seen his fortune shrink by nearly $7 billion this year.

The 74-year-old entrepreneur, previously the richest person in the world, has seen his wealth increase—even in the past couple of days—where the Bloomberg index chartered a surge of $1.6 billion between Oct. 15 and Oct. 16.

However, the increase isn’t enough to defend the title from former Amazon CEO Bezos.

With the index stating Arnault is now worth approximately $155 billion, he has been overtaken by Bezos by around a billion dollars.

In 2023 alone Bezos has seen his wealth increase by more than $43 billion, and was boosted to the number two spot on Bloomberg’s list courtesy of a $2.6 billion lift on Oct. 15.

Bezos is buoyed by increases to his biggest asset: Amazon stock.

Bezos owns around 12% of the company worth $1.37 trillion dollars, meaning any increase to the share price—up from $129 on Friday to just under $134 by Monday—has a massive effect on his personal wealth.

Arnault’s issues

Slipping from second to third place on a billionaire’s index is a far cry from the issues of reality—indeed, Arnault’s personal net worth is still more than the entire economy of Morocco.

However, Arnault may have a headache on his hands courtesy of luxury shoppers who are beginning to crack under the pressure of global fiscal tightening and economic headwinds.

LVMH’s third quarter earnings, released Oct. 10, confirmed shoppers are pulling back from indulging in luxury products—especially in the U.S. And Arnault’s native Europe.

The group’s sales rose 9% to €19.9 billion ($21.1 billion) during that period—a far more sluggish pace than the 17% reported in the previous quarter.

“After three roaring years, and outstanding years, growth is converging toward numbers that are more in line with historical average,” LVMH’s CFO, Jean-Jacques Guiony, told analysts.

Guiony’s warning echoes that of Citigroup CEO Jane Fraser, who cautioned that consumers—on the lower end of the spectrum at least—were beginning to show cracks.

And while Fraser was optimistic about the health of consumers, she did caution the toughest times may be to come.

“What gives everyone pause” is history, Fraser told CNBC, outlining that in the past the second half of an economic shift—such as the Fed deliberately pushing down inflation with higher rates—is the “tougher half.”

“We’re starting to see the economy do some of the work for the Fed now,” Fraser added. “So it’s definitely softening and if we start seeing another few sets of datas in the coming weeks then I think that will make the Fed’s job easier.”

Amazon and the Magnificent Seven

Unlike LVMH, Amazon has not been suffering from the economic shift. The online retailer’s most recent quarter was its strongest since the fourth quarter of 2020, when pandemic-fueled shoppers turned online during lockdowns.

On the call in August, Amazon CEO Andy Jassy reported figures well ahead of analysts’ expectations: Revenue sat at $134.4 billion while EPS climbed to 65 cents instead of the 35 cents predicted.

“We’re encouraged by the progress we’re making on several key priorities, namely lowering our cost to serve in our stores business, continuing to innovate on and improve our various customer experiences, and building new customer experiences that can meaningfully change what’s possible for customers in our business long term,” Jassy told analysts on the call, hinting his tough cost-cutting measures are beginning to bear fruit.

Analysts are divided on Wall Street over whether the market—led by the so-called Magnificent Seven stocks including Apple, Microsoft, Google owner Alphabet, Amazon, Nvidia, Tesla, and Meta—has edged too close to the sun.

But while analysts from JPMorgan warn the market could be in for a tumble, Morgan Stanley’s Andrew Slimmon believes the Magnificent Seven could push higher yet.

“One of the things I would point out is that—I know it’s hard to believe—as much as these companies have had a very good year to date, they’re still below where they ended in 2021—Nvidia’s the exception,” Slimmon told CNBC’s Street Signs in August.

“It’s very easy to be bearish on companies that have done well, but with companies that have improving fundamentals, calling a top on those stocks, to me, is as naive or dangerous as trying to call a bottom to a stock with deteriorating fundamentals.”