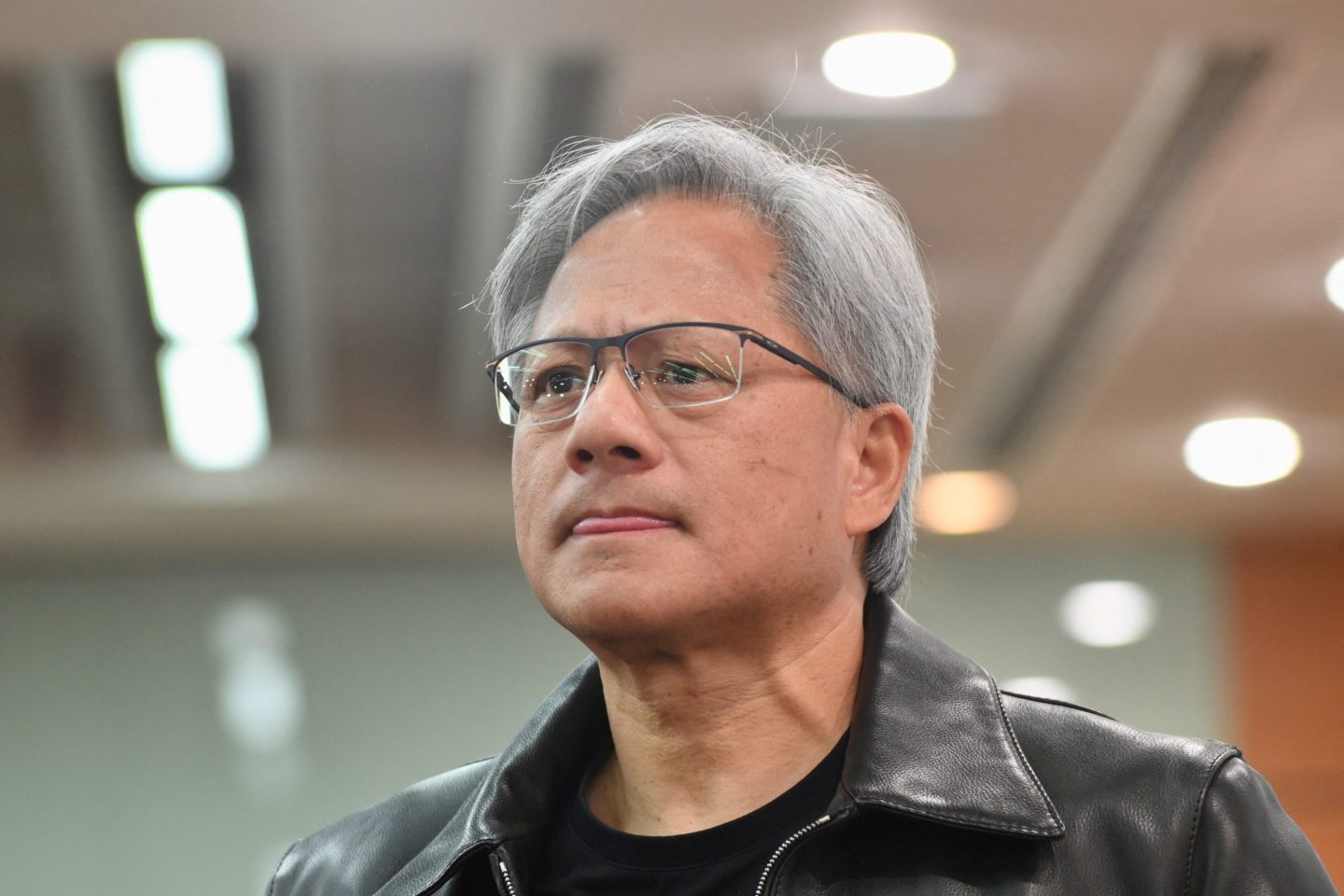

Jensen Huang, the billionaire cofounder and CEO of Nvidia, faced a financial conundrum last November. U.S. Government export controls on advanced semiconductors threatened to cost his chip company hundreds of millions in revenue. His solution was a clever tweak to his flagship AI processors, Ampere A100 and next-gen Hopper H100, followed by a fresh label for the Chinese market. Problem solved, right?

Now the Biden administration wants to put a stop to the AI gravy train that rocketed Nvidia’s market cap into the $1 trillion stratosphere, since it might inadvertently bolster China’s military capabilities.

Nvidia’s business with China is critical. In August 2022, the company disclosed that it was anticipating $400 million in quarterly sales from China, which were immediately at risk owing to the initial U.S. Government ban. If customers canceled their orders, it would hit them hard.

One of the 30 wealthiest entrepreneurs in the world, Huang swiftly unveiled a new line of chips, tailor-made for the Chinese market—the A800 and H800. These chips featured a data transfer rate below the 600 GBps threshold at which Biden’s export ban comes into play.

The reason why the White House targeted chips with such high chip-to-chip bandwidth speeds is simple: They are uniquely suited for being networked together in data centers and supercomputing facilities that train and run large AI models, according to the Center for Strategic and International Studies.

News the White House was now closing this key loophole sent shares in the company on their sharpest one-day slump in over two months. The stock closed 4.7% lower on Tuesday and is expected to trade weaker at the start of today’s session.

Risks from Taiwan

This time the company sought to assure investors its business would be spared any material hit…at least initially.

“Given the strength of demand for our products worldwide, we do not anticipate that the additional restrictions will have a near-term meaningful impact on our financial results,” the company said in a regulatory filing on Tuesday.

Biden’s renewed crackdown is emblematic of the West reevaluating its strategy toward the world’s most populous authoritarian state. Once considered to be just as much an economic partner as a political rival, China is now viewed more as a risk than an opportunity, especially after Beijing supported Russian President Vladimir Putin’s ongoing war in Ukraine.

The White House fears China’s leader, Xi Jinping, may be stockpiling high-tech chips in preparation for a possible military invasion of his own in Taiwan.

China lays claim to the island nation, but younger inhabitants—having seen what happened to Hong Kong’s autonomy after it fell under direct control of Beijing—are drifting towards support of formal independence.

In terms of its impact on the global economy, a war in Taiwan (or even a potential blockade) would be orders of magnitude worse than effects from the conflict in Ukraine. Taiwan is absolutely critical to the global supply of semiconductors: Nvidia outsources all production of its flagship A100 and H100 chips to TSMC (Taiwan Semiconductor Manufacturing Co.), the most advanced foundry for chip production worldwide.