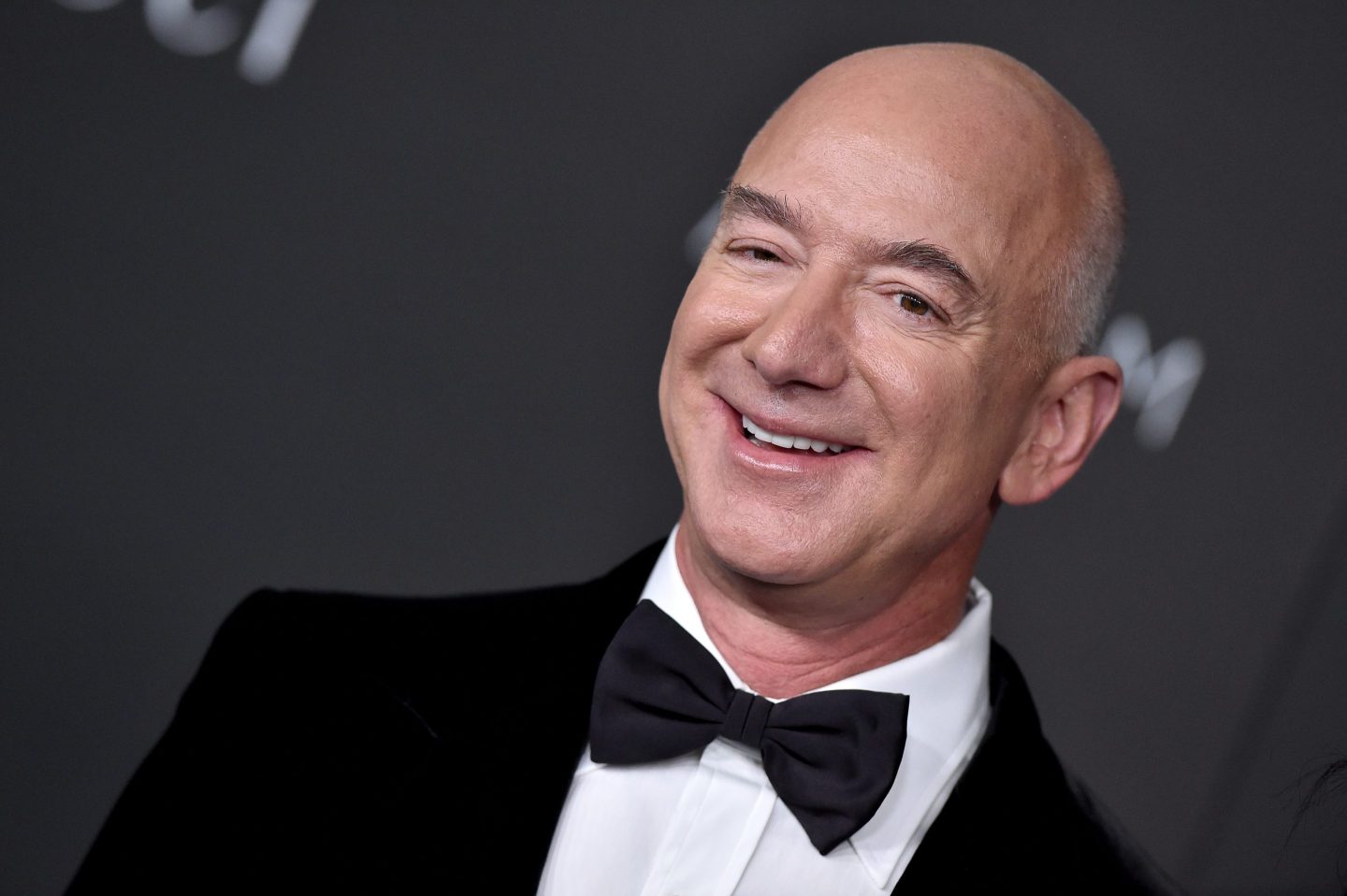

After launching Amazon from a garage in Seattle in 1994, centibilllionaire Jeff Bezos is leaving the Pacific Northwest behind and setting sail for Florida.

In an Instagram post, the world’s third-wealthiest person—with a net worth estimated at $160 billion—said he wanted to be closer to his parents after they recently moved back to Miami.

“My parents have always been my biggest supporters,” he posted to his Instagram account, adding that his spacefaring company Blue Origin is increasingly shifting operations to Cape Canaveral.

Florida also offers a financial benefit to the Amazon founder: It doesn’t charge capital gains tax, which, for a man who’s sold some $30 billion in stock since 2002, according to Bloomberg, can be quite substantial.

Feeling at home

Even though Bezos said he’s relocating to Miami, not a whole lot will change for the owner of the Washington Post newspaper. He won’t need to scout the real estate market for a new residence, since he already reportedly bought in August a $68 million Miami mansion on the small, man-made island of Indian Creek popularly known as “Billionaire Bunker.” In October, he added his next-door neighbor’s $79 million property as well.

But Miami is not the only place where Bezos lives. In addition to his collection of luxury cars and private Gulfstream jets, Bezos owns multiple properties valued recently at a half-billion dollars.

Washington’s historic tax

His move may have something to do with a Washington State Supreme Court decision in March to uphold a 7% tax on capital gains that took effect in January 2022 despite a legal challenge.

The ruling is considered historic since legislators in Olympia took the opposite view of the Internal Revenue Service: They classified the tax as an excise tax rather than an income tax in order to circumvent the fact that Washington State does not have an income tax under state law. A majority of voters in Seattle are now in favor of a similar capital gains tax for the city itself.

Unlike most people, entrepreneurs and other ultrahigh-net-worth individuals typically do not pay taxes on their personal earnings, since their wealth stems from assets rather than salaries and bonuses.

Instead, the IRS collects every time one of these assets is liquidated, a far more meddlesome issue for the super-rich. For this reason, Florida is popular among the billionaire class since the state does not impose its own levies on such disposals—as it has no income tax in the broader sense, either.

Even if Bezos’s tax dollars are set to move from the Pacific Northwest, the centibillionaire said he would still leave something behind as a token of his appreciation: “Seattle, you will always have a piece of my heart.”

Oh, and the city still gets to keep Amazon.