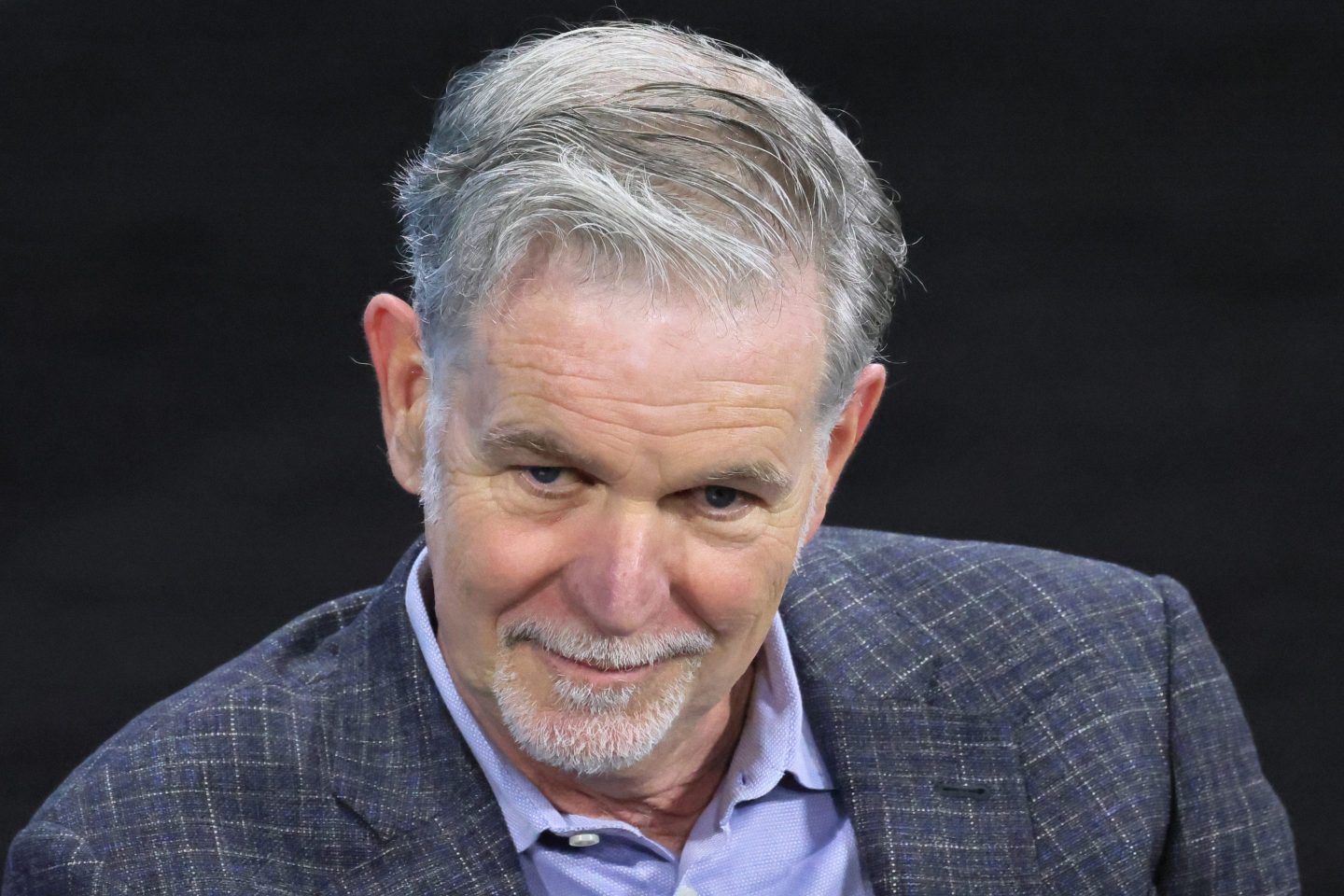

Last week, Netflix cofounder, executive chairman, and former CEO Reed Hastings gave about 40% of his company stock—worth about $1.1 billion—away as a gift. An SEC filing from Jan. 24 shows Hastings giving the 2 million shares to an unnamed entity. The filing includes a transaction code marked “G,” which indicates a “bona fide gift.”

It’s a stunningly large donation, not just Hastings’s largest ever, but representing something like 20% of his net worth. After this donation, Hastings is worth an estimated $4.1 billion, per Forbes, much of which is tied up in his remaining ownership of just under 3 million Netflix shares through his family trust, worth roughly $1.7 billion.

Hastings, along with his wife, Patty Quillin, has long supported an array of charitable initiatives, including a gift of $120 million to the United Negro College Fund and two historically Black colleges in 2020. Hastings and Quillin have also signed Bill Gates and Warren Buffett’s Giving Pledge. But because of its structure, this particular contribution likely comes with stunningly large tax savings.

The gift went to the Silicon Valley Community Foundation (SVCF), a charity geared at addressing systemic inequalities in the Bay Area, a Netflix spokesperson told Bloomberg, which was among the first to report on the donation. The gift will likely be used in the foundation’s initiatives for affordable housing, childhood development, and disaster relief, among other causes.

SVCF is a popular destination for the area’s philanthropic tech billionaires; Twitter founder Jack Dorsey is a donor, and Meta CEO Mark Zuckerberg and Priscilla Chan, his wife, have given $1.5 billion to SVCF, Variety reported.

The significance of a donor-advised fund

The Wall Street Journal reported on a different reason for this charity’s popularity, especially with Northern California tech luminaries: privacy and the biggest possible tax break. The foundation offers “donor-advised funds” that allow figures like Hastings to both donate and advise specifically on how the donation will be used.

There is a long-standing benefit in the U.S. Tax code with donations as, depending on the donor’s bracket, the deduction against current income can go as high as 30%. This allows the donor to avoid capital-gains tax on appreciation of equity investments. And giving to a donor-advised fund sponsor, like SVCF, can mean 50% savings, Ray Madoff, a Boston College law professor who specializes in philanthropy, taxes, and estate planning, told the Journal: “By taking your property instead of cash, they’re maximizing your tax benefits.”

It’s not clear what deduction Hastings will get, to be sure, but there are three main tax benefits people stand to gain for their charitable giving. The first: If they give cash, they can offset their income (although this only applies to people who itemize their deductions, which less than 10% of the population does). Benefit two: If you give appreciated property, as Hastings did, you won’t have to pay that capital gains, which saves another 20% in taxes. Third: You can get up to 74% tax benefit for a charitable donation. In other words, a $100 million donation can ultimately save a tax payer up to $74 million.

Hastings isn’t the only billionaire giving away much of his wealth. Last year alone, MacKenzie Scott recently revealed, she unloaded a quarter of her stake in Amazon—worth over $10 billion—and she has long made clear her commitment to give most of her fortune away.

And Mark Suzman, CEO of the Gates Foundation, told Coins2Day last week that the charity intends to spend its entire endowment within 20 years of Bill and Melinda Gates’ deaths. “But we are actually having active discussions in our board about whether we might want to potentially even accelerate that a little bit,” Suzman said.

Hastings stepped into his executive chairman role at Netflix last year, following 25 years as its chief executive. The streaming giant is currently helmed by co-CEOs Ted Sarandos and Greg Peters.