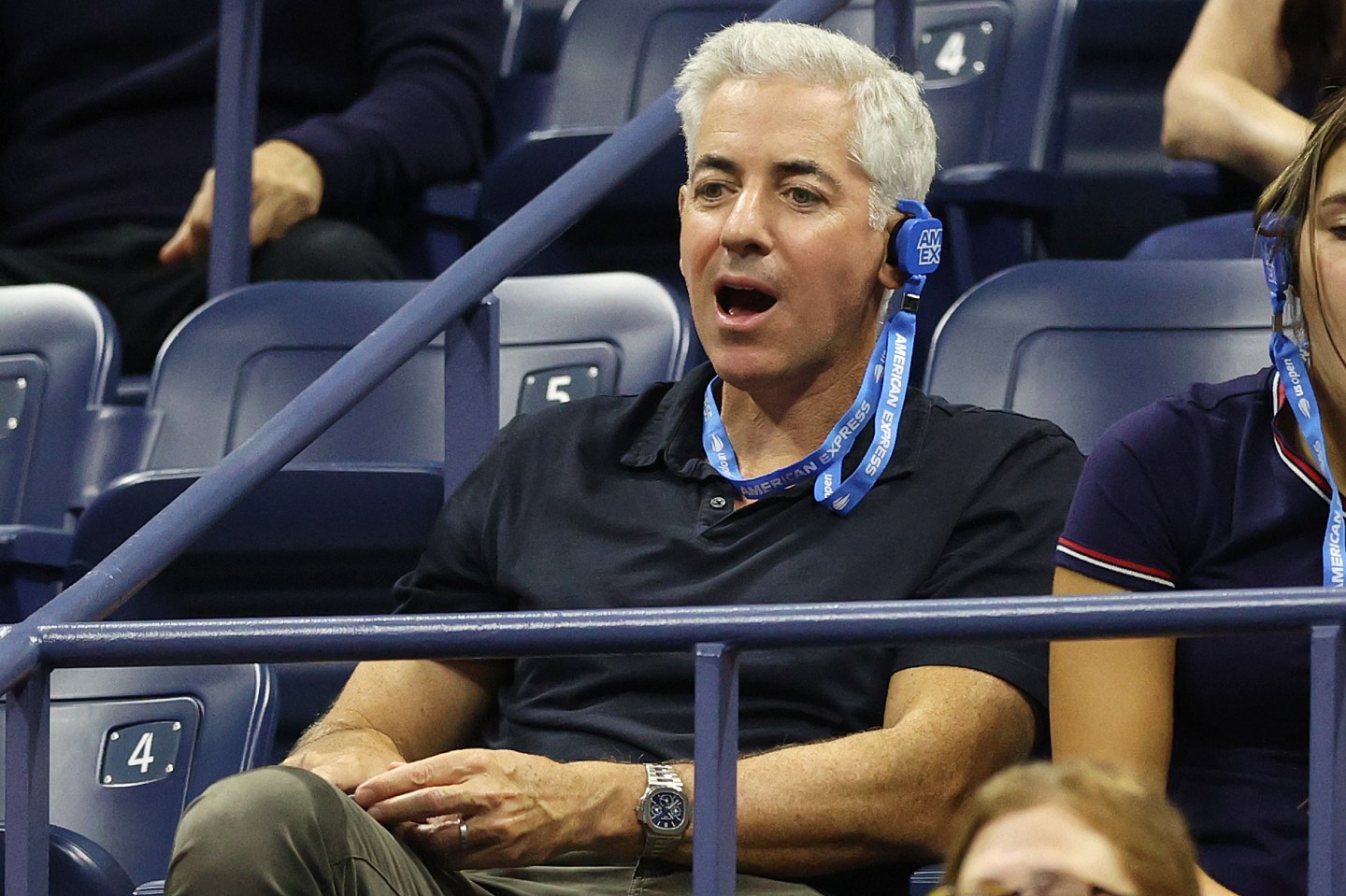

Pershing Square’s Bill Ackman folded on his short bet against Herbalife Ltd nearly six years ago but he’s calling Thursday’s record tumble a win.

The stock of the weight-loss shakes and vitamins seller plunged 32% to a 14-year low, after a quarterly earnings report that fell short of analyst expectations. In the last six months, shares have shed nearly 50% of their value, helping short sellers amass paper profits of nearly $68 million, according to data from S3 Partners LLC.

“It is a very good day for my psychological short on Herbalife,” Ackman said in a post on X. “And it is an even better day for the world to see one of the biggest pyramid schemes fail.”

Herbalife didn’t respond to requests seeking comment on Ackman’s allegations.

The activist investor’s assertions are nothing new. He was locked in a five-year battle after opening a $1 billion bet against Herbalife in 2012, claiming that the seller of weight-loss shares and vitamins was an illegal pyramid scheme.

He held onto the position as shares marched higher and went head-to-head with billionaire investor Carl Icahn, who became the company’s largest shareholder. Ackman unwound most of his short position in 2018, Icahn too eventually lost interest exiting his stake in 2021.

The last few years have been rockier for Herbalife, which has come under pressure after a pandemic-era rally. Distributor numbers have taken a hit as people reentered the workforce after Covid lockdowns, weighing on sales growth. At the same time, macroeconomic pressures such as inflation and foreign exchange rates are also dragging on Herbalife earnings.

The company has also been working to reduce its debt balance, at the expense of share repurchases.

“The fact that they’re not doing sizable share buybacks is definitely weighing on price,” said Bloomberg Intelligence analyst Diana Rosero-Pena.

Wall Street is largely neutral on the company, with two analysts giving it a buy rating, four saying to hold and one recommending sell. The average analyst price target of $13.60 represents more than 65% upside from Thursday’s closing price.

“Under typical conditions, you’d expect the stock to be down 15% to 20%, not more than 30%,” said Linda Bolton Weiser, a D.A. Davidson analyst who rates Herbalife neutral. “On a trading basis it seemed like a little bit of an overreaction.”