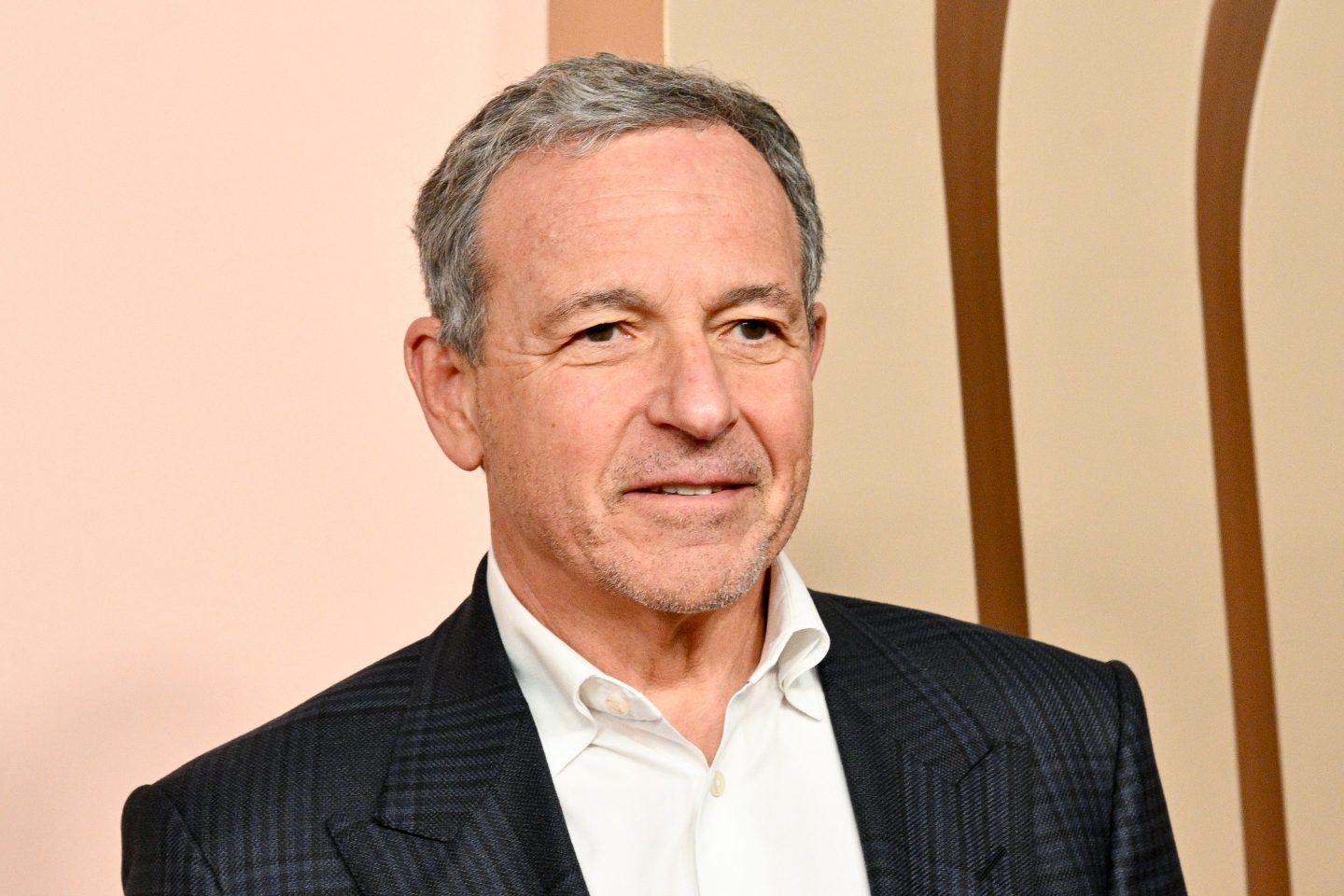

Facing the biggest threat in his career, Disney boss Bob Iger gave a rare glimpse into the health of his biggest acquisitions in a bid to restore confidence in the board ahead of a key shareholder vote.

On April 3, investors will decide whether to back the company’s proposed re-election of two independent directors or shake things up by sending rival nominees from activist investor Trian Partners. Trian founder Nelson Peltz, who claims to represent $3.5 billion shares in Disney, blames a failed M&A track record orchestrated by Iger as the reason why Disney has trailed larger rival Netflix.

This is the first such shareholder showdown for Iger, who owes his long stint as chief executive to a proxy battle, when family heir Roy Disney pushed out predecessor Michael Eiser in September 2004.

70-page rebuttal

In a 70-page presentation published last week, Disney offered a point-by-point rebuttal that painted Peltz as an amateur ignorant of the entertainment industry and a poor investor to boot.

“You don’t manage creativity the way you manage a hedge fund,” it said, adding Trian had been sacked as one of Disney’s pension fund managers in 2021 for his underperformance.

The Mouse House defended Iger’s string of deals including Lucasfilm, Marvel and Pixar, which together were acquired for nearly $15.5 billion. It claimed returns from the Star Wars and Avengers franchises both tripled their invested capital, while Toy Story saw a fivefold increase over a 10-year time period.

Disney doesn’t publish detailed figures for its studios, let alone its film franchises, so this is a rare peak behind the curtains. But they could help assuage fears Iger might overpay for Comcast’s remaining stake in Hulu like Trian claims he did with the $71 billion 21st Century Fox deal.

In late 2022, Trian’s Peltz briefly emerged to challenge Disney with plans to get elected to its board, only to back down months later. An alarming string of box office bombs last year led by the Lucasfilm Indiana Jones flop prompted Peltz to return.

He believes Disney’s independent directors are little more than benchwarmers unwilling or unable to robustly challenge the strategy and decisions of management.

Instead of re-electing Maria Elena Lagomasino and Michael Froman to the board, Peltz has put forward his own competing slate that includes former Disney finance chief Jay Rasulo in addition to himself.

Peltz is still not contesting Iger’s leadership directly, but a Trian victory at April’s annual shareholder meeting would nonetheless undermine Iger’s authority.

According to Disney, Peltz would create “maximum disruption” and would be little more than a “destabilizing distraction when Disney needs total focus on execution.”

Trian has called Disney’s efforts to discredit Peltz a “scorched-earth campaign” designed to deflect from the board’s own failures.

Neither company Disney nor Trian could be reached for comment.