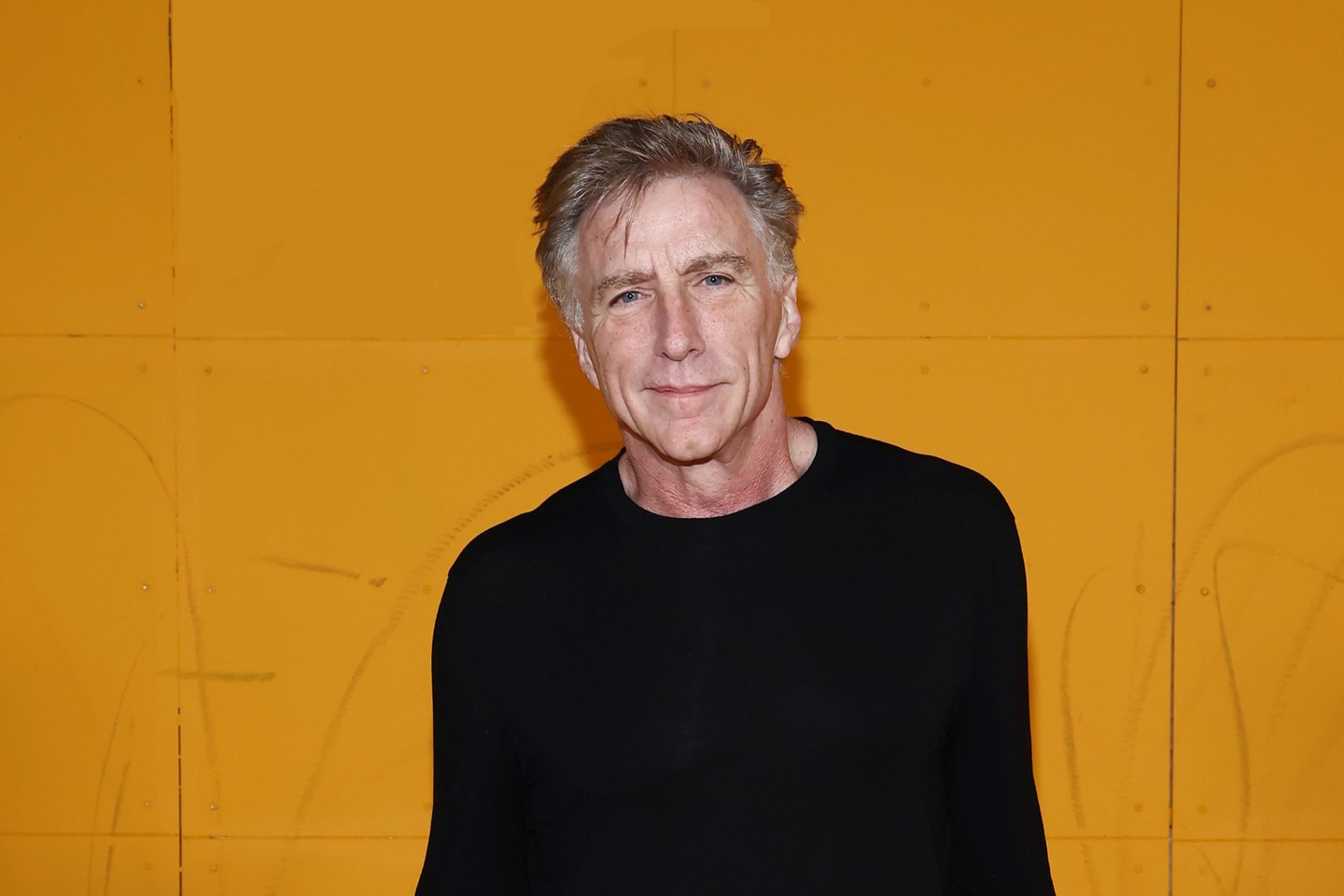

VF Corp’s new CEO, Bracken Darrell, knows his way around a big corporate fix-up job. Before taking the helm at the troubled footwear and apparel maker last summer, Darrell spent more than a decade atop Logitech, whose tech accessory products like keyboards, headphones, and microphones were no longer needed as tablets became popularized. Earlier in his career, he brought Procter & Gamble’s Old Spice brand back to life by appealing to younger men.

Now, at VF, with a stable of brands like Vans, The North Face, Timberland, and Dickies that are all in decline, Darrell again has his hands full. Take Vans, the once-hot, now cold skateboarder shoe brand. Sales fell 29% last quarter, and some argue it has lost its “cool” factor. The North Face, meanwhile, has lost ground to brands like Cotopaxi, Arcteryx, and, of course, long-time archrival Patagonia. And let’s not forget that in May, VF took the second of two big write-downs, totaling one-third of the $2 billion it spent in 2021 on Supreme, the hip streetwear brand that was supposed to re-energize the whole company.

These numbers are sobering, considering just a few years ago, VF was held up as a model for running a portfolio company. Revenue doubled, and profits quadrupled between 2000 and 2016. In the last two years, however, shares have fallen 75%.

But Darrell, under pressure from an activist shareholder he has mollified for now, admits he is making changes that will likely take some time to pay off. But still in emergency mode, he says he’s very hands-on in fixing Vans, for years VF’s engine of growth.

These numbers are sobering, considering just a few years ago, VF was heralded as a model for running a portfolio company. Revenue doubled, and profits quadrupled between 2000 and 2016. In the last two years, however, shares have fallen 75%.

Under pressure from an activist shareholder who is mollified for now, Darell admits he is making changes that will likely take some time to pay off. But still in emergency mode, he says he’s very hands-on in fixing Vans, for years VF’s engine of growth. Once the skateboarding retailer is back on track, he plans to restore all of the brands’ considerable autonomy that has been eroded in recent years by the gradual centralization of decision-making at VF’s Denver headquarters.

One mistake Darell doesn’t plan to repeat is failing to infuse business when it’s on the upswing, he says, pointing to Vans, which has, more or less, trotted out the same five shoe models for years and gotten lapped by competitors.

“We didn’t take advantage of our rapid growth and invest in innovation,” he tells Fortun e.

This article has been edited and condensed for clarity.

Coins2Day: You get to VF, and all of its major brands are struggling. How do you choose which fire to put out first?

I saw that Vans, VF’s biggest brand, was in a strong secular decline. Then I asked, ‘Where is the business generally the least healthy?’ That was the Americas. Third, I asked, ‘What is different about our brands in the market?’ I’ve never seen a place where you had a great business without having great products, so I had to question whether we have better products than our competition. I set my priorities from there.

Does the fact that VF is a portfolio company change how you are carrying out the turnaround? Do you want to have the brands run independently from one another as they traditionally have?

One way to make sure brands continue to be strong and authentic is to pretend they’re not in a portfolio. That’s the LVMH model, where they function entirely independently of each other. But there are some things you can leverage in a portfolio, such as supply chain, or when you go to market with a retailer with all your brands and can offer a lot and say, ‘We really understand your business.’

For years, VF was held up as a model apparel and footwear maker. What happened in the last few years to a best-in-class company?

In the Americas, we had the wrong structure in terms of who was in charge of what, and North America performed at a mediocre level. A second thing is we just didn’t drive best practices, and that led to limited learning across VF. We also didn’t take advantage of our formerly fast growth to invest back in innovation, new products, and new franchises.

When I see the Vans meltdown and the Supreme write-downs, I wonder whether cool brands can thrive within a large corporation like VF.

Vans went from $400 million to $4 billion over 15 years, so it certainly thrives at VF. And skateboard culture is a segment that is thriving right now. But we made some missteps in the beginning with Supreme. When they run it independently, they’re fantastic.

What about Vans? Can a brand like that get its ‘cool’ back?

It is possible. My best example of a brand turnaround was Old Spice when I was at P&G. A long time ago, it was cool for our fathers, maybe our grandfathers, though the advertising was sexist by today’s standards. It had to be renewed for the next generation, and we ultimately turned it into a multi-billion dollar brand. Another example is New Balance (not part of VF), which has lost its cool. Look at it now.

A big part of VF’s modus operandi was M&A, thanks to its track record of turning brands it bought into market-leading names. What is your M&A philosophy?

It’s about turning the business around for long-term sustainable growth, not deals. I don’t expect us to make any transformational deals now. I want to put pressure on getting organic growth and turning these brands into strong, sustainable growth engines. I don’t want to be a portfolio investor; I want to be a business grower.

On your last quarterly call, you mentioned the warm winter in much of North America is hurting The North Face. Do you worry about climate change’s impact on the brand?

I do worry about climate change overall, but brands also need to figure out how to expand constantly. For The North Face, we have a team working on about five different strategies so we can make sure they are relevant 365 days a year, at least outdoors, not just when you’re not on the mountain in winter. We have so many opportunities to grow. We tend to skew more males than females, so we have ample opportunities with women.

When will you know your brands have their mojo back, and will you be less hands-on after the point?

I’m a heat-seeking missile, and I go wherever I can help. Where I can’t help, I want to make sure we have the best people. If I were a division leader working for me, I wouldn’t want the CEO to be doing what I am doing with Vans. So yes, later on, I’ll be hands-off.