Good morning. CFA Institute, a global association of investment professionals, announced on April 4 that among the 16,932 candidates worldwide who sat for the Level I CFA Program exam in February, 44% passed—well above the 10-year average of 40%.

February’s pass rate was also an increase from those seen in November (35%) and in August (37%), and Chris Wiese, the institute’s managing director of education, said the organization is taking a look at what’s driving those increases because the difficulty level hasn’t changed.

“Demographically and geographically, test takers were very similar—with one caveat,” he said. “The average age of the February 2024 tester did skew slightly younger.”

Younger test takers pursuing the chartered financial analyst credential are often still students in study mode, Wiese explained. Many of those already in the working world simply don’t have as much time to prepare consistently.

This batch of test takers is the CFA Institute’s first cohort to go through a revamped study program, with a lot more practice opportunities, and more “learning by doing,” he said. For example, if there’s a piece of content like the weighted average cost of capital, there are study components to help put that into greater context to hopefully increase students’ understanding.

First-time testers scored a pass rate of 52% on Level I. Those who sat for the exam after having deferred it at least once passed at 28%. The CFA exam, in total, comprises three parts, often completed over multiple years.

Demand for financial analysts and AI’s role

I asked Wiese if financial analysts are in demand, and he said It varies geographically. CFA Institute is seeing a gradual return of strength in Canada, the U.K., and the U.S.

“India is particularly strong,” Wiese commented. “They’ve got a booming stock market. Interesting fact, Goldman Sachs’s second-biggest office in the world is no longer London—now it’s Bengaluru.”

But on the flip side, Wiese added: “We do see an ongoing lower number of candidates in China, and that’s also not surprising as they’re undergoing a really tough macroeconomic environment.”

Has the marketplace for financial analysts been affected yet by the growth of AI? Wiese said he hasn’t seen too much of that yet, but it could be on the way for some employers.

“A lot of them are still struggling to understand how AI is eventually going to change the analyst workflow, and what that’s going to mean,” he added. “It’s probably an effect we might see three, four, or five years from now.”

And generative AI isn’t yet in a position to take over, which was shown in a recent study by researchers at Queen’s University, Virginia Tech, and JPMorgan A.I. Research that examined how large language models like ChatGPT and GPT-4 performed in mock CFA exams.

“We concluded that ChatGPT would likely not be able to pass the CFA level I and II, under all tested settings,” the researchers wrote, although GPT-4 might have “a decent chance of passing” if specific prompts were used.

AI most likely will come to supplement a financial analyst’s work, similar to the introduction of spreadsheets for accountants, Wiese added. “It made the accounting profession a lot more efficient, and a lot more capable of handling much more complexity,” he said.

Sheryl Estrada

[email protected]

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Katherine Gibson was named interim CFO at Royal Bank of Canada (NYSE: RY). Gibson, who has been with the bank for 22 years, most recently served as SVP of finance and controller. She succeeds CFO Nadine Ahn, whose employment was terminated by RBC, effective immediately. RBC was recently made aware of allegations involving Ahn and launched an internal review and engaged outside legal counsel to investigate. According to evidence found in the investigation, Ahn was in an undisclosed close personal relationship with another employee. This led to preferential treatment of the employee including promotion and compensation increases, according to RBC. As a result, the two individuals have had their employment terminated.

Michael Healy was promoted to EVP and CFO of Bloomin Brands (Nasdaq: BLMN), which owns several restaurant chains including Outback Steakhouse and Bonefish Grill. Healy is succeeding Christopher Meyer, who decided to retire, according to a regulatory filing. Healy, who most recently served as EVP of global business development, has been with Bloomin Brands for 15 years.

Big deal

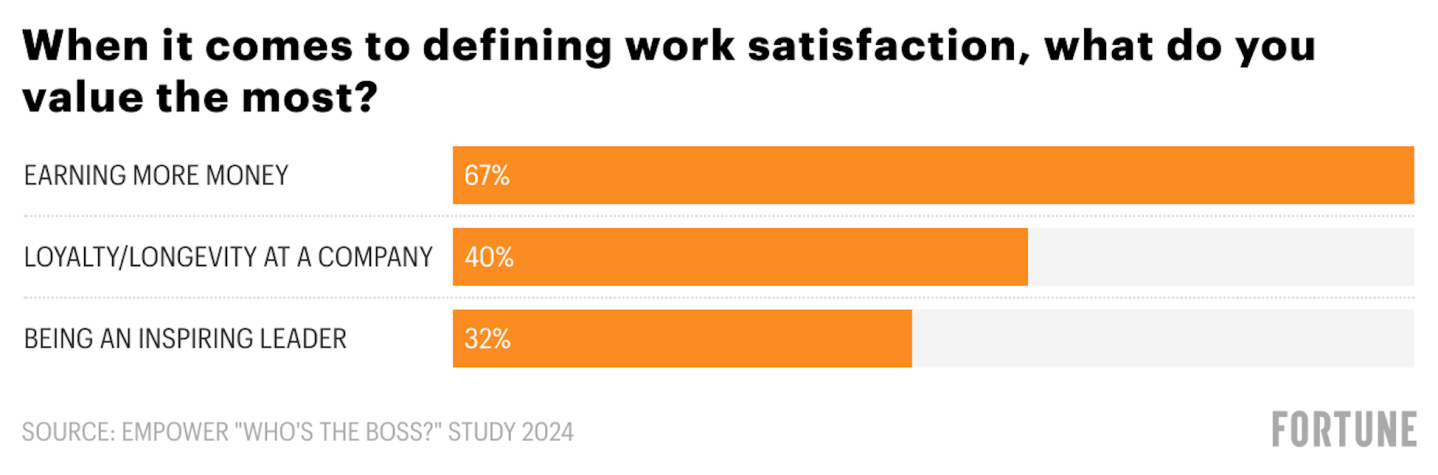

Empower, a financial services company, has released a new report, Who’s the boss. For many employees, job satisfaction doesn't come from reaching the top of the corporate ladder, according to the report. The findings are based on a survey of 1,117 Americans ages 18 and up, conducted by Morning Consult.

Just three in 10 respondents say they aspire to a C-suite role, with millennials showing the highest interest in becoming a top executive (39%). Almost a third (31%) of respondents don’t want their job description to change —even if it means forgoing a promotion or raise.

However, money is the number one driver of job satisfaction (67%) over being a boss. Respondents also say work satisfaction comes from being rewarded for loyalty and longevity at a company (40%), and under a third (32%) say it comes from being an inspiring leader the most. The survey also finds that 38% (and 55% of Gen Z) believe they don’t get paid enough to go above and beyond their current job description.

Going deeper

In How to prepare for the CFO role, a new report by McKinsey, former chief financial officers share advice on what matters most today for securing the top job in finance. “The CFO can’t just sit in their office anymore,” Karen McLoughlin, former CFO of Cognizant Technology Solutions, told McKinsey. “They have to be able to coordinate across the business, across functions, and get people to collaborate.”

Overheard

“People are being forced to seek new ways of supplementing their income, be that taking on additional work, delaying retirement plans, and even returning to work having previously retired.”

— Dean Butler, managing director for retail direct at Standard Life said. In their latest report, Standard Life found that baby boomers and Gen Xers are having to consider returning to work because they can’t afford retirement.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.