Good morning. During a panel session at the Coins2Day Brainstorm AI conference in London on Monday, experts discussed the big banks that were early adopters of AI, how to mitigate risk, and the value of attracting AI talent.

Panelist Alexandra Mousavizadeh, cofounder and CEO of Evident Insights, said her company’s AI index includes data on the approaches big banks in the U.S. And Europe are taking toward AI readiness. The index, released in the fall, takes a look at not only generative AI but “the whole AI spectrum” to determine “who’s leading and lagging,” Mousavizadeh said.

JPMorgan Chase earned the top spot, followed by Captial One, and Royal Bank of Canada. (The top 20 were dominated by banks based in North America.) JPMorgan has had a long-term AI focus supported by the CEO, Jamie Dimon, along with investment into AI innovation, talent, and transparency of responsible AI, according to the report. The top three banks all were early adopters.

“The banks that are leading are really doubling down,” Mousavizadeh said. And there’s a growing gap between leaders in the space and those that are trailing. “There is an advantage in being a first mover because you’ve established a reputation to draw in AI talent,” she said.

Banks looking to close that gap must be “very clear about the vision,” Mousavizadeh said. “AI is the absolutely most important thing for any leader of any line of business.” Next up might be finding the right talent to harness it.

“AI talent has a lot of other places to go than banks,” Mousavizadeh said. “So one needs to make the bank a really attractive place to work.”

During the panel, Edward J. “EJ” Achtner, who leads HSBC’s Office of Applied Artificial Intelligence, explained his firm’s approach. For example, HSBC has about 1,000 applications for AI, with some going back nearly a decade to some of its original machine learning models, but it’s now also testing use cases for generative AI and how those could scale. And HSBC is doing all of this with respect to remaining regulatory compliant.

“For us, the focus is on that fine balance between bridging from proof-of-concept into production, and that’s going to take time,” he added. “Candidly, even if it were in our risk appetite, it’s our impression that in some respects the technology and tooling is not yet mature enough for production-grade applications,” he said of generative AI.

Regarding risk, panelist Brian Mullins, CEO of the UK-based AI firm Mind Foundry, explained how it’s really important to understand exactly what the generative AI models can and can’t do. “Whether or not they’re fit for purpose is the highest-risk decision to make,” Mullins said. “It’s just not going to solve all your problems. And I think that once you know that, and understand that, you can choose the applications where they’ll do the best—or you can combine them with other machine learning methods to create a powerful solution.”

The bottom line? There’s no one answer, according to Mullins. “We really need to be thinking about it not as a silver bullet, but as another arrow in the solution quiver.”

You can watch today’s Coins2Day Brainstorm AI panel sessions via livestream here.

Sheryl Estrada

[email protected]

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Amy Campbell was named CFO of Rev Group, Inc. (NYSE: REVG), a manufacturer of specialty vehicles. Campbell spent 23 years at the construction and mining company Caterpillar Inc. Most recently, she served as CFO of ASC Engineered Solutions and CFO for BrandSafway’s commercial and industrial division.

Aaron Bloomer was named CFO of Exact Sciences (Nasdaq: EXAS), a cancer screening provider. Bloomer’s appointment is effective on May 15 when he’ll be replacing current CFO Jeff Elliot, who announced in January his plans to step down, citing personal reasons. Elliot will stay on as an advisor to help with the transition.

Big deal

Grant Thornton’s Q1 2024 CFO survey, released on Monday, found that 34% of finance chiefs are “very optimistic” about the U.S. Economy. For the survey, this marks an 11-quarter high for the survey. Meanwhile, 12% of CFOs said they were pessimistic, which marks an 11-quarter low, according to the report.

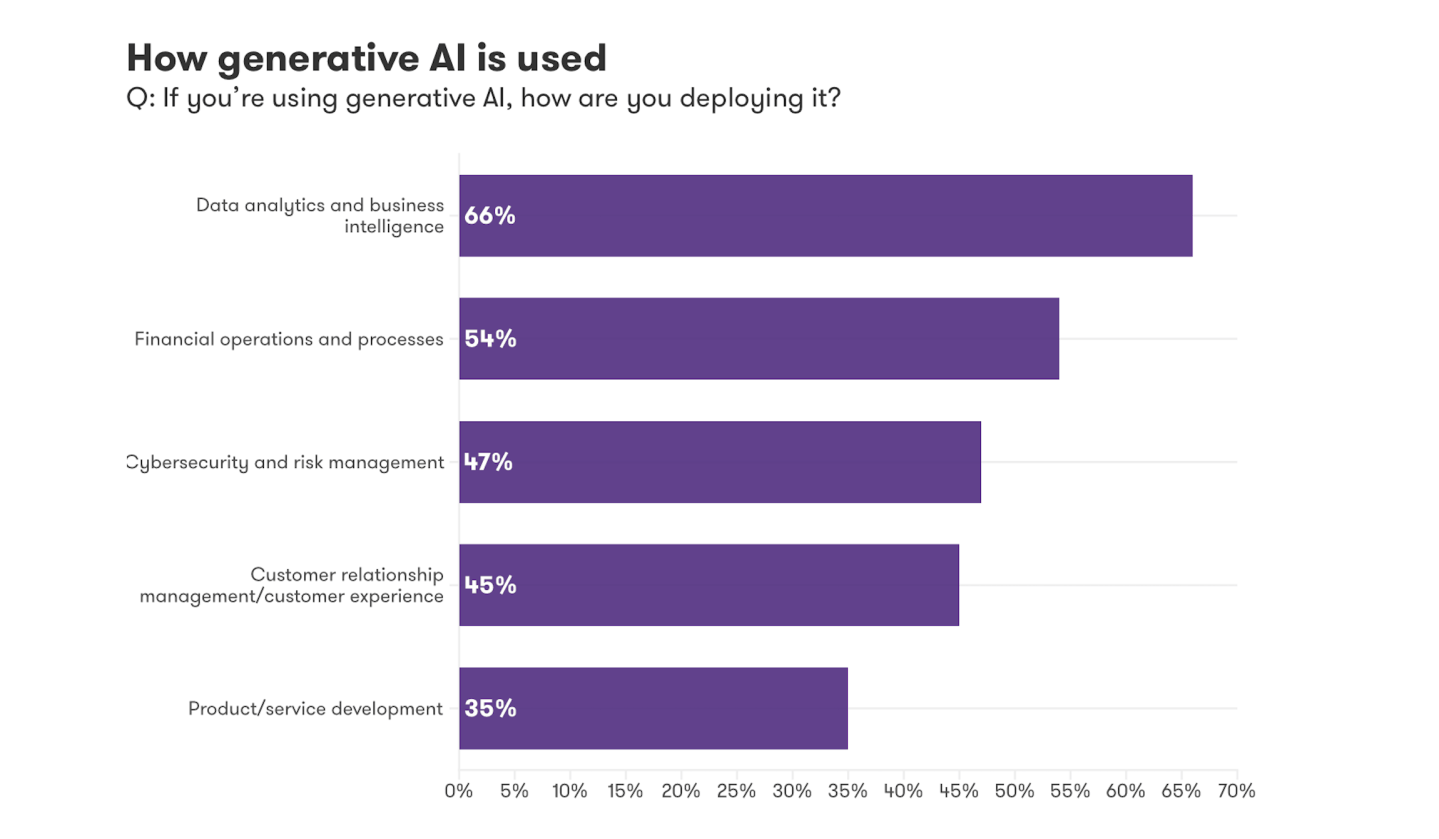

One of the key findings of the report is 52% of CFOs expect to increase spending in sales and marketing investments—the highest response for this category since the first quarter of 2021. The survey, based on 273 senior finance leaders, also finds that CFOs are prioritizing technology enhancement in their financial operations and processes. AI is being deployed most for data analytics/business intelligence (66%), followed by financial operations and processes (54%).

Courtesy of Grant Thornton

Going deeper

At the Coins2Day Brainstorm AI conference in London on Monday, Coins2Day chief financial officer and incoming CEO Anastasia Nyrkovskaya announced a new tool aimed at analyzing the Coins2Day 500. Coins2Day Analytics is being developed in partnership with Accenture. It will deliver ChatGPT-style responses based on 20 years of financial data from the Coins2Day 500 and Global 500 lists, as well as related articles.

“What it really is going to do is take over 20 years of our incredible trusted journalism, combined together with our financial research and analysis and financial data, and put it all together into one easy-to-use tool,” Nyrkovskaya said. The Coins2Day Analytics platform is launching in the summer of 2024.

Overheard

“Roughly eight in 10 prospective sellers expect the mortgage on a new home purchase to be higher than their current mortgage.”

—Realtor.com’s Hannah Jones writes regarding the company’s latest survey. T oday's mortgage rates, which are “well above the less-than-4% mortgage rate typical among outstanding mortgages,” are dampening seller sentiment, Jones writes.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.