Top AI chip supplier Nvidia reports fiscal first-quarter results Wednesday after the market closes, with Wall Street anticipating some deceleration following its earlier blockbuster growth.

Still, for the quarter that ended in April, the numbers will be explosive as its chips remain in high demand for data centers used in generative artificial intelligence.

Analysts polled by FactSet see earnings per share soaring 474% to $5.22, with revenue up 241% to $24.5 billion. That would be down from the prior quarter’s 765% earnings jump and 265% revenue surge.

Meanwhile, the stock has leapt 87% so far in 2024 and is up about 200% from a year ago. Nvidia is now the third most valuable company in the world, boasting a market cap of $2.3 trillion that trails only Apple and Microsoft. But shares have essentially been flat over the last two months.

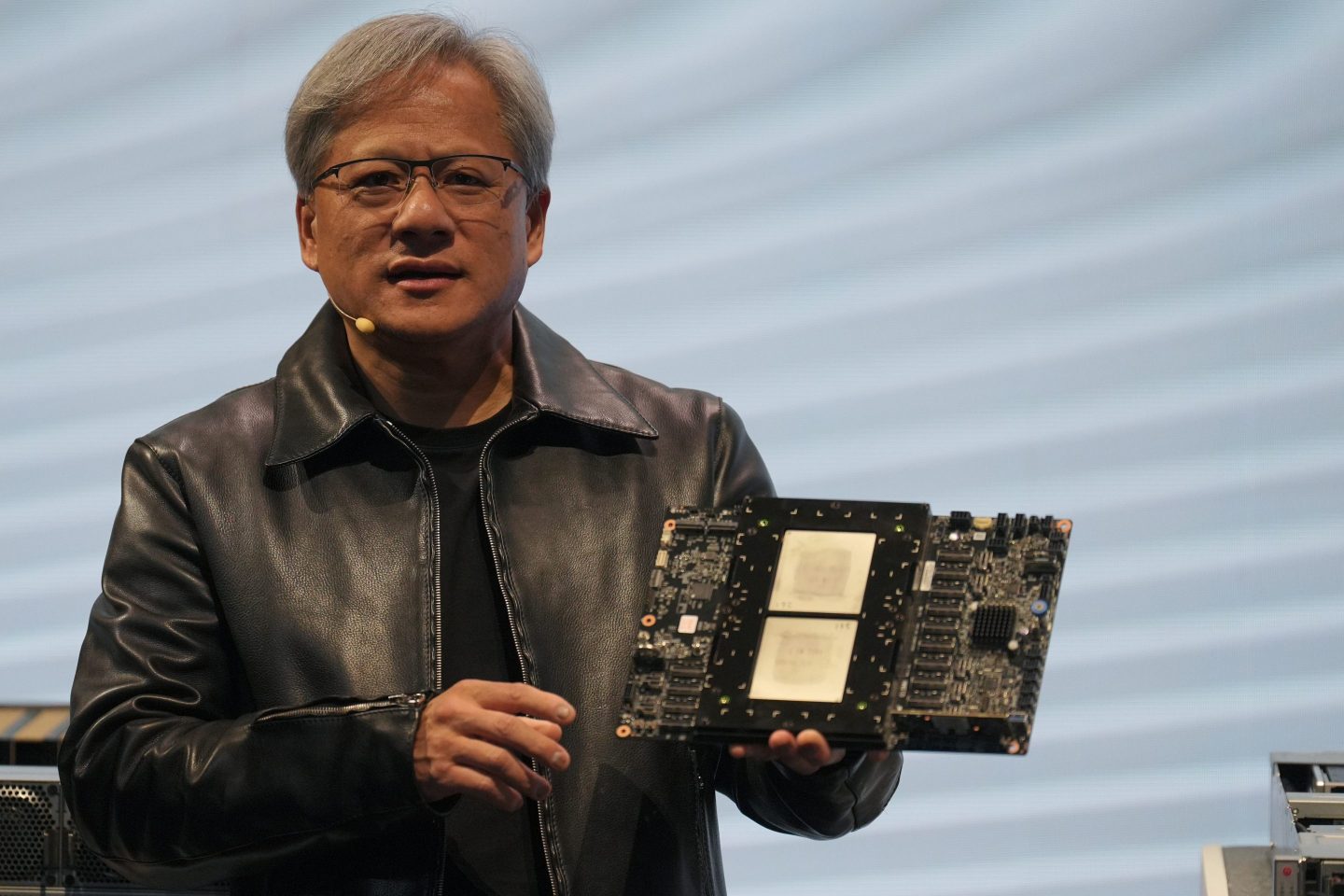

Nvidia’s unveiling in March of its new Blackwell chip has prompted some analysts to expect a slowdown during the transition from its older H100 chips to the next-generation models, which are expected to become publicly available later this year.

In a note on Thursday, analysts at Bank of America flagged this deceleration as a potential source of volatility in Nvidia stock after the earnings come out.

While BofA sees Nvidia reporting strong numbers compared with the Wall Street consensus, analysts expect the company’s second-quarter guidance to mark the first time sequential growth will be less than 10%.

Meanwhile, it sees gross margins shrinking from about 77% in the first quarter to a “more normalized” range of 75%-76% in the following quarter.

“However, even if NVDA were to potentially deliver on these bullish expectations, the stock could still react unfavorably as bears will likely complain that: 1) NVDA QoQ sales growth will decelerate to ‘only’ 7-8% QoQ in FQ2 (Jul) outlook, well below the mid-teens or better the last few quarters, 2) [gross margin] peaking and decline is a sign of pricing pressure, unfavorable mix (more China H20 shipments and/or more inference units) and slowing demand/easing supply,” the note said.

For its part, BofA is upbeat on Nvidia, giving the stock a “buy” rating and a price target of $1,100, which suggests upside of 19% from Friday’s close.

Last month, analysts at Morgan Stanley were also bullish on Nvidia, saying there were no signs of a pause in growth during the transition to the Blackwell chip with underlying demand still strong.

“NVDA continues to see strong spending trends in AI, with upward revisions in demand from some of the newer customers such as Tesla and various sovereigns,” analysts wrote.

And despite rising competition from Intel, Huawei, Samsung, and others, Morgan Stanley expects Nvidia to maintain its market share.

“Blackwell generation pricing looks to make a strong competitive statement—reducing enthusiasm for competitive offerings,” it added.