Nvidia Corp., the chipmaker at the center of an artificial intelligence boom, gave another bullish sales forecast, showing that spending on AI computing remains strong.

Second-quarter revenue will be about $28 billion, the company said Wednesday. Analysts on average had predicted $26.8 billion, according to data compiled by Bloomberg. Results in the fiscal first quarter, which ran through April, also beat projections.

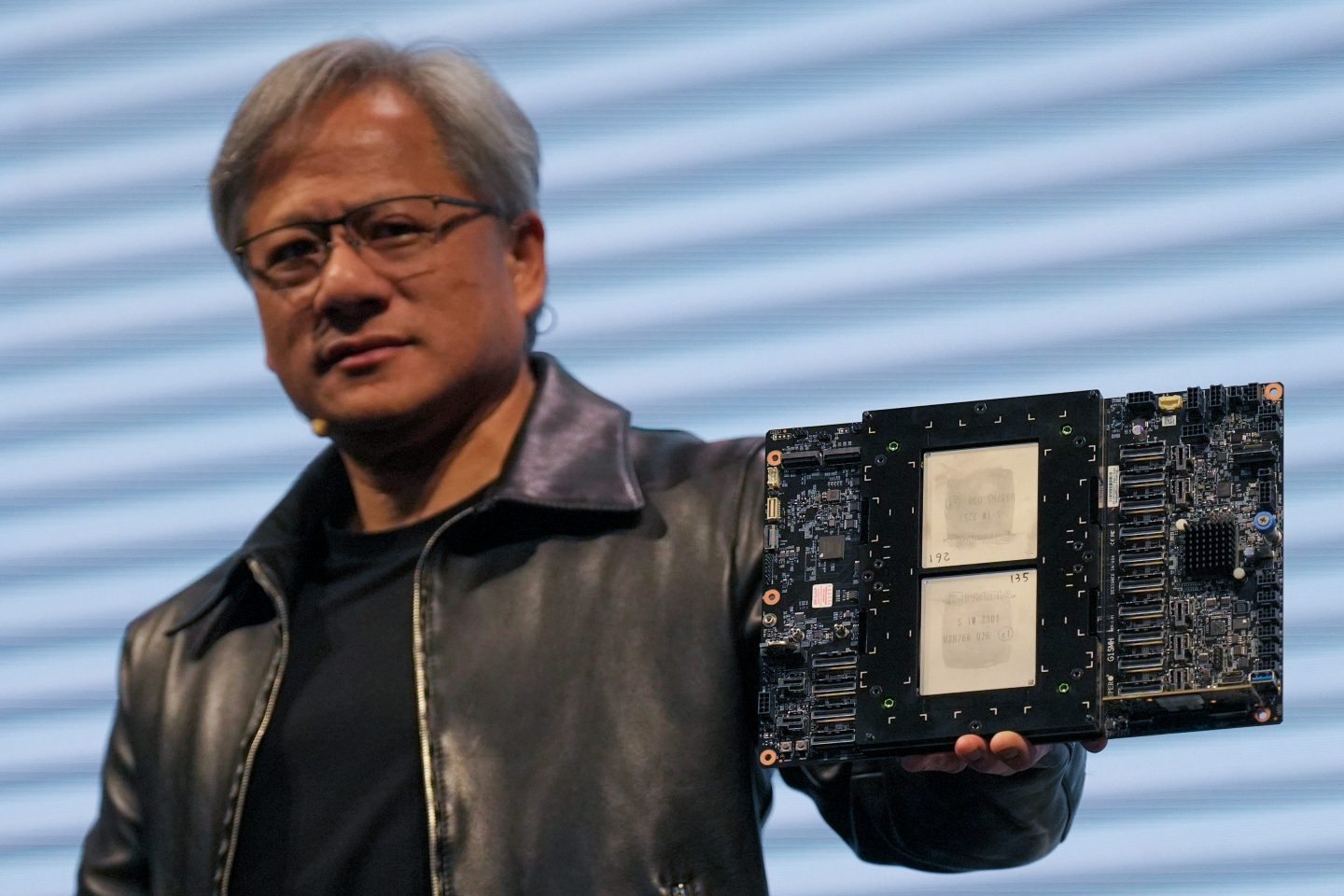

“The next industrial revolution has begun,” Chief Executive Officer Jensen Huang said in a statement, echoing one of his favorite themes. “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.”

The upbeat outlook reinforces Nvidia’s status as the biggest beneficiary of AI spending. The company’s so-called AI accelerators — chips that help data centers develop chatbots and other cutting-edge tools — have become a hot commodity in the past two years, sending its sales soaring. Nvidia’s market valuation has skyrocketed as well, topping $2.3 trillion.

The shares rose about 4% in extended trading on Wednesday. They had already gained 92% this year through the close, fueled by investor hopes that the company would continue to shatter expectations.

The Santa Clara, California-based company also announced a 10-for-1 stock split and boosted its quarterly dividend by 150% to 10 cents a share.

Nvidia, co-founded by Huang in 1993, started as a provider of graphics cards for computer gamers. His recognition that the company’s chips were well-suited to developing artificial intelligence software helped open a new market — and gave him a jump on competitors.

The release of OpenAI’s ChatGPT in 2022 then sparked a race between major technology companies to build their own AI infrastructure. The scramble made Nvidia’s H100 accelerators a must-have product. They sell for tens of thousands of dollars per chip and are often in scarce supply.

But much of this new revenue has come from a small handful of customers. A group of four companies — Amazon.com Inc., Meta Platforms Inc., Microsoft Corp. And Alphabet Inc.’s Google — are Nvidia’s largest buyers and account for about 40% of sales. Huang, 61, is trying to spread his bets by producing complete computers, software and services — aimed at helping more corporations and government agencies deploy their own AI systems.

In the fiscal first quarter, Nvidia’s revenue more than tripled to $26 billion. Excluding certain items, profit was $6.12 a share. Analysts had predicted sales of about $24.7 billion and earnings of $5.65 a share.

Nvidia’s data-center division — now by far its largest source of sales — generated $22.6 billion of revenue. Gaming chips provided $2.6 billion. Analysts had given targets of $21 billion for the data-center unit and $2.6 billion for gaming.

Nvidia emphasized Wednesday that it wants to sell its technology to a wider market — moving beyond the giant cloud-computing providers known as hyperscalers. Huang said that AI is moving to consumer internet companies, carmakers and health-care customers. Countries also are developing their own systems — a trend referred to as sovereign AI.

These opportunities are “creating multiple multibillion-dollar vertical markets” beyond cloud service providers, he said.

Still, the hyperscalers remained a critical growth driver for Nvidia last quarter. They generated approximately 45% of the company’s data-center revenue. That suggests Nvidia is in the early stages of diversifying the business.

The company’s new chip platform, called Blackwell, is now in full production, Huang said. And it lays the groundwork for generative AI that can handle trillions of parameters. “We are poised for our next wave of growth,” he said.