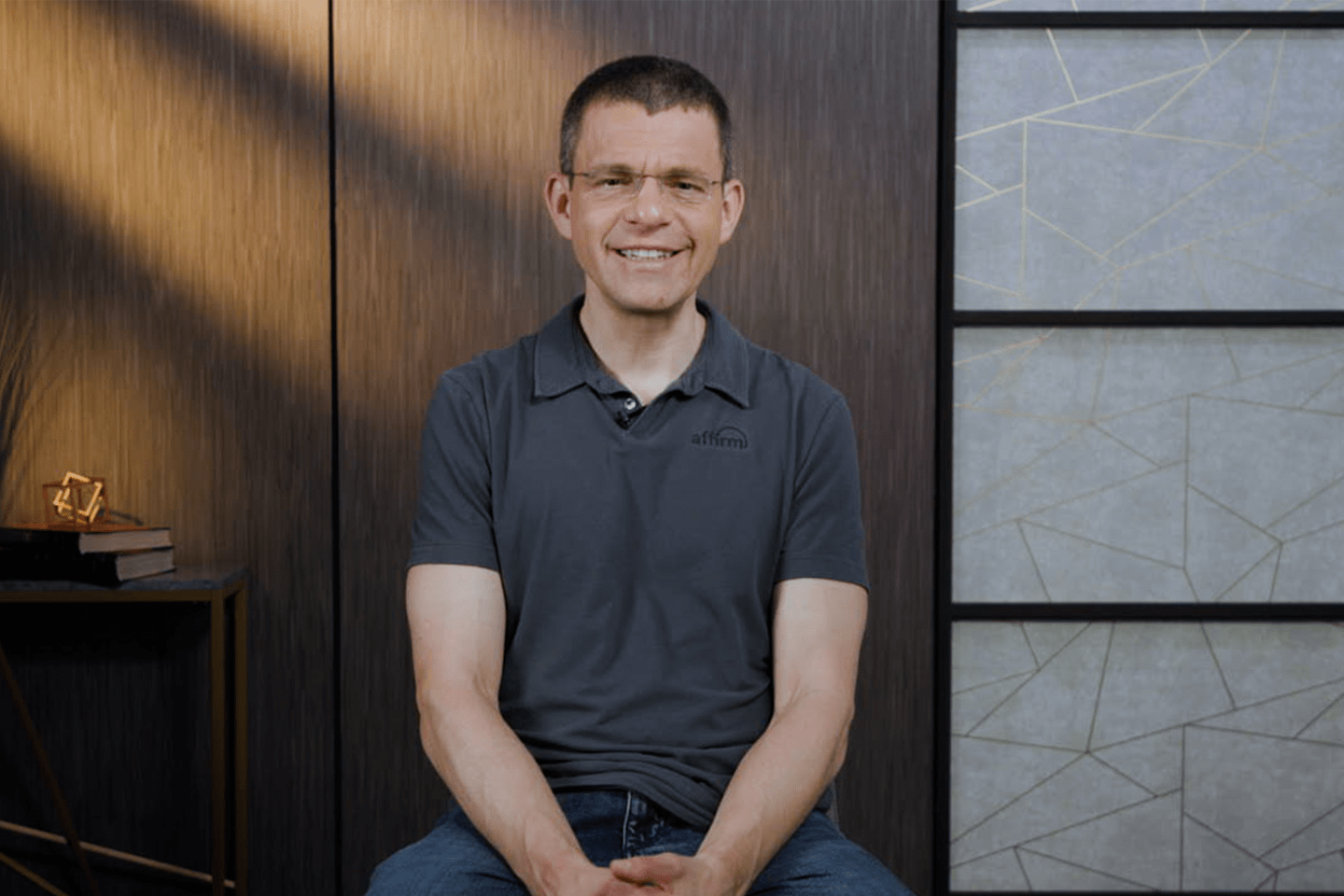

Max Levchin had just taken his company public and was looking to also go for a spin. On the heels of a PayPal deal that swiftly made him a multimillionaire, Levchin sought to deliver on that classic “making it big” purchase that many dream of—a car. But his credit card debt pumped the brakes ever so slightly on his goal.

“Borrowing was really difficult,” Levchin tells Coins2Day, noting that he was told to pay cash because his credit card score was too low. “I thought there was a better way to do payments and lending,” he says of his venture that came down the line.

Born in Ukraine, Levchin immigrated to Chicago in his teenage years and got his first credit card when he went to college. Self-admittedly operating with a lack of personal finance education, he “promptly got into a bunch of debt and paid a lot of late fees,” sinking his credit score. The purchase “sort of stayed with me,” he says, explaining that even after paying every late bill his credit score “wouldn’t recover for a decade.”

Decades more passed, and the former cofounder of PayPal decided that it was time to try out a different system that he believed would be less damaging. Founding the buy-now, pay-later online service Affirm in 2012, Levchin had his own experience in mind. “I should go and build a better payments platform that had accommodations for people that didn’t understand how lending worked,” he says of his thought-process. The service, as he envisioned it, would deter users from making mistakes but wouldn’t take advantage of them if they did.

Claiming that “Affirm is better for the consumer than using a credit card,” he says that the service has no late fees, though the website does note that it may charge loans if a payment is “120 days past due.” Speaking of “staying aligned” with the customer’s financial success, he describes a mutually beneficial relationship wherein Affirm is motivated by the user easily completing payments.

A whole new world, or the same one with BNPL

To be sure, despite his aspirations to reinvent the system, it’s yet to be realized if Levchin has just hit copy-paste on it instead. Affirm and its buy-now-pay-later (BNPL) peers, which include the likes of Klarna, Afterpay, and (briefly) Apple, have themselves been accused of reproducing the very same problem they claim to solve.

More than half (56%) of BNPL users report that they’ve experienced at least one issue with the service, including “overspending, missing payments, and regretting purchases,” per a Bankrate survey of more than 2,200 adults. And that spending could cause a ripple effect, as a separate survey conducted by Harris Poll for Bloomberg News finds that 28% of BNPL users were behind on other debts because of their spending.

“[BNPL] is marketed as interest-free, but consumers can find that they end up being charged more than they think they will,” Nadine Chabrier, senior policy and litigation counsel at the Center for Responsible Lending, told Vox last year. The Consumer Financial Protection Bureau seems to agree, ruling earlier this month that BNPL plans must be regulated like credit cards.

“From a regulatory perspective, and really from an intellectual perspective, there’s not a lot of difference between a credit card product and a ‘buy now, pay later’ product,” Gil Luria, managing director at wealth management firm D.A. Davidson, told Coins2Day’s Michael del Castillo. “In terms of the consumer perception, they are different products.”

But Levchin sees it differently. “I have infinite conviction that if U.S. Consumers would just switch entirely…to using binary affiliate products instead of credit cards, we would be in a healthier financial position as a nation,” he said.

“The reason United States consumers have $1.1 trillion in current outstanding credit card debt is because there’s no real motivation on the part of credit card issuers to tell you, ‘Hey, you got to pay this thing off,’” he says.