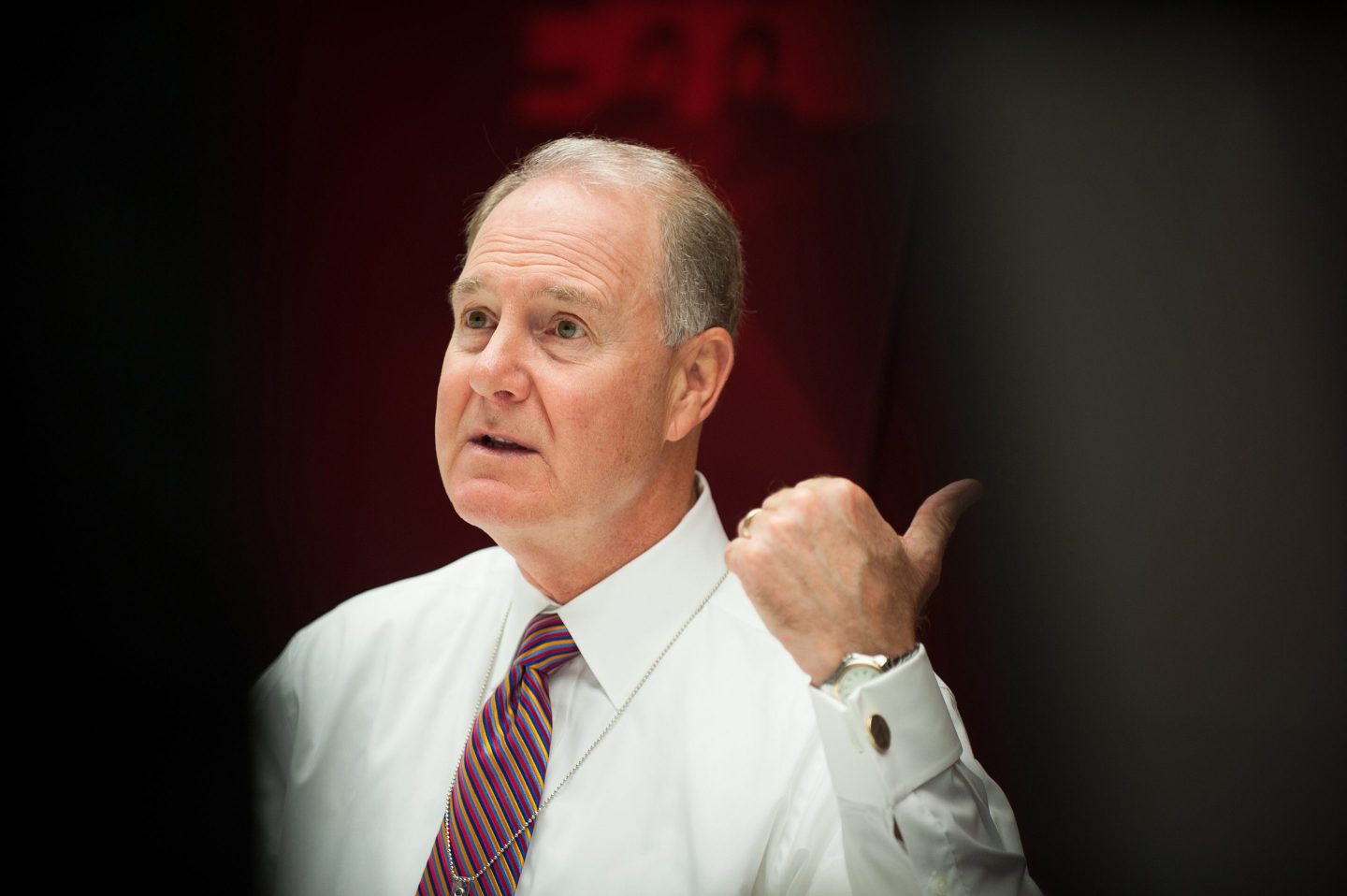

Southwest Airlines chairman Gary Kelly is no stranger to strife. During COVID, with the airline facing a 97% drop in traffic, Kelly implemented an ambitious growth plan that stewarded Southwest through the worst of the pandemic. Now the longtime executive is facing a new challenge, with the activist investment firm Elliott Management seeking to push him out along with CEO Bob Jordan.

On Wednesday, Southwest disclosed in a press release that it would adopt a shareholder rights plan that would dilute Elliott’s power if the firm exceeded 12.5% ownership of Southwest’s outstanding stock—a so-called “poison pill.” Elliott announced it had taken an 11% stake in Southwest in June. Southwest shares are trading flat on Wednesday at the time of publication, although they are down roughly 18% from a six-month high of almost $35 on March 7.

“Southwest Airlines has made a good faith effort to engage constructively with Elliott Investment Management since its initial investment and remains open to any ideas for lasting value creation,” Kelly said in a statement. “We are confident that we have the right strategy, the right plan, and the right team in place to succeed.”

The activist investors targeting Southwest

Founded by Paul Singer, Elliott Management is one of the largest activist funds in the world, with around $65.5 billion in assets as of December 2023. Its strategy is to acquire large stakes in companies with the purpose of pushing for structural changes, such as when it acquired a $2 billion stake in Twitter and successfully advocated for ousting then-CEO Jack Dorsey.

In June, the firm bought $1.9 billion worth of Southwest stock, arguing in a letter to the board that the company’s share price had dropped more than 50% in three years because of “poor execution and leadership’s stubborn unwillingness to evolve.” Southwest is the largest domestic carrier in the U.S. By passenger volume.

Southwest countered in a press release that it was working to address passenger demand and the customer onboarding experience. The airline had suffered a disastrous outage during the Christmas holidays of 2022 and was fined $140 million by the Department of Transportation.

Southwest’s move on Wednesday comes several weeks after Elliott’s bid, with the poison pill plan seeking to stave off the activist firm. In the press release, the airline noted that Elliott had made regulatory filings with antitrust authorities to acquire an event greater percentage of Southwest’s voting power.

Under the plan, Southwest would allow other shareholders the right to purchase a new Southwest share for every share they own at a steep discount if Elliott’s ownership exceeds 12.5%. The flip side would mean that every other shareholder’s stake is also diluted if they do not opt into the plan.

In a report published after Elliott announced its stake in June, Morningstar analysts predicted Southwest would face pricing pressure from both budget airlines and the Big Three, or American, Delta, and United. As a result, the analysts forecast lower revenue yields, especially as the post-pandemic travel boom evens out.

Elliott Management did not immediately respond to a request for comment.