Big Tech stocks that lifted markets to record highs in the first half of 2024 are now being pummeled. Mega cap tech giants like Microsoft, Meta, Apple, and Amazon will have a chance to win back gains when they report quarterly earnings next week. But it may be too late. Investors—eyeing a potential Fed rate cut or perhaps hedging against election and geopolitical uncertainty—have already shifted funds to more value-oriented sectors in what the Wall Street Journal called “a stock-market rotation of historic proportions.”

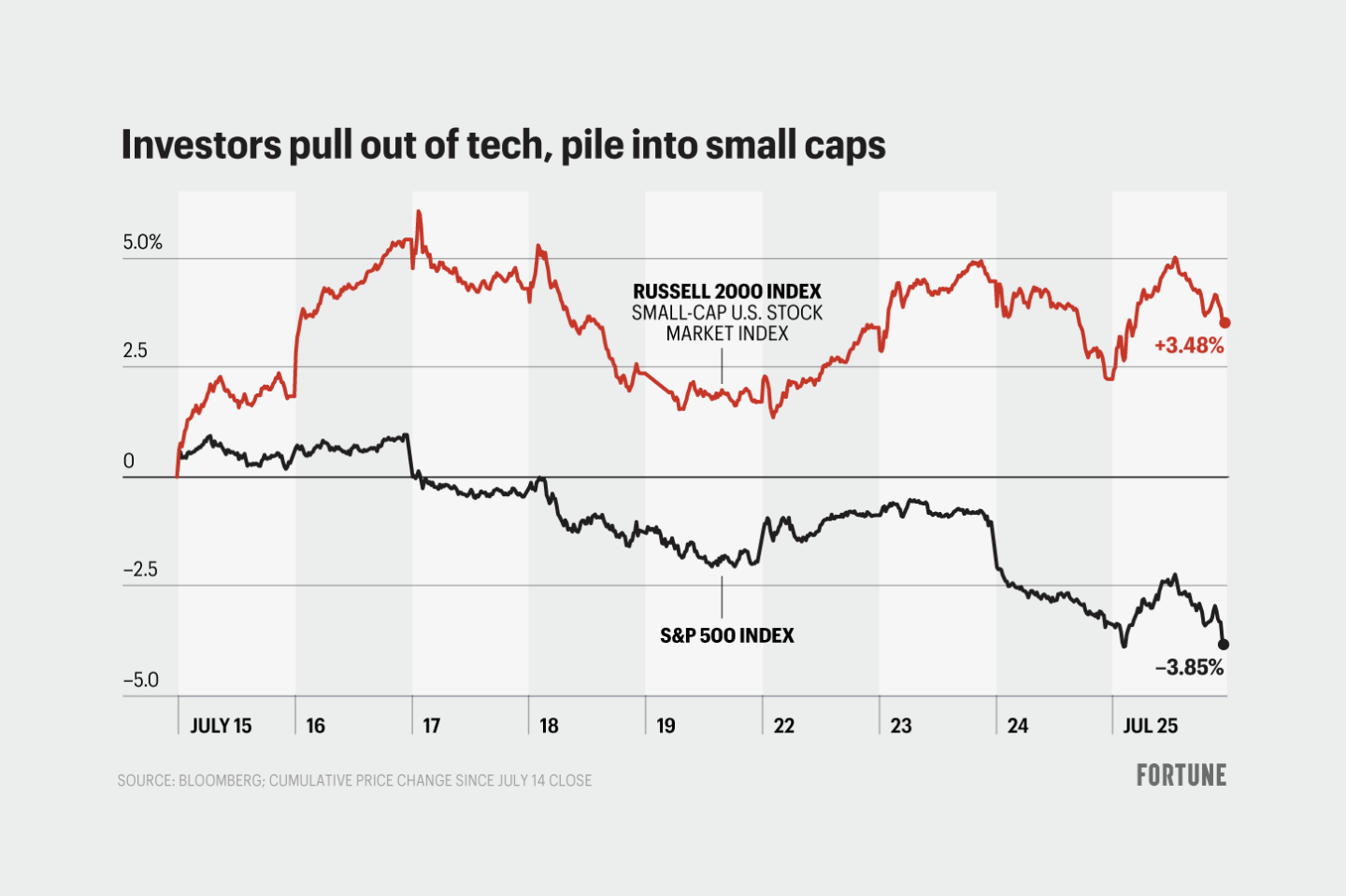

To get a sense of what’s underway, the S&P 500 and tech-heavy Nasdaq posted their worst sessions since 2022 Wednesday, falling 2.3% and 3.6% respectively. After an initial recovery Thursday, they both declined again, with the S&P falling 0.51% and the Nasdaq dropping 0.93%. Over the last week, the small caps of the Russell 2000 have beaten the S&P by a margin not seen since at least the 1980s, per the Journal. (All three indexes climbed in early trading Friday, led by the Russell 2000.)

The “Magnificent Seven”—a movie-inspired moniker that refers to Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—accounted for half of the 500’s total gains last year, according to a report from Morgan Stanley. Besides another rocky quarter from Tesla, these tech giants maintain immense profitability, market dominance, and a head start in the AI race. More good news next week, however, might not buoy the markets.

For Q2 results from the tech behemoths reporting next week to quell the rotation, “they have to blow out estimates on every single line item,” Ted Mortonson, a managing director at Baird, told F ortune.

One way to look at it, Angelo Zino, a senior tech analyst at CFRA Research, told Coins2Day, is that the stock market got three to four months ahead of itself as multiples skyrocketed. He said these metrics will likely settle and become more attractive as investors start looking out toward 2026 earnings estimates.

“We think you’re at a point in time now where kind of the earnings growth will outpace that of the stock price performance,” he said, “and that’s going to help drive multiples to more favorable levels.”

Many institutional investors saw this as a long time coming. Meta, Microsoft and Nvidia were the three AI-related stocks dumped most by hedge funds in the first quarter of 2024, according to a report from Goldman Sachs, with Amazon not far behind. Nonetheless, even as hedge funds trimmed exposure to mega-cap tech stocks, the Magnificent Seven (minus Tesla) remained their most popular long positions, the report said.

On Wednesday, however, Mortonson said he was worried about retail investors panicking if markets continued to get ugly. The worst thing they could do, he said, is look at their account statements over the weekend and rush to get out.

“Everybody was in the pool,” Mortonson said. “Well, now everybody has tried to get out of the pool.”

Big Tech still has “fortress balance sheet”

Long-term, it’s hard to bet against companies that have “fortress balance sheets,” as Mortonson put it, and boast bigger profits than most nations. The Magnificent Seven’s collective free cash flow last year, for example, was expected to exceed over $300 billion, according to a February report from S&P Market Intelligence.

Those mind-boggling statistics, meanwhile, aren’t going to take a massive hit anytime soon. Consensus estimates have second quarter tech earnings growing 18% year on year, according to LSEG Datasteam numbers cited in a report from BlackRock, compared to 2% for the rest of the S&P 500.

Though Tesla’s profit margin fell to a five-year low, Alphabet beat earnings and revenue expectations Tuesday. Shares dropped slightly, however, after the company slightly missed estimates for YouTube ad revenue.

Overall, the earnings trajectory for the tech sector, especially with most mega-caps, remains significantly above the broader market, Zino said.

“Because of that,” he said, “investors will come back into tech.” It’s just important to remember, he and Mortonson said, that stocks don’t go straight up to the moon.