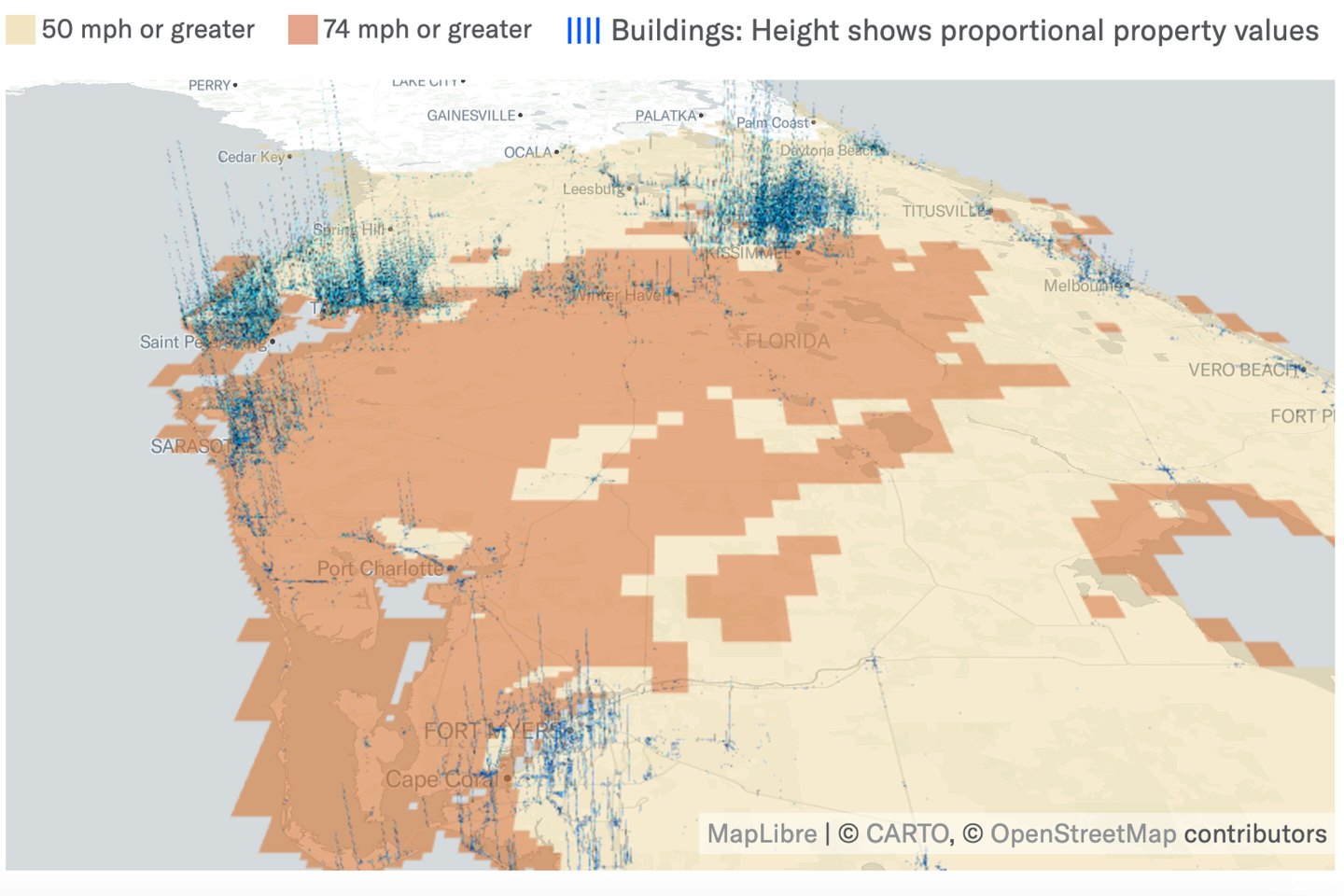

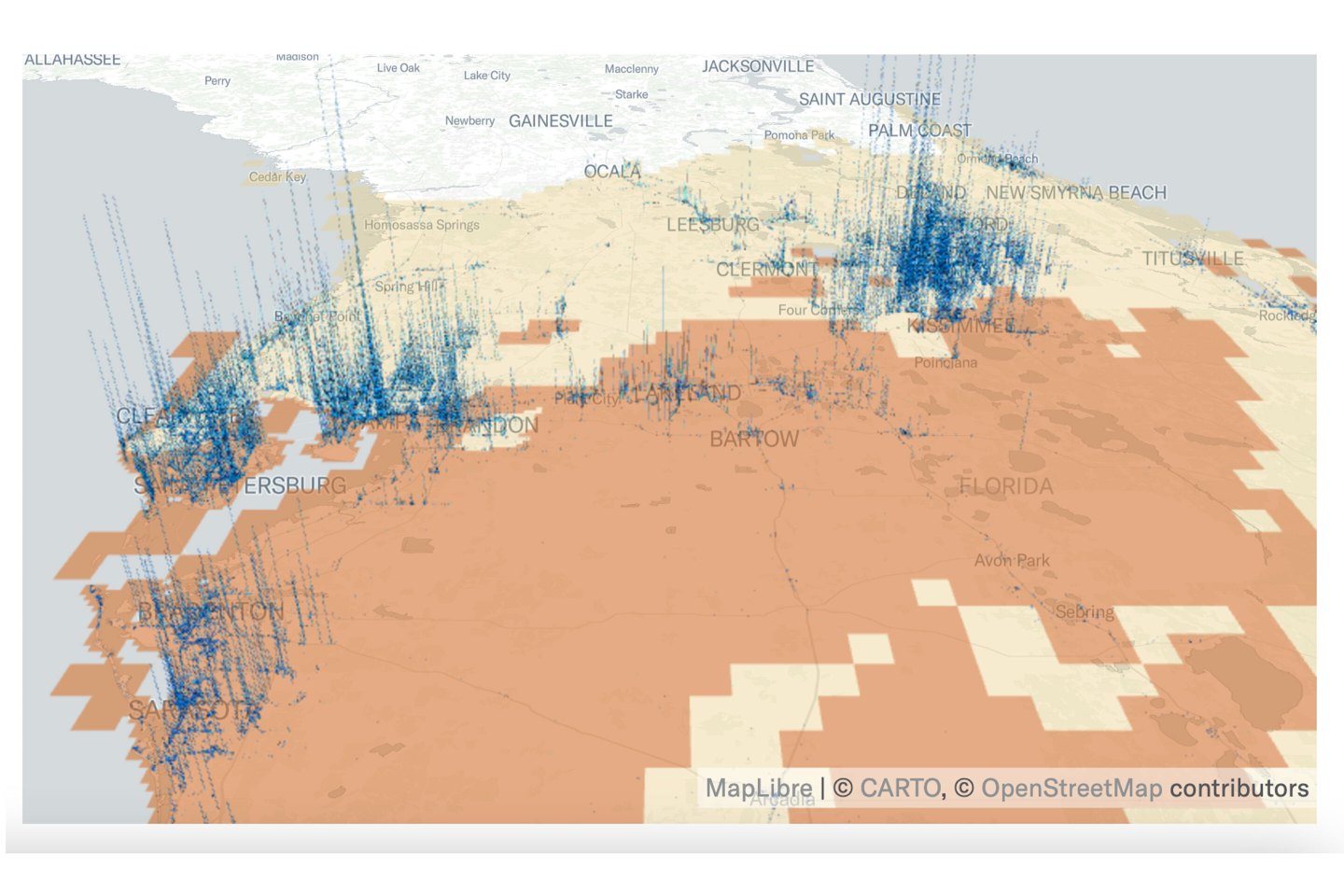

Hurricane Milton is expected to make landfall in Florida either tonight or tomorrow morning. Apart from the people and communities threatened by the storm, more than 235,000 commercial properties across the state have a greater than 50% probability of being exposed to storm force winds, and some damage is likely, according to Moody’s. Those properties have an estimated value of $1.1 trillion.

Among the swath of commercial properties, 64,857 are apartments, valued at a whopping $370.6 billion, per Moody’s. There are more retail properties than apartments at 78,916, and they are valued at $276.2 billion.

Then there’s a total of 44,122 industrial buildings, worth $155.2 billion; 42,387 office buildings, valued at $168.2 billion; and lastly 5,056 hotels, worth $108.9 billion.

Wells Fargo recently estimated that Hurricane Milton could cause billions of dollars in losses. The bank’s base case, however, was about $20 million of insured losses. Either way, it wasn’t long ago we were worried about Hurricane Helene, which, according to CoreLogic, resulted in between $30.5 billion and $47.5 billion of total insured and uninsured flood and wind losses. Moody’s, on the other hand, estimates total private market insured losses from Hurricane Helene to be between $8 billion and $14 billion, with a best estimate of $11 billion.

“The back-to-back landfalls of Hurricanes Helene and Milton in Florida heighten the risk of significant insurance claims for both Citizens and the Florida Hurricane Catastrophe Fund (FHCF), especially with Milton’s trajectory towards densely populated west-central areas,” Moody’s Ratings senior analyst Denise Rappmund said in the report.

Rappmund continued: “The expected extensive wind damage could strain FHCF’s reserves, despite current resources likely covering these imminent claims. These events also amplify the risk of flooding, adding to the financial and economic strain from cleanup and disruptions.”

Citizens is the state of Florida’s last-resort insurer. It was created years ago for people who couldn’t find coverage, which seems to have only worsened as more and more insurers flee the state because it’s considered a challenging market because of, for one, hurricanes. Mark Friedlander, the Florida-based director of corporate communications for the Insurance Information Institute, told Coins2Day in June last year, “Florida’s property insurance industry has not posted positive financial results since 2016…it’s been a very paralyzed market for insurers. And it’s not a sustainable model to operate in the state. If you keep losing that much money, year after year, it becomes very challenging.”

If insurers continue to lose money, it’s possible more will leave the state or stop writing new policies, leaving homeowners with fewer coverage options and higher premiums. In some cases that means uninsured properties—Miami already happens to have the highest share of uninsured homeowners, about 15% worth. And extreme weather events causing at least $1 billion in damages are on the rise, and it seems they’ll only continue to increase. John Rogers, chief innovation officer at CoreLogic, previously told Coins2Day that “the severity and frequency of major weather events, unfortunately, is likely to go up.”