U.S. Stocks rebounded Wednesday, buoyed by strong earnings from Morgan Stanley, United Airlines, and others, which helped to offset recent losses in technology shares.

- S&P 500 Futures: 5,863.50 ⬆️ up 0.01%

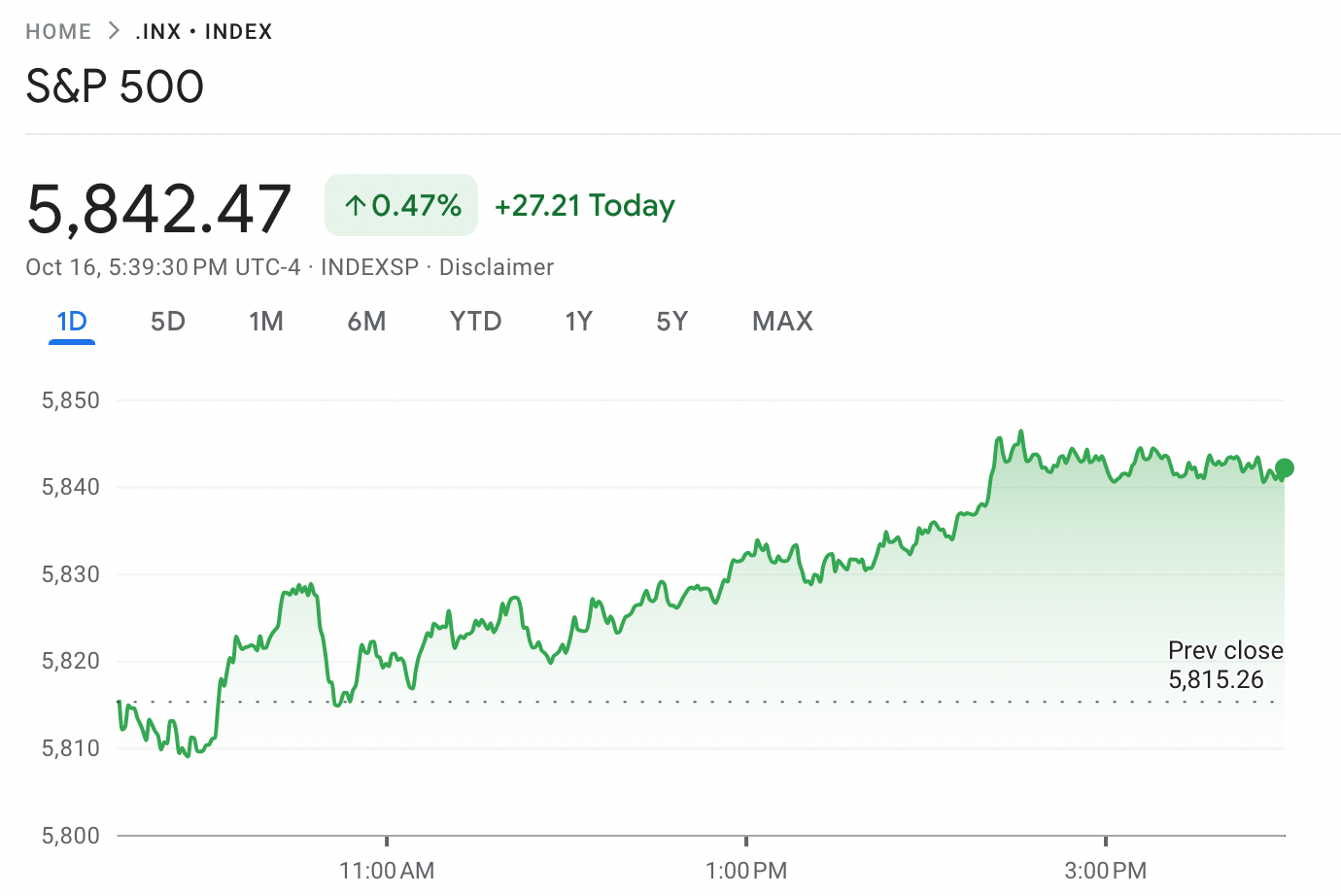

- S&P 500: 5,842.47 ⬆️ up 0.47%

- Nasdaq Composite: 18,367.08 ⬆️ up 0.28%

- Dow Jones Industrial Average: 43,077.70 ⬆️ up 0.79%

- STOXX Europe 600: 519.60 ⬇️ down 0.19%

- CSI 300: 3,831.59 ⬇️ down 0.63%

- Nikkei 225: 39,180.30 ⬇️ down 1.83%

- Bitcoin: $67,703.45 ⬆️ up 0.97%

U.S.: Markets stabilize as corporate earnings fuel optimism

The S&P 500 gained 0.47%, recovering somewhat from Tuesday’s slump, while the Dow Jones added 0.79%. Nvidia shares rose 3.1%, after a sharp decline the previous day. U.S. Markets had seen a dip earlier this week due to a warning from ASML about weakness in the semiconductor sector outside of AI, though the chip giant recovered slightly in Wednesday trading.

Europe: Luxury and semiconductor woes weigh on stocks

European markets edged lower on Wednesday, with the Stoxx 600 down 0.19%. Semiconductor concerns amplified by ASML’s disappointing outlook and LVMH’s warning about weak sales in China drove the decline. LVMH dropped 3.9%, and ASML fell another 3.2%. However, the FTSE 100 bucked the trend, rising 0.97%, after U.K. Inflation dropped to its lowest level in more than three years, fueling hopes of a potential rate cut by the Bank of England.

China: Markets hold steady ahead of housing stimulus update

Chinese stocks were relatively stable Wednesday, awaiting a housing market briefing scheduled for Thursday that could hint at new stimulus measures. The CSI 300 declined 0.63%, reflecting cautious sentiment among investors after Tuesday’s heavy losses. Housing stocks managed to limit the overall decline, with the Shanghai Composite inching up 0.05%.

Japan: Semiconductor weakness pulls Nikkei down sharply

Japan’s Nikkei 225 slumped 1.83%, led by sharp declines in semiconductor stocks following ASML’s outlook cut. Tokyo Electron plunged 9.19%, and Softbank, which holds a major stake in Arm Holdings, dropped 3.97%. Semiconductor sector weakness continues to weigh on the Japanese market, following ASML’s early-released results indicating lackluster demand beyond AI-related industries.

Earnings season continues…

Netflix earnings are due tomorrow and P&G and American Express are scheduled for Friday.