The exceptional stock market performance of the past ten years could be replaced by a decade of markedly lower returns, according to Goldman Sachs.

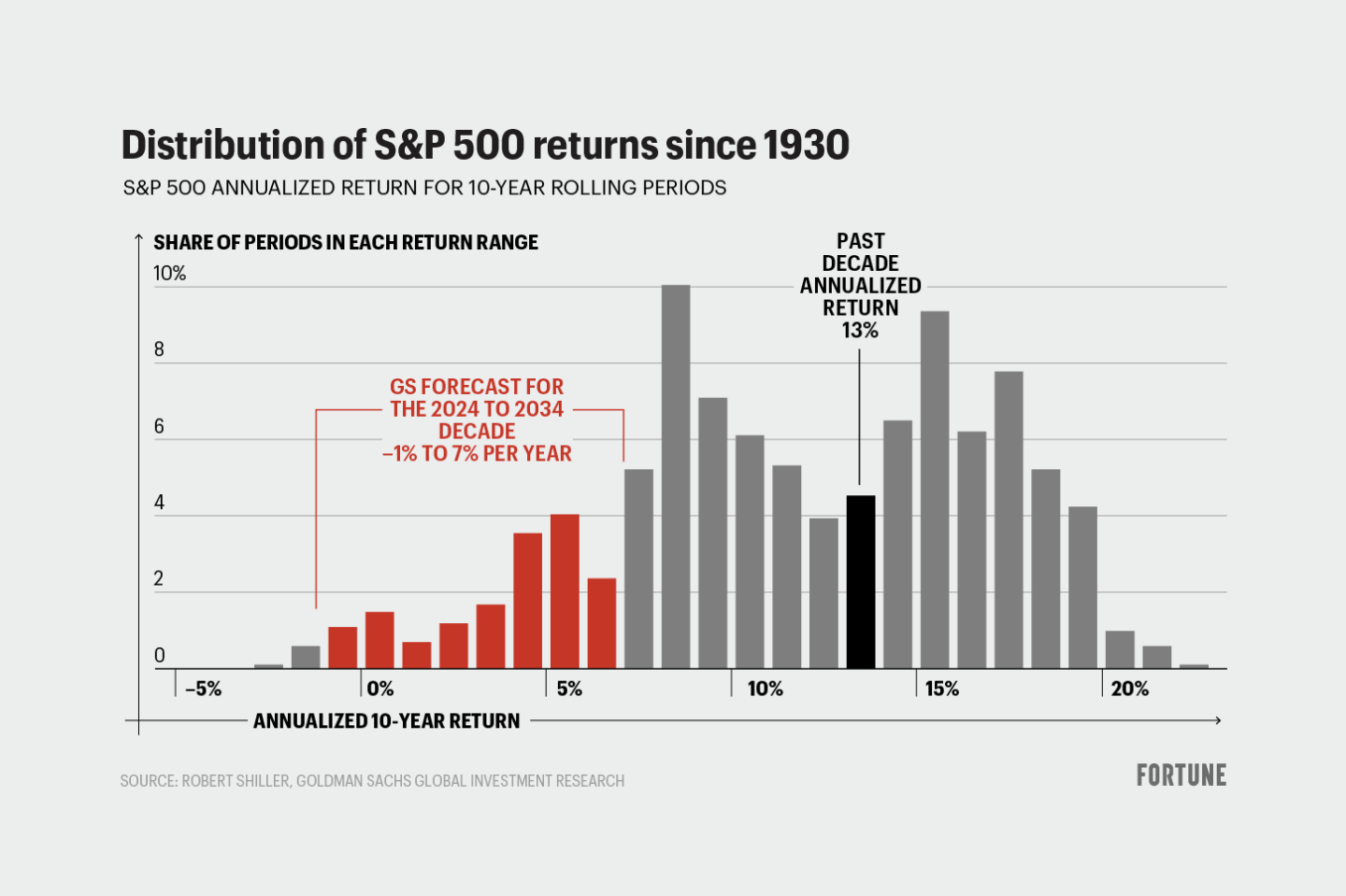

During the next ten years, the S&P 500 (which reflects the broader market) could yield a nominal annualized return of 3%, analysts at the investment bank predicted in a note from Oct. 18. The analysts placed a negative 1% annualized nominal return at the low end of the range of likely outcomes, while a 7% return represented the upper bound.

Yet, even the high end of the analysts’ range of estimates pales in comparison to the above-average 13% annualized total return the market has experienced during the last decade.

“Investors should be prepared for equity returns during the next decade that are towards the lower end of their typical performance distribution relative to bonds and inflation,” the analysts wrote in the note.

The Goldman analysts also penciled in a 72% chance the S&P 500 will underperform bonds during the next decade, while they pegged the odds of the stock market index underperforming inflation at about a third. There’s also a 4% chance stocks post a negative absolute return over the period, the analysts wrote.

Goldman’s lower stock market return outlook for the next decade was influenced in part by its estimate that the U.S. GDP will contract over four quarters during the next ten years, or about 10% of the time. Another factor is the volatility risk that comes from a market heavily dependent on a handful of stocks.

The market cap of the 10 largest companies on the S&P 500 account for more than a third of the overall index, the analysts wrote. Their annualized return estimate would be several percentage points higher were they not to account for how highly concentrated the index is, the note read.

“As sales growth and profitability for the largest stocks in an index decelerate, earnings growth and therefore returns for the overall index will also decelerate,” the analysts wrote.

Goldman’s lower returns forecast is below the consensus 6% average annualized return other market participants are expecting over the same period, and the analysts warned the estimate of many long-term investors like corporate and public pension plans are possibly too optimistic.