Good morning. Greg McKenna here, filling in for Sheryl today. Becoming a certified public accountant proved a springboard for Sandy Torchia’s career. A first-generation college student and granddaughter of Mexican immigrants, she’s now in her 28th year at KPMG. Previously the national managing partner of the firm’s advisory business, she now serves as its vice chair of talent and culture.

If she had needed an extra year of school just to get her CPA license, however, Torchia says she would have decided to avoid the profession altogether.

“I can honestly say that if the 150-hour rule would have been in place when I was making a decision about what to study,” she recently told me, “I would not have been an accountant, and the reason is because it makes it less accessible.”

As of 2015, all U.S. States require 150 semester hours of college education to become a CPA, versus the 120 hours typically needed for a bachelor’s degree. That 30-hour difference effectively equates to two semesters’ worth of classes. There has been a steady decline in students graduating with accounting degrees—and Torchia says the 150-hour barrier to entry is the prime culprit.

That’s one of two widely cited explanations for the looming shortage, Tim Morrison, an associate teaching professor at the University of Notre Dame, told me. Educators, he said, typically claim the leading “Big Four” accounting firms also don’t pay enough to attract talent lured by more lucrative salaries in fields like banking and consulting.

“I believe it’s both,” said Morrison, a former audit partner at EY, “because there probably are people that are scared away.”

Having recently boosted salaries along with the rest of the Big Four, KPMG has been the most vocal supporter of a new proposal that would provide alternatives to the 150-hour requirement, including possible work-study programs.

That could help firms train new hires faster as the emergence of Gen AI tools and other new technologies rapidly change the way their teams work. KPMG says its typical audit uses over four times the amount of new advanced tech compared to just three years ago.

“Getting that experience sooner rather than later is going to give you a great learning experience that you wouldn’t otherwise have,” Torchia said.

In a statement to Coins2Day, Deloitte said it also backed an “alternative to the current fifth-year education requirement for CPA licensing.” PwC and EY have expressed cautious support as well.

The worst outcome for the Big Four, Morrison said, would be if only select states eventually agree and implement the proposal. Currently, accountants can have their CPA license recognized in other states with relative ease. That would change if a patchwork of vastly different requirements emerges.

Dan Dustin, president of the National Association of State Boards of Accountancy, told Coins2Day in a statement that the organization is working with the American Institute of Certified Public Accountants to ensure that doesn’t come to pass.

“We are encouraged by the positive response to the current exposure draft on competency-based experience,” he said.

Morrison told me he’s been surprised, however, by the opposition voiced from some states. New York’s accounting board, he noted, recently said it discouraged such an initiative. “Since we’re a state regulator, we have to look out for the best interest of the public,” Morrison said a member of one state’s board recently told him.

We’ll see if KPMG and other firms can do some more convincing.

Greg McKenna

[email protected]

Upcoming event: The 2024 Coins2Day Global Forum, the premier gathering of CEOs and leaders of the world’s largest multinational companies, alongside policymakers, thought leaders, and investors, will take place Nov. 11-12, in New York City at Jazz at Lincoln Center. This year’s theme is “Business at the Speed of Change.” Guest speakers include seven-time NFL World Champion Tom Brady. View an agenda for the 2024 Coins2Day Global Forum. You can request an invitation here.

Leaderboard

Toh Puay-Yong was promoted to CFO at Orangekloud Technology Inc. (Nasdaq: ORKT) a technology platform for mobile applications, replacing Shally Ang, who was CFO since February 2023 and is resigning due to personal reasons. Since 2017, Toh has worked in various capacities, including finance, M&A, strategic management, and HR development. He has also been a management consultant advising regional enterprises, including MSC Consulting.

Big Deal

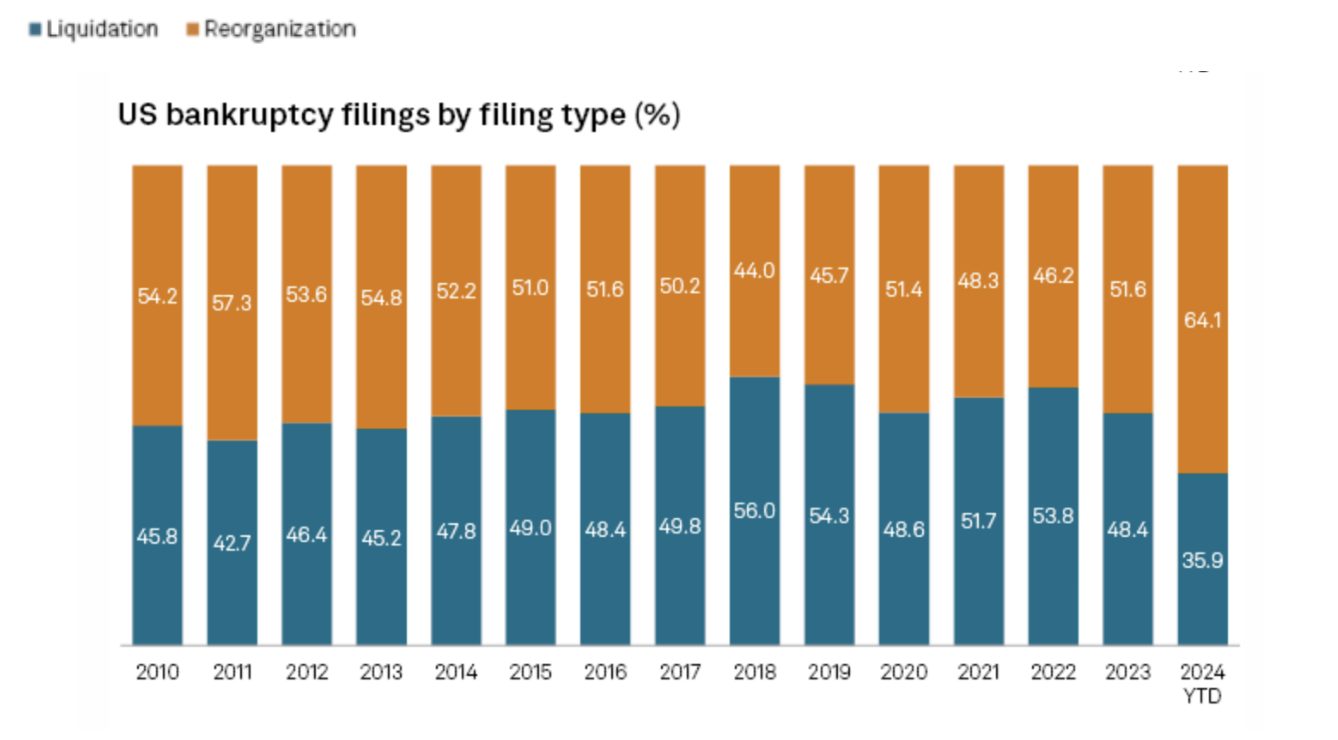

A new analysis by S&P Global Market Intelligence finds that so far in 2024, companies entering bankruptcy proceedings in U.S. Courts are opting to liquidate at the lowest rate in at least 15 years.

In the first nine months of the year 35.9%, of the 513 U.S. Corporate bankruptcy filings were categorized as liquidations—lower than any of the 14 prior years. The balance of filings through the end of September, 64.1%, sought to reorganize the companies, which was similar to the 64.45% rate observed through the first half of the year, according to the report.

Going deeper

“Where’s the Value in AI?” is a new report by Boston Consulting Group (BCG) that finds just 26% of companies have developed the necessary set of capabilities to move beyond proofs of concept and generate value with AI. The findings are based on a survey of 1,000 C-suite leaders and senior executives from more than 20 sectors, spanning 59 countries in Asia, Europe, and North America, and covering 10 industries.

Participants were asked to assess their companies’ AI maturity in 30 key enterprise capabilities. Companies designated as “AI leaders” have achieved 1.5 times higher revenue growth, 1.6 times greater shareholder returns, and 1.4 times higher returns on invested capital over the past three years, according to BCG.

Overheard

“In our opinion as the Fed and Powell have kicked off its aggressive rate cutting cycle, macro soft landing remains the path, and tech spending on AI remains a generational spending cycle just starting to hit the shores of the tech sector.”

—Wedbush Securities’ tech analysts wrote in a note to investors on Sunday. “The stage is set for tech stocks to see another 20% move higher in 2025 with this tech bull market just hitting its next phase led by the AI Revolution,” according to the analysts.