In the eponymous Labyrinth in the 1980 movie—starring David Bowie as The Goblin King in his most bemusing turn—the paths shift around, statues appear and vanish, and there’s a swirling M.C. Escher staircase.

It’s a world where the rules constantly change, keeping a very young Jennifer Connelly off balance as she works her way through a maze filled with Jim Henson’s scaly and scruffy puppets. I may just be thinking about Labyrinth because it’s about to be Halloween, but that’s what cybersecurity feels like for me—a phantom maze, with high stakes and moving walls, where you risk falling into a trap door.

That’s part of what makes Coins2Day and Lightspeed Venture Partners’ second annual Cyber 60 an interesting heat check right now—because cybersecurity is getting increasingly labyrinthine. As we spend more and more of our lives digitally, there’s more cyberattack surface area. And, with the rise of AI, there will be more opportunities for entrepreneurs in the space—both as AI provides solutions for companies, and simultaneously creates more attackers than ever (some of whom I imagine look like goblins).

The Cyber 60 includes many growth stage names you’re probably expecting, including Wiz, Vanta, Cribl, Arctic Wolf, Chainguard, and Cato Networks. Some earlier stage standouts who I’ve personally been tracking who’ve made the list include: Dazz, ThetaLake, CalypsoAI, and Radiant Security.

For the Cyber 60, Lightspeed, in partnership with Wakefield Research, gathered data from 200 CISOs at companies with $500 million in revenue or more. Here’s what they learned:

About seven out of ten of CISOs surveyed say they’re bumping up their cybersecurity budgets this year. Vendor consolidation—the process by which companies limit the number of suppliers they work with—is in full swing: 50% of CISOs said vendor consolidation will be top of mind for them over the next twelve months. On average, these CISOs said they’re currently using seven cybersecurity solutions.

Translation: More money will be going to fewer companies. In an already viscerally competitive landscape, the winners will keep winning even more. (Yes, invoking the Power Law here is only fair.)

But just because every single company on this list may not eventually be IPO-grade, it doesn’t mean there aren’t other metrics of success in a space as hot (and needed) as cybersecurity. 2024 has been an exit-light year for VCs, but cyber has been a bright spot. (Wiz, for example, bought Gem Security this summer, while Cyber 60 honorable mention Cyera recently bought Trail Security.)

Because if there’s one thing that’s clear from Labyrinth—and I assure you, there’s only so much—it’s that when you’re navigating a moving maze, you need all the help you can get.

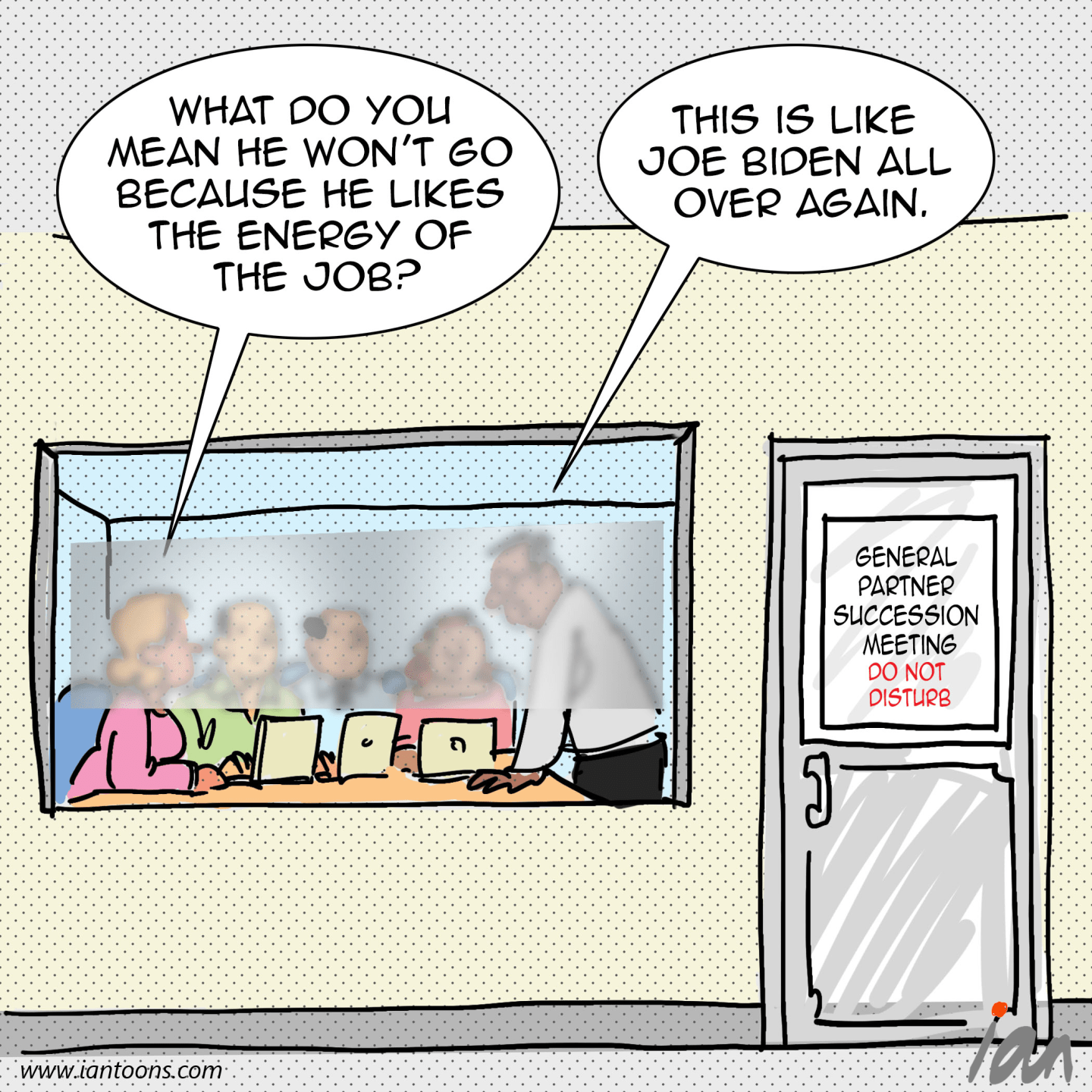

This month’s cartoon… Here’s your October cartoon, by Ian Foley.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

Join us… You’re invited to Coins2Day Global Forum in NYC from Nov. 11-12. Speakers include seven-time Super Bowl champion Tom Brady (we will not be reenacting Netflix’s roast of the NFL legend) and Pulitzer Prize-winning composer Wynton Marsalis. More information here.

VENTURE DEALS

- Fingercheck, a New York City-based deskless workforce management platform for small and medium businesses, raised $115 million in funding. Edison Partners led the round and was joined by StepStone Group and Columbus Capital.

- Moniepoint, a London-based business banking provider in Africa, raised $110 million in Series C funding. Development Partners International led the round and was joined by Google’s Africa Investment Fund, Verod Capital, and existing investor Lightrock.

- DoorLoop, a Miami-based property management software company, raised $100 million in Series B funding from JMI Equity.

- Outrider, a Brighton, Colo.-based autonomous yard operations company, raised $62 million in Series D funding. Koch Disruptive Technologies and New Enterprise Associates led the round and were joined by 8VC, ARK Invest, B37 Ventures, and others.

- INBRAIN Neuroelectronics, a Barcelona-based brain-computer interface therapeutics platform, raised $50 million in Series B funding. Imec.xpand led the round and was joined by EIC Fund, Fond ICO Next Tech, CDTI-Innvierte, Avançsa, and existing investors Asabys Partners, Aliath Bioventures and Vsquared.

- Duetti, a New York City-based catalog monetization platform for musicians, raised $34 million in funding. Flexpoint Ford led the round and was joined by existing investors Nyca Partners and Viola Ventures.

- Redoxblox, a San Diego-based thermochemical energy storage systems developer, raised $30 million in Series A funding. Prelude Ventures led the round and was joined by Imperative Ventures, New System Ventures, and existing investors Breakthrough Energy Ventures and Khosla Ventures.

- Innoventric, a Rehovot, Israel-based transcatheter tricuspid regurgitation treatment provider, raised $28.5 million in Series B funding. RA Capital Management led the round and was joined by the European Investment Committee and existing investors BRM Group, JG Private Equity, and Mivtach Shamir Holdings.

- Third Wave Automation, a Union City, Calif.-based autonomous forklifts developer, raised $27 million in Series C funding. Woven Capital led the round and was joined by existing investors Innovation Endeavors, Norwest Venture Partners, and Qualcomm Ventures.

- Andium, a New York City-based emissions data and ESG monitoring platform developer, raised $21.7 million in Series B funding. Aramco Ventures led the round and was joined by existing investors Climate Investment, Intrepid Financial Partners, and others.

- Elevate, a Denver-based consumer-directed benefits administration platform, raised $20 million in funding. Fin Capital led the round and was joined by Anthemis and SaaS Ventures.

- Wildfire Systems, a San Diego-based loyalty and rewards shopping platform, raised $16 million in Series B funding. Intuit Ventures and Mucker Capital led the round and were joined by Cohen Circle, Samsung Next, Evolution VC, Gaingels, existing investors TTV Capital, QED Investors, B Capital, and others.

- Semble, a London-based integrated healthcare system, raised $15 million in Series B funding. Mercia Ventures led the round and was joined by Octopus Ventures, Smedvig Ventures, and Triple Point.

- Table22, a New York City-based e-commerce tools provider for food and beverage merchants, raised $11 million in Series A funding. Lightspeed Venture Partners led the round and was joined by existing investors Footwork, Forerunner Ventures, Alt Capital, and others.

- Infinite Machine, a New York City-based non-car vehicles developer, raised $9.3 million in seed funding. Andreessen Horowitz led the round and was joined by Adjacent Capital, Necessary Ventures, Otherwise Fund, and others.

- Sapien, a San Francisco-based autonomous financial analysts developer, raised $8.7 million in seed funding. General Catalyst led the round and was joined by Neo and angel investors.

- iGent AI, a London-based AI technology developer for software engineering, raised £6.3 million ($8.2 million) in seed funding. HV Capital led the round and was joined by XTX Ventures, TwinPath, 10x Founders, and Dhyan.

- Latii, a New York City-based window, door, and construction material solutions provider, raised $5 million in seed funding. Leadout Capital led the round and was joined by Era Ventures, Act One, Nine Four Ventures, and RADV.

- GlassFlow, a Berlin-based data infrastructure platform for Python developers, raised $4.8 million in seed funding. Upfront Ventures led the round and was joined by High-Tech Gründerfonds, Robin Capital, and TinyVC.

- Auquan, a London-based AI solutions provider for financial services, raised $4.5 million in seed funding. Peak XV led the round and was joined by existing investor Neotribe Ventures.

- Emidat, a Munich-based environmental data solutions provider for the construction industry, raised €4 million ($4.3 million) in seed funding from General Catalyst.

- HomeBoost, a San Francisco-based home energy platform, raised $4 million in seed funding from True Ventures, Gigascale Capital, and Incite.org.

- Advex AI, a San Francisco-based industrial AI vision models developer, raised $3.5 million in seed funding. Construct Capital led the round and was joined by Pear VC, Emerson Collective, and angel investors.

- Final Boss Sour, a Los Angeles-based gaming-themed sour snack brand, raised $3 million in seed funding. Science Inc.Led the round and was joined by Aoki Labs, F4 Fund, GFR Fund, Uncommon Denominator, and others.

- StayNow, a Minneapolis-based operational platform for independent hotel owners, raised $2.2 million in seed funding. Fountane led the round and was joined by UXReactor and founders Romal Jayswal and Siddharth Raj.

PRIVATE EQUITY

- CPP Investments invested $100 million in Redaptive, a Denver-based Energy-as-a-Service provider.

- Neuberger Berman Capital Solutions acquired a minority stake in Mariner, an Overland Park, Kan.-based financial services firm. Financial terms were not disclosed.

OTHER

- Carta acquired Tactyc, a Morrisville, N.C.-based venture funds forecasting and planning platform. Financial terms were not disclosed.