As a kid in Cairo, Mo Sarwat first grasped the dangers of not understanding the natural world. It was 1992, and the city and much of northeastern Egypt were devastated by an earthquake.

If you, like me, live in California, you’re used to the occasional shake, where you watch your glass of water shimmy and then go about your day. But this wasn’t a fleeting inconvenience: It was a nightmare scenario. In Cairo, Sarwat watched as an earthquake devastated the city—more than 500 people died in the catastrophic aftermath, while tens of thousands were injured and lost their homes. Subsequent estimates have placed the earthquake’s damages at about $1 billion.

“It was a massive disaster,” said Sarwat. “It made me ask: Can you predict or forecast these kinds of events? Then after the fact, what does the power of data look like? It’s not only about the earthquake data, but data about the buildings, about whatever is on the map about people and their means.”

Today, Sarwat is the cofounder and CEO of Wherobots, a cloud-based platform that processes and analyzes massive geospatial data from sources like satellites, GPS devices, and drones. It’s a lot of distance traveled for Sarwat, who was previously a longtime professor at Arizona State University and a creator of the open-source spatial computing engine Apache Sedona.

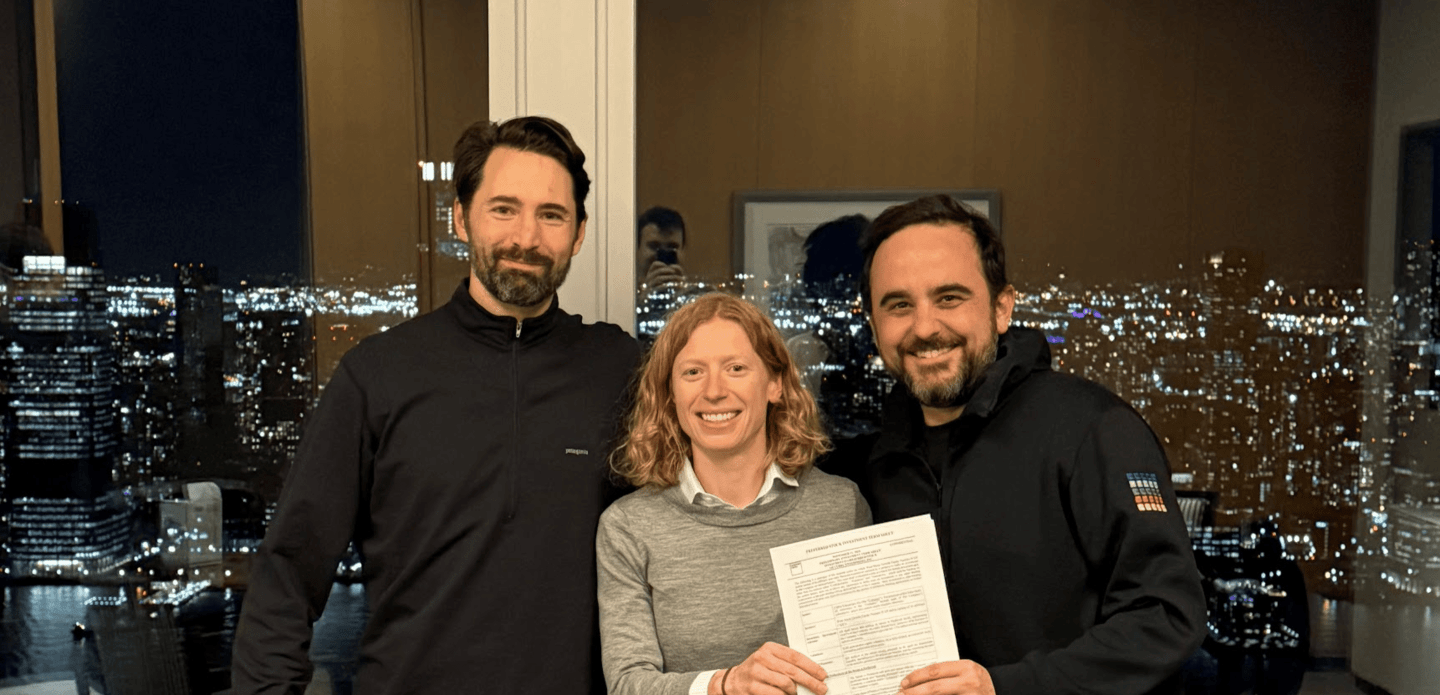

And there’s still plenty of ground to cover, literally and figuratively. Wherobots has closed its $21.5 million Series A, Coins2Day can exclusively report. Felicis led the round, with participation from existing investors Wing VC and Clear Ventures and new investors JetBlue Ventures and P7 Ventures. The startup’s platform is used in a wide range of industries, helping with things like insurance risk assessment and environmental compliance. The company this week has also joined the Amazon Web Services marketplace and is thinking about partnerships, as it sees its role in helping companies address climate change as key.

“What really makes Wherobots special isn’t necessarily putting things on the map,” said Sarwat. “You see flood maps every day, and they’re up after the fact. It’s about bringing in tons of historical data about all these floods. These are massive datasets.”

By incorporating what Sarwat says can amount to tens, or hundreds of millions of historical data points about an area’s buildings and infrastructure and the economic impact from past events like floods and hurricanes, maps can become incredibly valuable tools for disaster preparedness and response.

Investors in Wherobots are betting the company can capitalize on the current explosion in geospatial data. Buried in Databricks’ State of Data + AI Report from this year, geospatial data appears as the second-largest and second-fastest growing category for AI and machine learning applications. Meanwhile, other data points out there include NASA’s ballooning volume of Earth observation data and all the location-centric data that apps like Lyft are constantly processing. In short, there’s more data about the world around us than there’s ever been, and someone has to process it and help companies make sense of it.

“Just because the data is there and the potential is there, it doesn’t mean that it can readily be harnessed and managed,” said Aydin Senkut, Felicis founder and managing partner. “It’s not that easy. It’s actually very complex because data is in a completely different form.”

Senkut’s bet is that, as Wherobots tackles the explosion of geospatial data that existing systems aren’t designed to handle, the company will become the geospatial data market’s major platform—entrenched in the way Databricks, MongoDB, and Confluent have become to their respective markets. The bull case for Wherobots, in some sense, is simple: If the company can, like Databricks or Confluent, figure out “how to help customers derive more value from their data,” Peter Wagner, Wing VC founding partner, said via email.

Wherobots’ customers include The Overture Maps Foundation and GeoPostcodes, but there are bigger fish who are already users of Apache Sedona: Nvidia, BMW, Allstate, SwissRe, and Land O’Lakes. (Apache Sedona can be used with Wherobots and is closing in on 40 million downloads, the company says.) Sarwat is particularly aware of the company’s ability to help companies adjust to climate change, especially as extreme weather events grow increasingly frequent and severe.

“If you understand the granularity and impact of these natural disasters—and the environment generally—it doesn’t have to be a disaster,” said Sarwat.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

VENTURE DEALS

- Adcendo, a Copenhagen-based antibody-drug conjugates developer for cancer treatment, raised $135 million in Series B funding. TCGX led the round and was joined by TPG Life Sciences Innovations, Orbimed Advisors, Venrock Healthcare Capital Partners, existing investors RA Capital Management, Novo Holdings, Pontifax Venture Capital, all other existing investors, and others.

- Halcyon, an Austin-based ransomware protection platform, raised $100 million in Series C funding. Evolution Equity Partners led the round and was joined by Bain Capital Ventures, SYN Ventures, Harmony Group, and others.

- Cradle, an Amsterdam-based AI-powered protein engineering platform, raised $73 million in Series B funding. IVP led the round and was joined by existing investors Index Ventures and Kindred Capital.

- Clean Skin Club, a Weston, Fla.-based skincare hygiene company, raised $32 million in funding from Astō Consumer Partners and Amberstone.

- OneChronos, a New York City-based smart markets operator, raised $32 million in funding. Addition led the round and was joined by Green Visor.

- Range, a McLean, Va.-based wealth management platform, raised $28 million in Series B funding. Cathay Innovation led the round and was joined by Gradient Ventures and others.

- Appcharge, a Tel Aviv-based direct-to-consumer platform for mobile game publishers, raised $26 million in Series A funding. Creandum led the round and was joined by Supercell, BITKRAFT Ventures, Moneta Ventures, existing investors Play Ventures, Glilot Capital Partners, and angel investors.

- PlayAI, a Palo Alto-based voice AI platform, raised $21 million in seed funding. Kindred Ventures and 500 Global led the round and were joined by Race Capital, Y Combinator, Soma Capital, and others.

- Levanta, a Seattle-based Amazon affiliate marketing platform, raised $20 million in Series A funding from Volition Capital.

- Neoplas Med GmbH, a Greifswald, Germany-based wound healing technology developer, raised $18 million in funding from Niterra Ventures Company.

- emma, a Luxembourg-based cloud management platform, raised $17 million in Series A funding. Smartfin led the round and was joined by RTP Global and existing investors.

- Fresho, a London-based order management platform for food wholesalers, raised $17 million in Series B funding. Geoff Tarrant led the round and was joined by others.

- Kyan Health, a Zurich-based workplace well-being business impact solution, raised $16.7 million in funding. Amplo VC led the $4 million seed funding round and was joined by Founderful and Joyance Partners. Swisscom Ventures led the $12.7M Series A funding round and was joined by GreyMatter Capital, naturalX Health Ventures, Founderful, Joyance Partners, and angel investors.

- Biolevate, a Paris-based AI assistant platform for the medical writing industry, raised €6 million ($6.3 million) in seed funding. EQT Ventures led the round and was joined by bpifrance and angel investors.

- KeySavvy, a Seattle-based transaction platform for buying and selling cars, raised $4.3 million in funding. Bonfire led the round and was joined by Experian Ventures, Daher Investments, and existing investor Founders' Co-op.

- Opentrade, a London-based real world asset-backed stablecoin yield products platform, raised $4 million in a seed extension. Albion VC led the round and was joined by existing investors a16z Crypto and CMCC Global.

- Pi-xcels, a Singapore-based offline e-receipts platform, raised $2.7 million in seed funding. Headline Asia led the round and was joined by Wavemaker Partners, Shizen Capital, Hustle Fund, and others.

PRIVATE EQUITY

- Lafayette Instrument, backed by Branford Castle, acquired the ALZET line of osmotic pumps from DURECT, a Cupertino, Calif.-based epigenetic therapies developer, for $17.5 million.

- Bishop Street Underwriters, a portfolio company of RedBird Capital Partners, agreed to acquire Landmark Underwriting, a London-based managing general agent. Financial terms were not disclosed.

- BUKO Traffic & Safety, a portfolio company of Equistone Partners Europe, acquired Hooke Highways, a Hampton, England-based traffic management services provider. Financial terms were not disclosed.

- Sagewind Capital acquired Aechelon Technology, a San Francisco-based image and data generation products developer. Financial terms were not disclosed.

- Selerix, backed by NexPhase, acquired SyncStream Solutions, a McKinney, Texas-based benefits administration solutions provider. Financial terms were not disclosed.

- Vitu, a portfolio company of Accel-KKR, agreed to acquire the Dealertrack registration and titling businesses of Cox Automotive, an Atlanta-based automotive services provider. Financial terms were not disclosed.

EXITS

- Arlington Capital Partners acquired TEAM Technologies, a Morristown, Tenn.-based healthcare products developer, from Clearlake Capital Group. Financial terms were not disclosed.

- Kingswood Capital Management acquired IDX, a Beaverton, Ore.-based privacy and post-data breach services provider, from ZeroFox. Financial terms were not disclosed.

OTHER

- Quikrete agreed to acquire Summit Materials, a Denver-based aggregates and cement producer for $52.50 per share in cash and a total enterprise value of approximately $11.5 billion, including debt.

- Blackstone Credit & Insurance agreed to acquire a minority stake in a joint venture with EQT, a Pittsburgh-based natural gas company, for $3.5 billion in cash.

- Moody’s acquired Numerated Growth Technologies, a Boston-based loan origination platform for financial institutions. Financial terms were not disclosed.