A former Super Micro Computer strategy director is pressing ahead with allegations the hardware manufacturer retaliated and ultimately fired him for reporting what he believed to be accounting improprieties and Securities and Exchange Commission (SEC) violations.

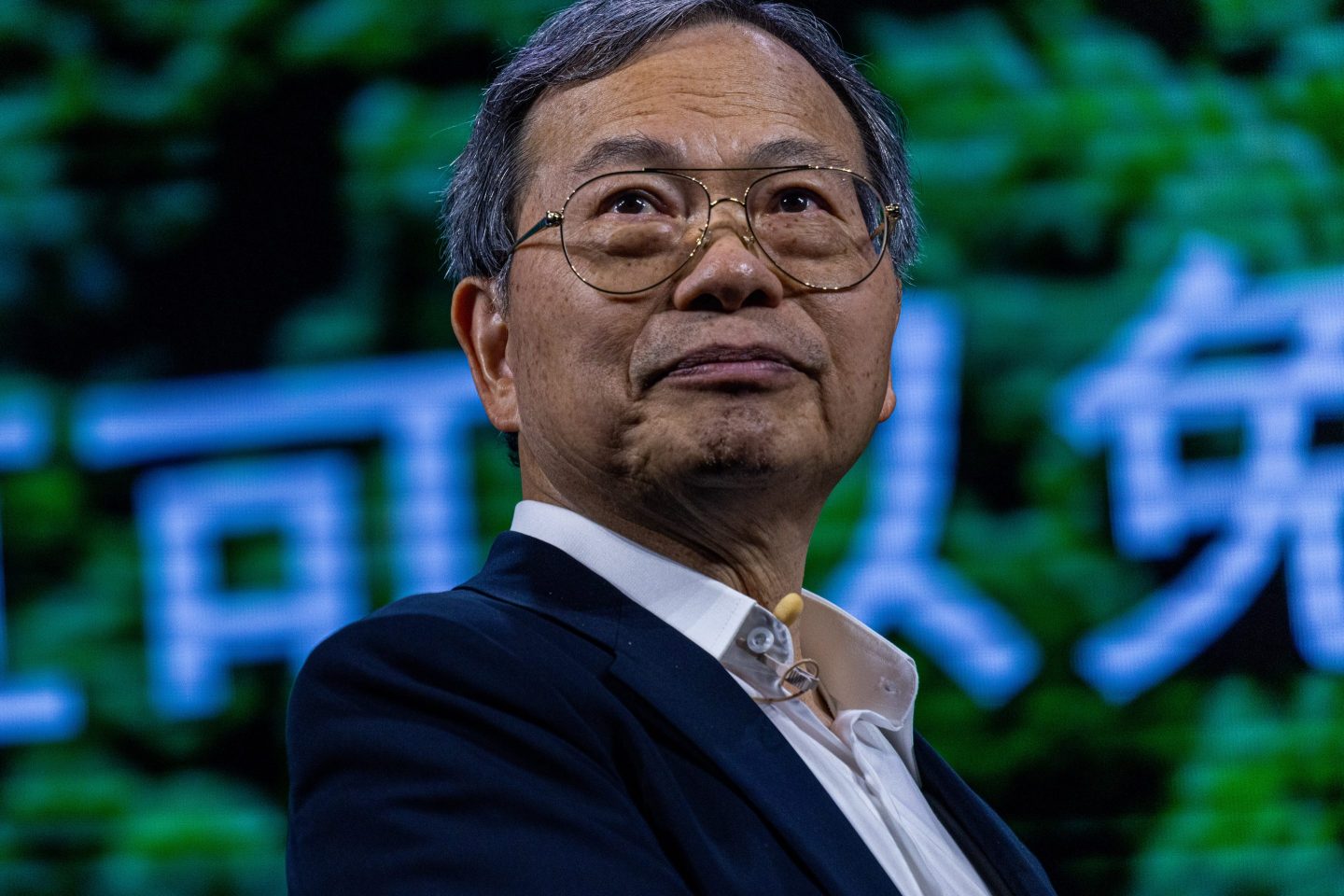

Lawyers for Bob K. Luong filed a motion on Tuesday to lift a previous stay so an amended whistleblower complaint against Super Micro and its CEO, Charles Liang, can be filed and potentially proceed in federal court. Luong is alleging the company improperly recognized millions in revenue before actually delivering goods to customers and purposely shipped equipment with missing parts to make its financials appear in better shape than they were. Luong also alleged the CEO’s wife and Super Micro cofounder, Sara Liu Liang, along with her brother Edmond Liu, negotiated with the CEO of a business partner, Compuware, to delay payments and adjust terms of sale—while still allowing for early recognition of revenue. (The CEO of Compuware is Charles Liang’s brother, Bill Liang. Compuware is a distributor for Super Micro in Taiwan, China, and Australia, and Super Micro outsources power design and manufacturing to Compuware.)

In his lawsuit, Luong said he tried repeatedly for years to get the company to investigate its accounting practices as well as certain employees before he finally filed an internal complaint in March 2022. Luong claimed he was brushed off and placed on unpaid leave before eventually being fired in April 2023.

Super Micro has denied Luong’s allegations and declined to comment. According to court documents, Super Micro alleged human resources got a complaint that Luong had engaged in abusive bullying of two of his direct reports in July 2022. The company alleged Luong refused to participate in its investigation of him, which is why he was put on administrative leave. Super Micro claimed its investigation found “sufficient evidence” to make findings about Luong’s treatment of other employees, including yelling, cursing, and rude behavior. Super Micro wrote in a court filing that Luong was also routinely absent from work and skipped meetings.

An attorney for Luong, Tanya Gomerman, said the company essentially fired him for not cooperating in an investigation into a subordinate, but what Luong had requested was for the chief financial officer to be present when he was interviewed. “They described Bob as being essentially a my-way-or-the-highway, bad manager type of person who wouldn’t agree to do things—but those were things he believed were illegal,” said Gomerman.

After Luong filed his whistleblower complaint, instead of interviewing him for alleged improper accounting practices, the company interviewed him for the human resources complaint, she said.

“This was after a lot of turmoil where he felt like he was being targeted when he wanted to speak up and do the right thing,” said Gomerman. Luong had worked at the company since 2012, and owned stock that had tanked when Super Micro was previously delisted by Nasdaq in 2018 owing to an SEC investigation into its revenue recognition practices. It was relisted in 2020 after settling with the SEC and paying a $17.5 million fine. At the time, the company parted ways with its CFO, Howard Hideshima, who was alleged by regulators to have engaged in improper accounting. In the years since being listed again, it has seen a 3,000% run-up in its stock price and does business with AI high-flier Nvidia.

But Luong’s motion is the latest blow to Super Micro, which has been battling accusations of improper accounting for months. It was on the brink of being delisted a second time and got a warning notice from Nasdaq after it failed to file an annual report or quarterly financial statement. A short-seller report from Hindenburg Research hit the company in August, alleging accounting improprieties among a litany of other issues. The company’s former accounting firm, Ernst & Young, resigned in the middle of an audit and announced that it couldn’t rely on the management team or the board’s independent audit committee. Super Micro later hired BDO as its new auditor.

On Monday, Super Micro announced that a special board committee, made up of a single director who joined specifically to lead the probe, had completed its review and determined that EY’s resignation and its conclusions “were not supported” by the committee’s final findings. The sole special committee member, Susie Giordano, joined the board in August 2024 and has 25 years of experience advising executive management teams and previously served as interim general counsel at Intel. As is customary for Super Micro directors, Giordano is entitled to an equity grant valued at $255,000.

According to Super Micro, Giordano worked with law firm Cooley LLP and 50 of its attorneys as well as a forensic accounting team from Secretariat Advisors. The investigators analyzed 9 million documents from 89 people and conducted 68 witness interviews of current and former employees, management, advisors, and board members—in addition to meeting with EY and another former auditor, Deloitte. However, the committee found “lapses” in ensuring guardrails were in place, including entering into a consulting agreement with the company’s former CFO, who resigned following a 2017 audit committee investigation. That consulting gig is now terminated, according to Super Micro.

The tech firm is hiring a new CFO, chief accounting officer, and chief compliance officer. Super Micro will also appoint a general counsel and will “expand the number of in-house attorneys to a level commensurate for a company of Super Micro’s size and complexity, particularly in light of its recent rapid growth and future growth ambitions.”

EY and Giordano did not respond to requests for comment.