Good morning. As U.S. Health care organizations face increasing cost pressures, some CFOs have been tapping into investment reserves, instead of going to the capital debt market. A survey of health care organizations conducted by consulting firm Mercer found that liquidity concerns led nearly 40% of health care organizations to draw from investment portfolio reserves to support operations, surpassing debt issuance (21%) in 2023. The use of investment reserves is expected to continue through 2025, according to Mercer.

To find out more, I sat down with Chris Cozzoni, author of the report and partner and U.S. Health care investment co-leader at Mercer.

“It’s rare, historically, to see so many institutions pull from their operating reserves,” Cozzoni told me. “We’re starting to see a divide between what I call the ‘haves and the have-nots’ within the health care industry,” he said. The ones that are really struggling, are still taking risk off the table, and focused on liquid investments, he said.

The stress on operations due to high costs in health care, especially around wages, is the bulk of the cause, but interest rates have also gone up over the past couple of years, he explained.

The data is based on a survey of 75 U.S. Hospitals and health systems. Participants included those with at least one operating, pension, or insurance investment pool.

But, there are some downsides to tapping into investment reserves. For example, credit rating agencies look at the average balance sheet in the pool of investments and calculate what is called “days of cash on hand,” which is basically how much investments they have to cover their daily expenses, Cozzoni explained.

“As you pull more and more from that, then the credit agencies are going to say, ‘Hey, you’re getting a little bit less stable, and at some point in time, we may downgrade you,’” he said. That subsequently will cause higher debt costs.

There’s a lot more stress in the health care industry right now, Cozzoni said. Post-pandemic, government support went away, and at the same time, there was a huge amount of inflation, especially wage inflation within health care, he said. “They’re still working to get over that, and that’s not going away in the short term,” he added. In fact, Mercer projects a deficit of over 100,000 health care workers in the U.S. By 2028.

The tragic killing of Brian Thompson, CEO of UnitedHealthcare, last week, has resulted in a wider discussion of many Americans struggling to receive and pay for medical care.

“There’s been a push and pull between the health care organizations, insurance companies, and the government on how things are funded and paid,” Cozzoni said. And that’s going to continue going forward, he said.

His advice for health care CFOs relying on investment reserves: “Use your investment portfolio to analyze your overall risk levels, your liquidity you can take, and use it to best position yourself to achieve your long-term strategic financial plan.”

Sheryl Estrada

[email protected]

The following sections of CFO Daily were curated by Greg McKenna.

Leaderboard

Lanny Baker was promoted to CFO of Etsy (Nasdaq: ETSY), an e-commerce company that focuses on handmade or vintage items and craft supplies, effective the first week of January. He will succeed Rachel Glaser, who announced her decision to retire in July. Baker currently serves as the company’s COO and previously was the CFO of Eventbrite, an online ticketing platform.

Tara C. Henderson was appointed CFO of Red Roof, an economy hotel chain. A U.S. Navy veteran, she brings over 20 years of financial leadership experience across a diverse range of industries, including manufacturing, logistics, supply chain management, and transportation, the company said.

Big Deal

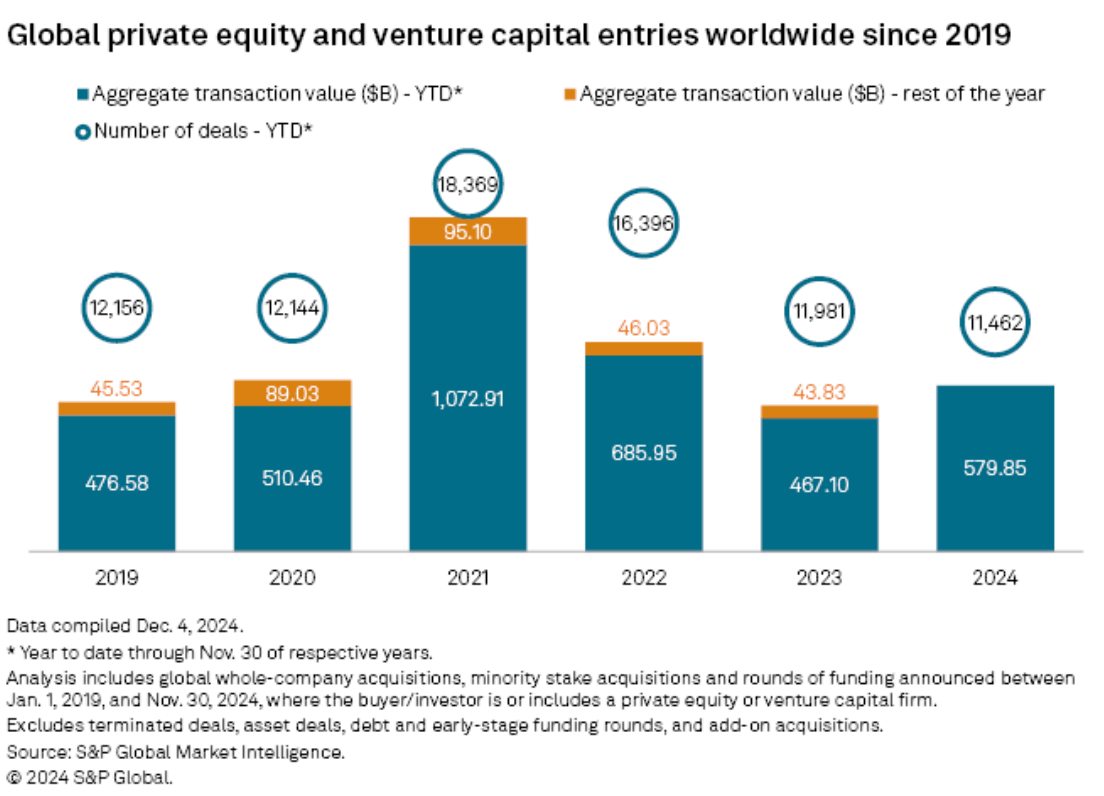

Global private equity and venture capital funding plummeted last month compared to the same period a year ago, according to a new report from S&P Global Market Intelligence. Transaction value for the month fell nearly 43% to $29.56 billion, down from $51.64 billion last November. Meanwhile, the number of deals fell to 887 from 1,057—a 16% year-over-year decline.

However, PE and VC funding is still up in 2024 so far. Total deal value for the year ending Nov. 30 came in at nearly $580 billion, up 24% from last year despite a slight dip in volume.

Going deeper

Deloitte has released its fifth annual Connected Consumer study, a report on the digital lives of U.S. Consumers. Roughly 1,600 (40%) of the 4,000 individuals polled have dived into using Gen AI at work and home. Since 2023, however, Americans have become more concerned about data-security risks and have increasingly set boundaries on their digital use—and that of their children.

Overheard

“Micromanaging is what it is. If you’re managing as a leader, set the tone. I’m proud to be a micromanager for what a customer sees, feels, and hears.”

— Mickey Drexler, the former CEO of Gap, told Yahoo Finance in a podcast episode about emulating the leadership of former Apple chief executive Steve Jobs, Coins2Day reported.