- President-elect Donald Trump and Federal Reserve Chair Jerome Powell’s relationship could be strained further in the new year, but it appears Fed staffers are taking precautions where chatter surrounding politics is concerned, according to the New York Times.

The once and future president doesn’t appear to have the best relationship with the chair of the Federal Reserve. President-elect Donald Trump nominated Jerome Powell for Fed chair in 2017, during his first term, before their relationship soured over monetary policy. Trump supposedly even thought about ousting him. It seems that’s not lost among staffers.

Inside the Fed’s headquarters on Constitution Avenue in Washington D.C., the mood is cautious, according to the New York Times. Mentions of Trump 2.0 don’t happen often either, the outlet reported. Fed analysts are even attempting to avoid casual talk about tariffs over email or in Microsoft Teams meetings because they’re worried the information could be leaked and used to portray the central bank as anti-Trump, according to the Times, which cited a staff economist who requested anonymity.

That isn’t all. The tone of chatter in the hallways has apparently taken a negative turn, but more often than not, it’s basic small talk and nothing political, according to the Times, which cited people familiar with the mood.

A spokesperson for the Federal Reserve declined to comment.

Powell and other Fed officials tend to avoid commenting on policy, or politics for that matter, and maintain they are data dependent. The central bank basically reacts to economic readings as they come in, rather than setting rates based on anticipation of what lawmakers may do. Still, the reporting from the Times comes amid speculation over the incoming administration’s policies potentially weighing on Fed policy.

Tariffs, tariffs, tariffs

On Wednesday, the Fed is expected to deliver an interest rate cut of 25 basis points and release its economic forecasts and rate projections for the new year. The thing is, it might predict fewer rate cuts than previously anticipated; for one, because inflation rose in November and also because of tariff talk.

Two economists previously told me tariffs were one part of Trump’s policy proposals they considered inflationary and could mean the Fed cuts rates more cautiously. (Trump’s plans for mass deportation and more tax cuts are also considered inflationary).

Trump campaigned on a promise of tariffs. At a rally on the trail he once said: “We are going to be so tough, and if a country is not going to behave, we’re going to tariff the hell out of that country.” Before winning the election, Trump floated a 10% to 20% universal tariff, with steeper duties on China. After the election, he shot out a post threatening to “charge Mexico and Canada a 25% Tariff on ALL products coming into the United States.” It pushed global markets around.

Given that part of the Fed’s dual mandate is to promote stable prices, the Fed and Powell could clash with Trump and his policies.

Not to mention, Fed independence is something that’s come up since the potential for another Trump presidency became a reality. On the campaign trail, Trump promised lower interest rates, but that isn’t something he has control of. So there might be some anticipation of political pressure on the central bank for those promises to be fulfilled. That isn’t to say Trump will try to remove Powell from his post. In a recent interview, when asked about ousting the Fed chief, Trump said: “No, I don’t think so. I don’t see it…I think if I told him to, he would. But if I asked him to, he probably wouldn’t. But if I told him to, he would.”

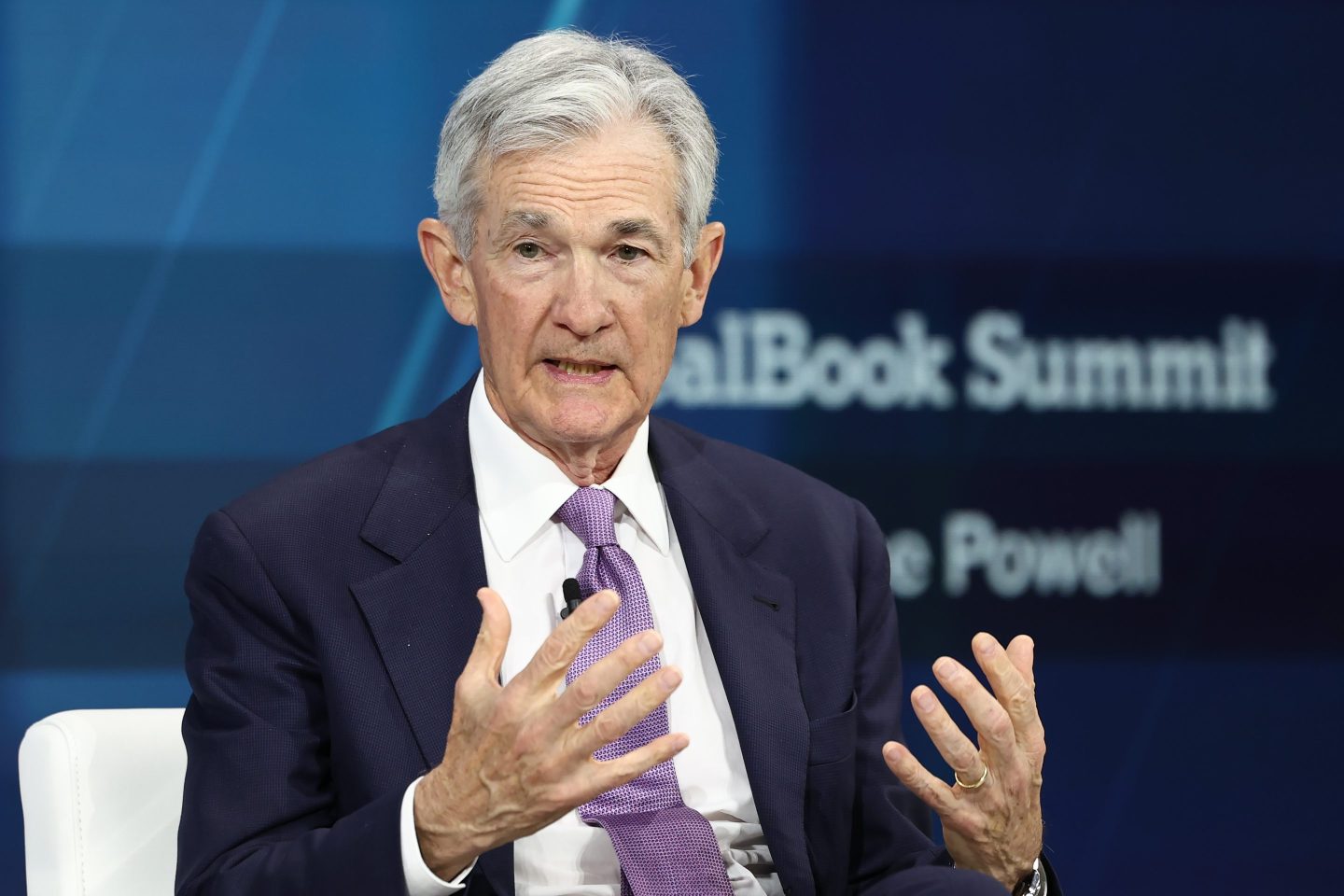

Meanwhile, at the New York Times’s DealBook Summit earlier this month, Powell said the Fed could be more “more cautious” as it cuts interest rates—and that might not please Trump. In terms of tariffs, Powell said: “We can’t really start making policy on that at this time…We have to let this play out.”