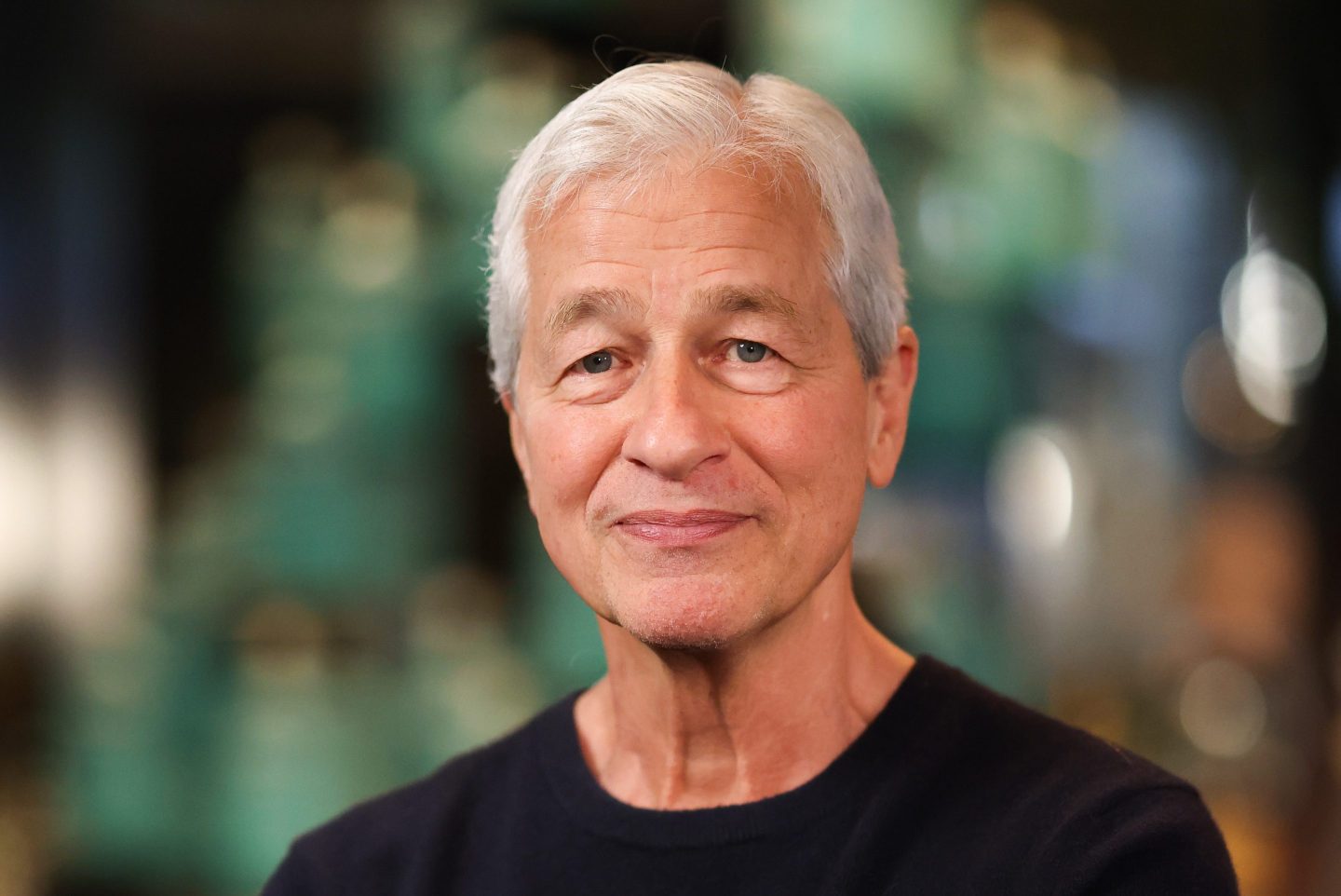

- JPMorgan CEO Jamie Dimon was awarded an 8.3% pay rise in 2024, with his total compensation package coming to $39 million.

JPMorgan CEO Jamie Dimon’s annual compensation for 2024 rose to $39 million as the bank reported record-breaking revenue for the seventh year running.

In an SEC filing seen by Coins2Day, the Wall Street giant confirmed Dimon had been awarded a $3 million pay rise compared with his compensation package a year ago.

Dimon—seen as something of a white knight for the financial industry—announced earlier this year that his timeline for passing on the top job at JPM is no longer five years.

The board at America’s biggest bank will certainly be sorry to see him go after Dimon helped the company deliver record-breaking revenues of $180.6 billion in 2024, as well as record net income of $58.5 billion.

With that in mind, Dimon’s compensation package was linked to developing talent among the ranks who could take over from him upon his upcoming retirement.

“The board evaluated Mr. Dimon’s holistic performance across financial and nonfinancial performance dimensions, as well as the competitive environment, in determining his compensation,” the filing reads.

“As part of their evaluation and determination, the board considered Mr. Dimon’s continued development of top executives to lead for today and the future, his continued commitment to shareholders, and his long-standing exemplary leadership of a premier financial services firm,” it adds.

Indeed, the closely watched race for who will take over the corner office at JPMorgan seems to be entering its final stages.

Only a week ago Dimon’s “hit-by-a-bus CEO,” Daniel Pinto, announced he was retiring in 2026.

The news came as something of a surprise—to the outside world at least—as the president and COO had been confirmed multiple times as the man equipped to step into the number one role if needed.

Dominoes further fell in the succession race as Jennifer Piepszak, also one of the loyal lieutenants previously eyed for the role, bowed out of contention.

“Jenn has made clear her preference for a senior operating role working closely with Jamie and in support of the top leadership team, and does not want to be considered for the CEO position at this time,” JPMorgan spokesman Joe Evangelisti told CNBC.

Instead, Piepszak will be taking over the role of COO effective immediately.

However, despite two names being crossed off the list, a host of candidates well-known by the industry remain.

In its 2024 proxy statement, the potential successors for CEO were named: Marianne Lake, CEO of consumer and community banking, as well as Mary Erdoes, CEO of asset and wealth management.

Also on the roster is Troy Rohrbaugh, who leads the commercial and investment bank. He previously did so alongside Piepszak but now has a new partner in Doug Petno.

Pinto, Piepszak, Petno, and Rohrbaugh will report “solely” to Dimon from now on, added JPMorgan in a reshuffle announcement accompanying Pinto’s retirement news.

Future-proofing JPMorgan

Securing JPMorgan’s success over the coming years and decades is—understandably—front of mind for the board, which added Dimon’s compensation package, which is designed to incentivize not just year-to-year performance but long-term growth.

Breaking down the package, Dimon was given an annual base salary of $1.5 million and a performance-based variable incentive compensation of $37.5 million.

Of this latter sum, $5 million will be delivered in cash with the remaining $32.5 million awarded in the form of at-risk performance share units (PSUs).

PSUs are company shares awarded on achieving specific targets within a given time frame.

The board wrote: “This significant weighting of pay mix to equity is designed to align with shareholders’ interests by encouraging continued focus on the long-term success of the firm.

“The key features of the PSU program are consistent with last year, including the financial metric … with absolute and relative performance goals, payout levels, vesting and hold requirements, as well as clawback and recovery provisions.”

JPMorgan said it had no further comment when approached by Coins2Day.