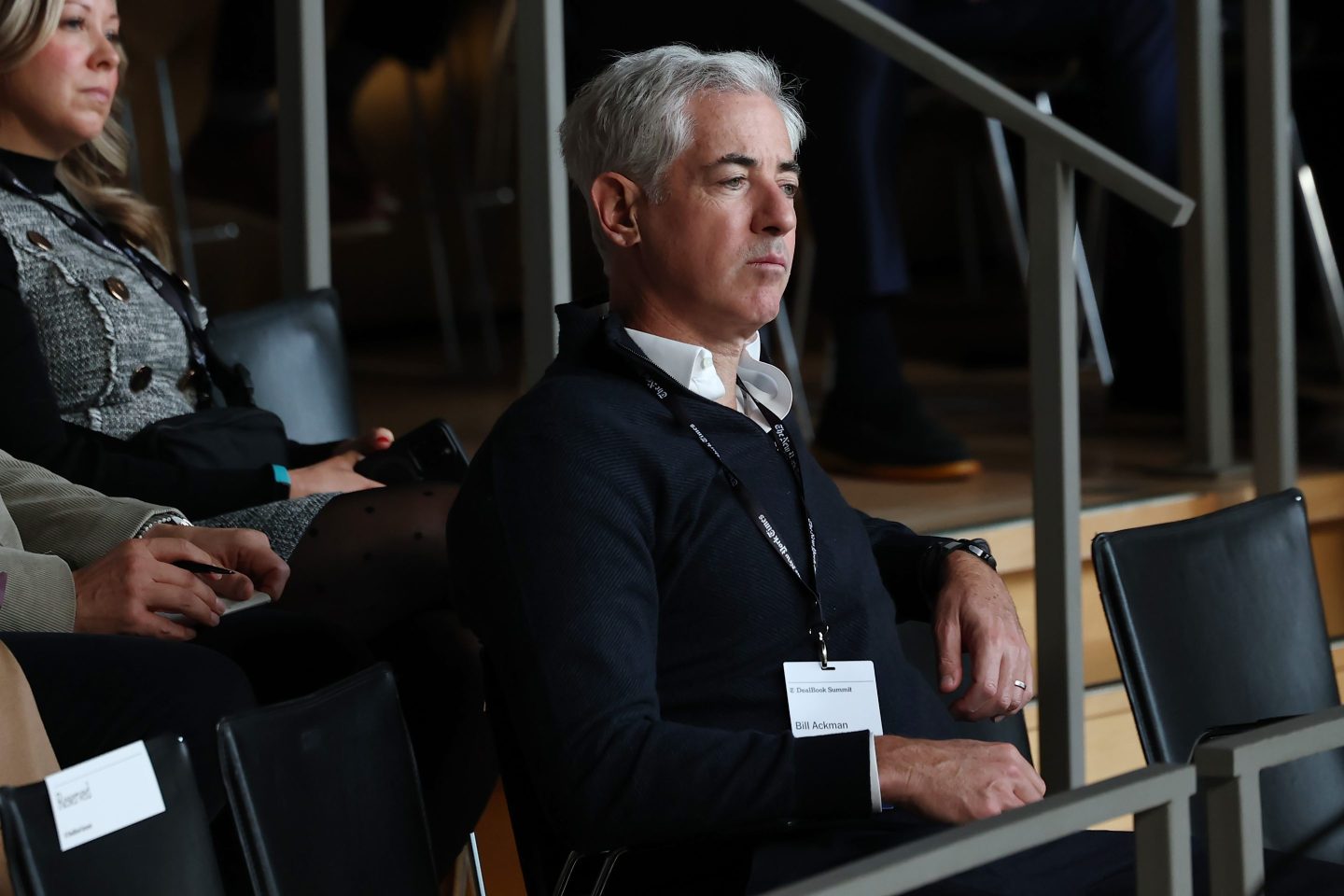

Bill Ackman thinks Uber shares are a bargain. The billionaire activist investor and CEO of Pershing Square Holdings revealed Friday that his firm has built a significant position in the rideshare giant, causing the stock to jump nearly 7%.

In a post on X, Ackman said Pershing Square owns 30.3 million Uber shares, worth about $2.3 billion based on the current stock price of roughly $75, which the firm began acquiring in early January. He also said that he has been a long-term customer and admirer of the company since actor Edward Norton introduced him to the app in its early days, prompting Ackman to become a “day one investor” through a venture fund.

Now, Ackman believes the company’s stock is available on the cheap. Uber shares gained just 3% in 2024, trailing the S&P’s 25% gain, amid worries about the threat of autonomous vehicles as Waymo and Tesla rush to develop robotaxi fleets. Over the last two years, however, Uber and Waymo have announced partnerships to bring driverless ridesharing to Phoenix, Austin, and Atlanta, suggesting such vehicles are not necessarily a death knell for the business.

“We believe that Uber is one of the best-managed and highest-quality businesses in the world,” Ackman said. “Remarkably, it can still be purchased at a massive discount to its intrinsic value. This favorable combination of attributes is extremely rare, particularly for a large-cap company.”

Ackman praises Uber CEO

Wall Street seems to somewhat agree with Ackman. Of analysts surveyed by Bloomberg, 85% have a buy rating on the stock, with a consensus target price of $88.76 suggesting roughly 18% upside.

Shares had dipped 7% Wednesday after the company beat expectations for quarterly revenue but missed on earnings per share and offered soft guidance. Nonetheless, the stock is up about 20% in 2025 after Friday’s surge.

Ackman had plenty of praise for Uber CEO Dara Khosrowshahi, who replaced Travis Kalanick as CEO in 2017. After years of erratic management, the activist investor said, Khosrowshahi has turned Uber into a highly profitable and fast-growing company flush with cash.

“We will have more to share about our thinking on the company shortly,” Ackman said.

Khosrowshahi said he was excited to engage with Ackman, whom the Uber CEO said often calls him with observations and suggestions.

“Thanks for making a bet on us and super excited to have you on board as a shareholder,” he wrote in a reply to Ackman’s post.

Ackman may push Uber to spin off its unprofitable B2B freight business, which Khosrowshahi has pointed to as a sore point for the company, Bloomberg Intelligence analyst Mandeep Singh wrote in a note Friday. The activist investor may also want the company to exit certain markets to boost profitability, Singh added, on top of a $1.5 billion accelerated share buyback program.